The gold market is off to a poor start as the trading week gets underway. On Tuesday afternoon, spot gold is down by over $10 per ounce in mid-afternoon action. Some weaker-than-expected data out of China this morning put the yellow metal as well as silver on the defensive, with gold down by over $20 per ounce earlier in the session. As the world’s second-largest economy, China has the power to strongly influence global financial markets. Poor data from China without question has the ability to move global markets as it did today.

Fed’s Interest Rate Decisions and Inflation Pondered by Financial World

In addition to any fresh developments out of China, the financial world remains focused on the two wars going on as well as inflation and interest rates. The Federal Reserve recently held interest rates steady, but seemingly left the door open to another hike before the end of the year. The idea of “higher for longer” has begun to resonate, and the Fed may decide to keep rates at current levels for much longer than many had expected. Inflation has come down in the previous few months, although price pressures remain stubbornly higher than the Fed’s preferred level of 2% annualized. The gold market may get a sense of all being clear once the Fed signals that no more rate hikes will be implemented. Until that time, however, the gold bulls may move with a sense of caution that may prevent any significant, sustainable upside in the market.

Ongoing Conflicts in Ukraine and Israel Heighten Global Uncertainty

The wars in Ukraine and Israel continue to rage on. There have been few, if any, fresh developments in the Russian/Ukrainian war in recent weeks. The potential threat of a nuclear war breaking out remains a source of concern for global markets. With so much uncertainty surrounding the health of Russian leader Vladimir Putin, it is unclear when this war may conclude. Russia does appear to be on the losing end of the conflict thus far.

The war between Israel and Hamas is another story. Israeli defense forces have penetrated into Gaza in recent days as the conflict takes a turn for the worse. With many civilians and non-combatants in the area, the potential for a high rate of civilian casualties is enormous. It is unclear whether this will alter Israeli plans in the region or not, but Israel does seem to be aware of the risks. This conflict is only a few weeks in age at this point, and could drag on for some time to come. The biggest potential risk for this conflict is the addition of other players. If Iran were to become involved, for example, it would almost certainly invite a response from the United States. This could, in turn, lead to the Third World War. The potential threat of this escalating into a much larger conflict may keep buyers looking to gold in the weeks and months ahead.

Gold Bulls Eye $2,000 Level as Key Indicator for Market Direction

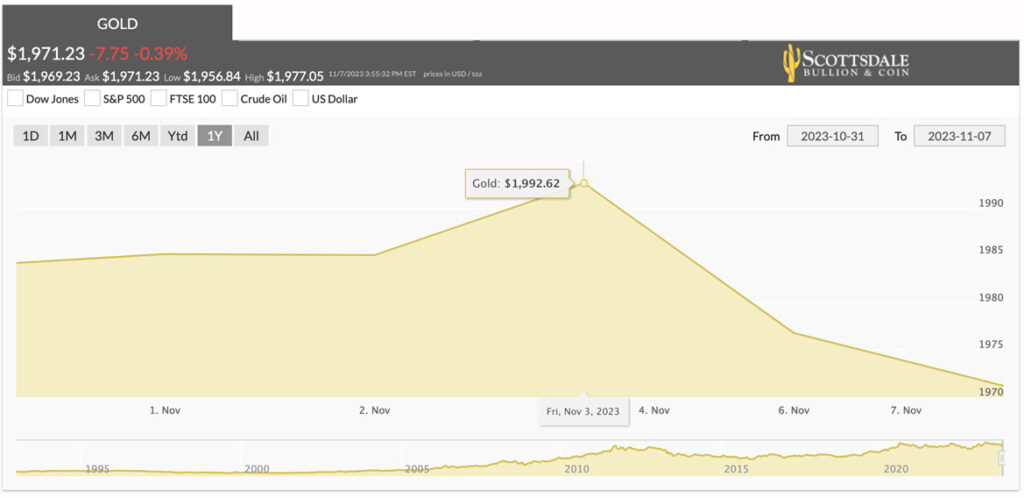

The gold bulls have done some significant work in recent weeks. That work is unfinished, however, as the bulls have yet to produce a solid rally and closing above the $2,000 level. This area may hold the keys to gold in the months ahead. If the bulls can produce a close or series of closes above $2,000, the market may attract a fresh round of buyers. If the bulls fail to do so, then the bears may look to take control of the market again.

To follow the action in precious metals prices, check out our spot gold and silver price charts. They offer daily, weekly and yearly charts, plus the option to overlay crude oil and US dollar for reference.