Gold’s rally is still rewriting the record books, even as the blistering pace seen in 2024 and early 2025 begins to ease.

Gold’s rally is still rewriting the record books, even as the blistering pace seen in 2024 and early 2025 begins to ease.

According to the World Gold Council’s latest report, the metal posted its highest quarterly average price on record.

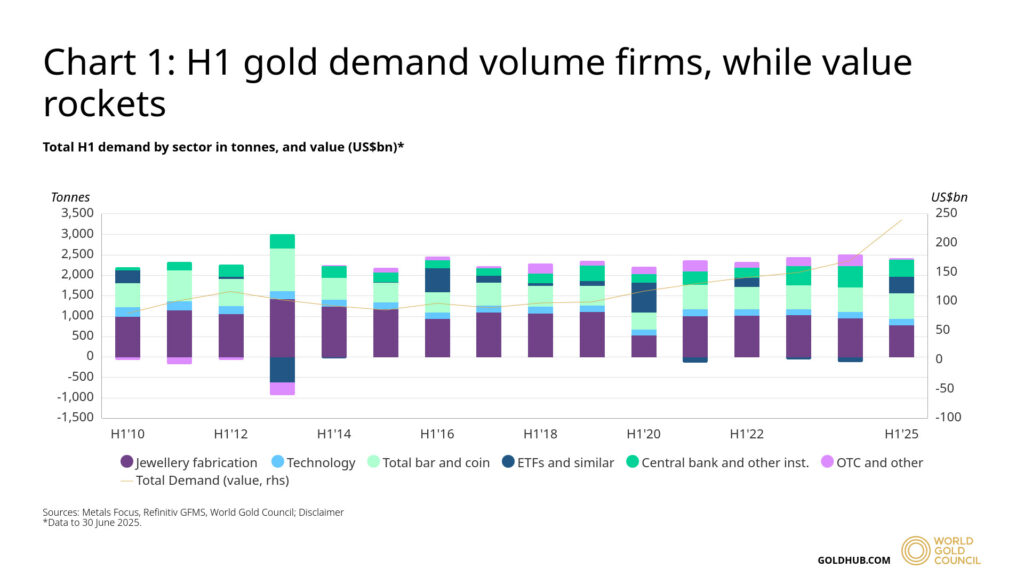

The report also shows that gold demand in the first half of 2025 surged to its highest level since 2020, signaling strong momentum across multiple sectors.

While central banks continued to buy heavily, soaring investment demand, particularly for ETFs and bars, claimed a larger share of the market.

| Demand Source | Q2 Demand (in tons) | H1 Total Demand (in tons) | Quarterly Change | Annual Change |

|---|---|---|---|---|

| Total | 1,248.8 | 2,423.3 | +6% | +3% |

| Central Banks | 166.5 | 415.1 | -33% | -21% |

| Investment | 477.2 | 1,028.4 | -13% | +78% |

| Exchange Traded Funds | 170.5 | 397.1 | -25% | +2,528.6% |

| Bars | 243.1 | 500.8 | -6% | +21% |

| Coins | 38.9 | 83.2 | -12% | -22% |

Gold Consumption Spikes to 2020 Highs

In the second quarter of 2025, total gold demand reached 1,249 tons, representing a 3% increase from the same period last year. In dollar terms, overall consumption rose by 45% year-over-year (YoY), hitting $132 billion. When factoring in Q1 demand of 1,174.5 tons, H1 gold purchases stretched to 2,423.3 tons—the highest level since 2020 and one of the most nominally valuable.

Slowed Central Bank Demand Remains Above Historical Levels

Official consumption, cited by many experts as the gold rally’s primary driver, slowed by 21% YoY and 33% quarter-over-quarter (QoQ). Central banks bought 166 tons in Q2, bringing total H1 demand to 415 tons.

This figure represents the slowest first half buying since 2022 yet remains well-above historical averages. In fact, H1 2025 official purchases nearly beat out full-year 2021 demand.

Interestingly, emerging economies remained the most active buyers, representing the top five buyers in Q2:

- Poland = +19 tons

- Azerbaijan = +16 tons

- Kazakhstan = +16 tons

- Turkey = +11 tons

- China = +6 tons

Notably, unreported buying accounted for more than half of official Q2 purchases, suggesting central banks are opting to conceal their moves.

WGC analysts cite strategic de-dollarization as the main catalyst pushing central banks to further pad their gold reserves, while price sensitivity was primarily responsible for slowing demand.

The group’s latest central bank survey indicates that the recent slowdown in official purchases is likely just a brief pause in an otherwise strong, long-term shift toward gold. In fact, 95% of central banks expect global gold reserves to rise in the next year, with 43% planning to increase their holdings.

The WGC still projects central bank gold demand to reach 1,000 tons for the year, consistent with the elevated annual levels seen in recent years.

Investment Demand Takes the Wheel

The center of gravity in the gold market shifted markedly from official sources to retail investors as investment demand made considerable strides in H1 2025. Total investment demand rose by 78% YoY in Q2, compared with central bank demand, which shrank by 21% over the same period. This quarter’s strong performance brought H1 investment demand to 1,028.4 tons, right in line with annual averages over the past few years.

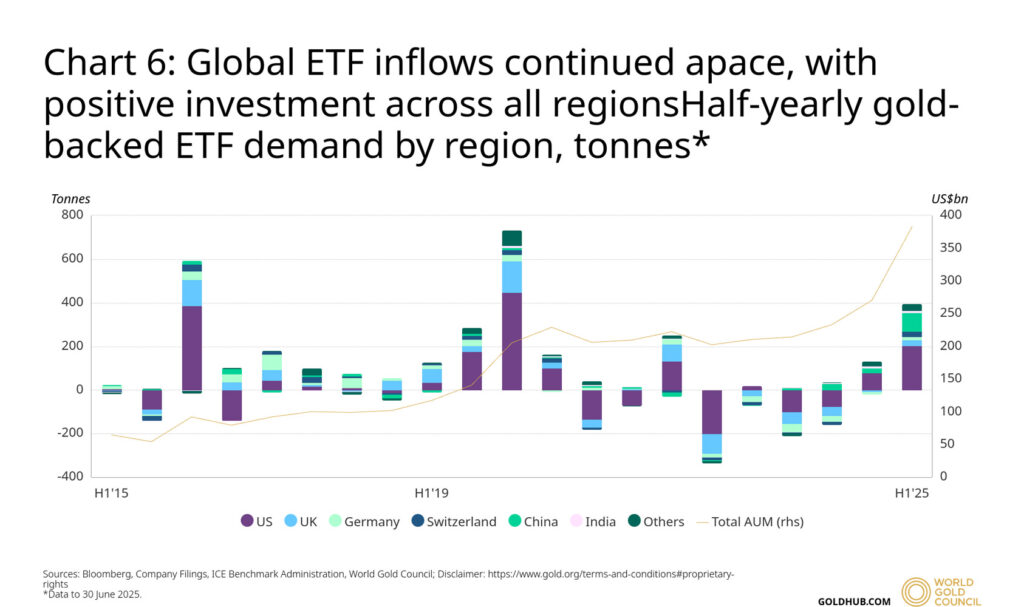

ETFs Lead the Investment Charge

Gold exchange-traded funds (ETFs) remain a favored target for retail investors, receiving tremendous annual growth. Q2 inflows reached 170 tons, capitalizing on Q1’s 227-ton volume.

Although this represents a 25% decline between quarters, gold-backed ETF purchases are up by more than 25 times, more than a 2,500% surge, between Q2 2024 and Q2 2025. Total H1 inflows of 397 tons mark the strongest halfway point since the record was set in 2020.

North America and Asia led regional ETF demand, buying 73 tons and 70 tons, respectively. China accounted for the overwhelming majority of Asian inflows with 61 tons. Switzerland and the UK led Europe’s demand spike of 24 tons.

According to the WGC report, retail investors poured into gold ETFs in anticipation of higher prices and due to widespread policy uncertainty. Given that these factors are expected to continue, analysts forecast further gains in ETF consumption.

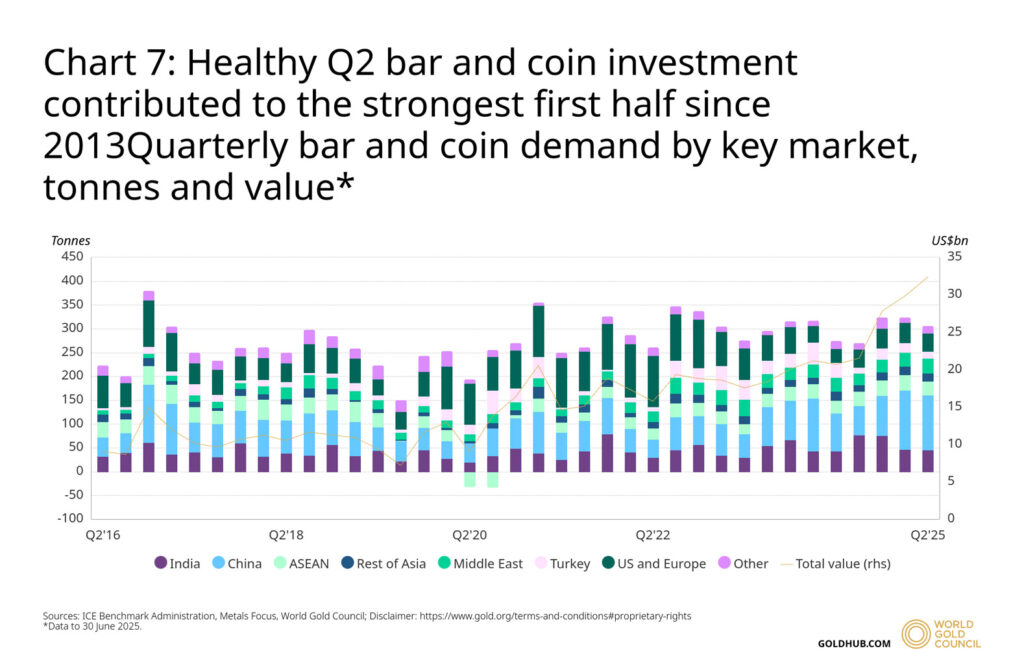

Coin & Bar Demand Hits Strongest H1 Since 2013

Physical gold profits also saw a robust demand increase in Q2, with bar and coin purchases rising by 11% YoY in Q2, reaching 307 tons. This marks the highest level in over 12 years. Combined with Q1’s demand of 325 tons, H1 2025’s total volume reached 632 tons.

Sparsing the figures, investors heavily preferred gold bars, buying 21% more than the year prior. On the flip side, gold coins were cast aside, suffering a 22% annual demand drop. However, the dominant share of demand coming from bars helped offset the slump in coin sales.

Jewelery Volumes Sink, Values Soar

Jewelry demand, which represented a solid 28% of Q2 gold consumption, jumped by 21% in dollar terms. Yet, these purchases slipped by 14% when measured in tonnage.

China and India, the world’s two largest consumers of jewelry, saw negative purchases as near-record prices scared off investors.

The disconnect between dropping demand in weight and increasing value suggests that jewelry weakness is price-driven, not structural. In other words, purchases from this sector could surge quickly if prices stabilize or incomes rise.

Spot Price Captures Historical Quarterly Average

Gold launched into 2025 with considerable momentum following a 27% rise in 2024. Within just four months, gold prices had soared from $2,624.50 to an all-time high of $3,500/oz, clearing a 33% gain.

Although the yellow metal’s momentum has stalled over the past few months, its second-quarter average landed a record of $3,280.35/oz.

This significant increase represents a 15% boost from the previous quarter and a 40% increase from the prior year, indicating an accelerating upward trend in average prices, not just a temporary spike in spot values.

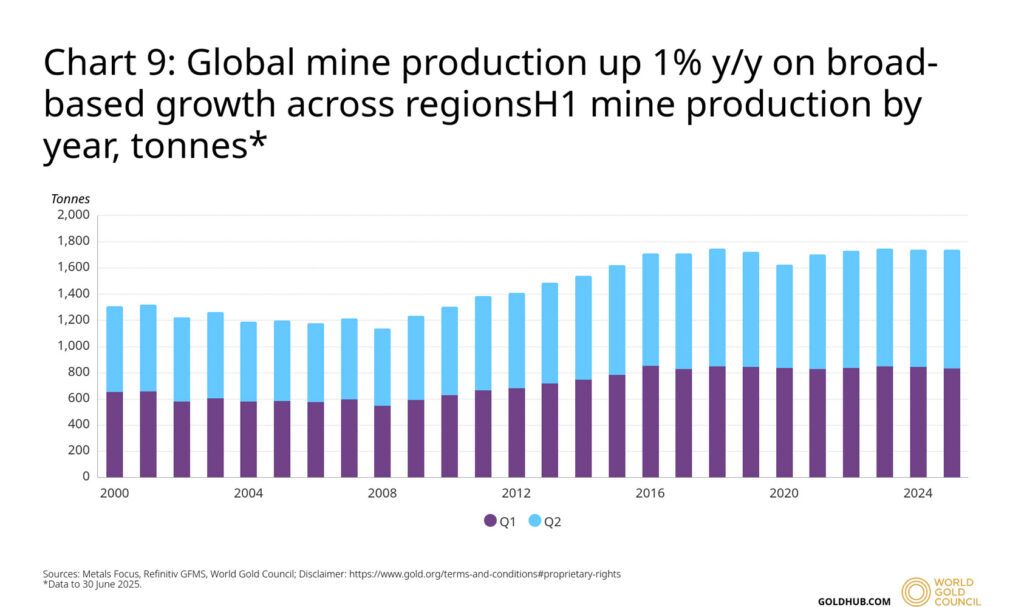

Gold Supply Keeps Pace With Demand

The global gold supply remained neck-and-neck with total demand, rising to 1,249 tons in Q2, measuring a 3% YoY increase.

Gold recycling held steady at 347 tons, as potential sellers held back in anticipation of higher prices and amid broad market expectations for further gains.

Although available gold remained stable, mining output shot up to a record of 909 tons as major producers attempted to keep up with rising demand.

The WGC report highlights new mining projects and high profit margins as considerable boons to gold output, while collateralized gold loans in India, the world’s second-largest jewelry market, could hamper future output.

Market Forces Fueling Projected 2025 Demand

The WGC highlights the following macroeconomic and precious metal market forces as stimulants to a heightened demand in the latter half of 2025.

Weak Dollar

The dollar is weak right now due to a mounting national debt crisis, a global shunning of the USD, and fractured trade relations. With a hobbled greenback evaporating confidence in fiat currencies overall, central banks are turning to physical gold to shore up their economies, and retail investors are following suit.

Fed Policy Shift

The Federal Reserve has been forced into a wait-and-see position as Trump’s unpredictable trade policies take time to reflect in the economic data. Yet, the central bank’s anticipated rate cuts later in the year and beyond are likely to boost safe-haven demand by reducing the opportunity cost of non-yielding assets.

Economic Uncertainty

The US Economic Policy Uncertainty (EPU) Index, which measures how investors feel about the economy, spiked to 328.78 in July–a steep rise from prior months. Many experts are warning about the fallout from the administration’s back-and-forth tariffs, with some predicting a potential stagflationary environment.

Central Bank Demand

Despite the slowdown in Q2, central bank gold demand remains historically high and is still on track to meet the WGC’s 2025 forecast of 1,000 tons–a level that would mark the fourth consecutive year of record purchases. Gold’s renewed status as a Tier 1 asset in the global financial system is one of the strongest signals that this buying trend will persist.

Although gold prices remain near all-time highs, many gold price predictions for 2025 and beyond suggest the yellow metal has more room to run.

If you’re interested in getting into precious metals investing before prices take off, the Scottsdale Bullion & Coin team is eager to help.

Contact us today by calling toll-free at 1-888-812-9892 or using our live chat function.