WisdomTree’s latest outlook suggests the metal’s next move could be explosive, with political drama, ballooning debt, and global flashpoints all pushing prices higher. From a steep drop to a historic surge past $5,000, their forecast spans a range of possibilities investors shouldn’t miss.

WisdomTree’s latest outlook suggests the metal’s next move could be explosive, with political drama, ballooning debt, and global flashpoints all pushing prices higher. From a steep drop to a historic surge past $5,000, their forecast spans a range of possibilities investors shouldn’t miss.

“Loading the Spring”

After crossing the $3,500/oz barrier and setting a record, gold prices have been bouncing within a tight range between $3,180/oz and $3,400/oz. While the untrained eye might see this static price action as a sign of weakness, WisdomTree analysts explain that gold is consolidating.

Following over a year of steady upward growth, prices are “loading the spring” as investor appetite grows and bulls take control of the market. Although prices could touch $3,000/oz in the short term, WisdomTree predicts gold will continue setting records throughout and beyond 2025.

Trade Uncertainty Stirs Up Demand

Trump’s rollercoaster tariff agenda is pushing official and retail investors toward gold with global trade tensions escalating. A failure to score 90 trade deals in the self-allotted 90-day timeline has triggered record-high import taxes on trading partners across the globe.

As analysts explain, “Gold remains a hedge against adverse trade developments.” Some warn these tariffs could become permanent, given the cash-strapped government is raking in billions.

National Debt Bubble Explodes

Gold’s revised projection is receiving a boost from the country’s ballooning debt crisis which towers at $37 trillion and costs $1 trillion annually to simply maintain.

As WisdomTree points out, the GOP’s most recent One Big Beautiful Bill Act is estimated to cost roughly $3 trillion over the next 10 years ($2.4 trillion in debt and $551 billion in debt-service expenses).

Fed Crisis Fuels Distrust

Amid the negative economic impact of trade uncertainty and surging debt levels, Trump is openly attacking the Federal Reserve Chair Jerome Powell, hoping to spur rate cuts.

This political interference in a historically non-partisan area is worrying investors about the central bank’s independence. This Fed credibility crisis could further fuel the gold rally as the US’s fiscal reputation takes a hit domestically and abroad.

Geopolitical Tensions Flare Up

Protracted wars in the Middle East and Eastern Europe continue to rattle international diplomacy and trade, weighing on the global economy.

The sustained instability is entrenching risk-off investing behavior as people seek long-term stability and wealth protection in safe-haven assets and turn away from traditional investments. With these multi-year conflicts heating up, this trend of embracing secure instruments is likely to continue.

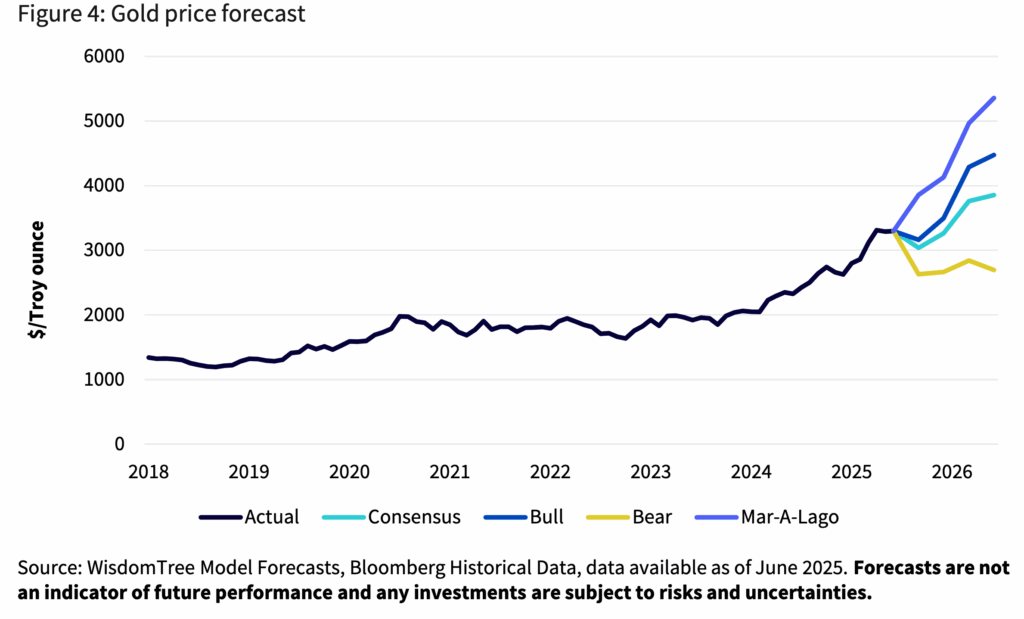

Gold Prices in 2026: Four Possible Paths

In its latest gold outlook report, WisdomTree outlines four potential scenarios for gold price trajectory over the next year. Between H2 2025 and H2 2026, analysts set a broad range for the yellow metal with a low $2,700/oz and a high of $5,355/oz, depending on various macroeconomic factors and policy decisions.

Consensus Case – $3,850/oz

According to the group’s base case, gold would hit $3,850/oz by Q2 2026. This model is marked by steady economic output, near-target inflation, and a further weakened dollar. Strong central bank demand and sustained retail interest keep prices elevated.

Bull Case – $4,475/oz

If inflation rises higher than anticipated, the dollar falls steeply, and speculative gold demand spikes, gold could climb near $4,475/oz within the next year. Analysts see rising geopolitical tensions propelling the yellow metal.

Bear Case – $2,700/oz

A sharp economic turnaround, with inflation slowing, yields rising, and the dollar strengthening, may wipe off some of gold’s luster. In this event, the group sees gold prices shedding all of 2025’s gains, falling to $2,700/oz.

Mar-A-Lago Accord – $5,355/oz

Interestingly, WisdomTree fleshes out a wild-card scenario where the Trump administration unleashes a surprise plan to deliberately weaken the dollar. With currency devaluation as official government policy, gold could experience a major influx of investments, boosting prices.

Keep in mind that WisdomTree, along with a majority of financial institutions and experts have had to revise their 2025 gold price predictions to the upside given the metal’s sheer momentum.

👉 Suggested Read: Gold Price Predictions & Forecasts for 2025