Gold mining stocks and ETFs are appealing due to their ease of trading and greater accessibility compared to physical gold. However, many investors make the mistake of assuming there’s no difference between paper and physical gold assets. In reality, there are fundamental distinctions between these assets that have a direct impact on the security and growth of your portfolio.

Gold mining stocks represent ownership in companies that specialize in the discovery, preparation, and mining of gold ore. These stocks provide investors with a stake in the financial performance of gold mining operations. Given the breadth of the industry, gold mining stocks can give investors exposure to various steps in the gold mining process.

Some popular types of gold mining stock include:

- Major Gold Mining Companies — These well-established mining operations tend to own several mining sites across the globe. These stocks are seen as stalwarts in their field and tend to experience steadier price action due to their established reputation.

- Junior Gold Mining Companies — Smaller in size than their major counterparts, these companies are usually focused on the early stages of mining such as exploration and site development. They’re recognized for their growth potential and speculative nature.

- Gold Exploration — While not involved in the mining process, these projects focus on discovering gold deposits on property that will eventually be mined.

- Gold Royalty and Streaming Companies — Instead of direct involvement in mining, these companies provide capital to mining operations in exchange for a portion of the product.

Some investors seek out gold mining stocks for indirect exposure to the yellow metal without having to hold physical products such as gold coins, bars, or bullion. However, the performance of gold mining stocks will always represent the financial health and success of the company, not the intrinsic value of physical metals.

Gold ETFs

A gold exchange-traded fund (ETF) is a financial product designed to track the price of gold. They’re publicly bought, sold, and traded on stock exchanges similar to normal stocks. Instead of representing a single security, however, gold ETFs usually contain a collection of stocks, bonds, and commodities. The structure of the investment is intended to track the performance of gold as accurately as possible without requiring investors to hold the physical asset. Some gold ETFs hold a portion of physical gold to track closer to the spot price, but these tangible assets are rarely accessible to investors in the fund.

Gold Mining Stocks vs Gold Spot Price

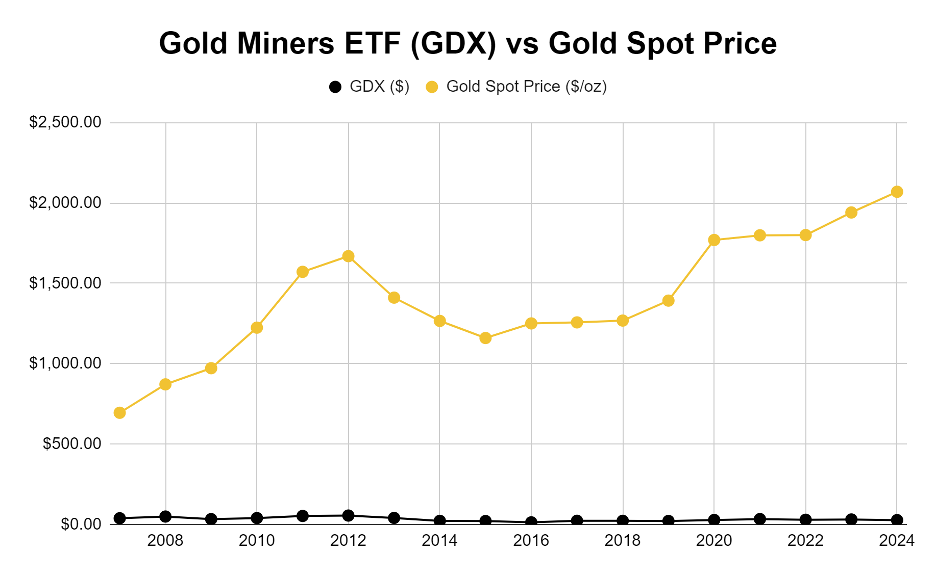

Looking at charts is one of the easiest ways to compare the performance of gold mining stocks versus the spot price of gold. The VanEck Gold Miners ETF (GDX) isn’t a mining stock itself. However, the majority of its shares are spread among companies involved in the gold mining industry, making it a reliable indicator of the performance of mining stocks in general.

As the graph below clearly demonstrates, the price action of GDX since its release in the late 2000s has fallen short of the growth achieved by the spot price of gold in the same time frame.

Source: https://finance.yahoo.com/quote/GDX/history?period1=1167609600&period2=1713544801&frequency=1mo

Gold ETFs vs Gold Spot Price

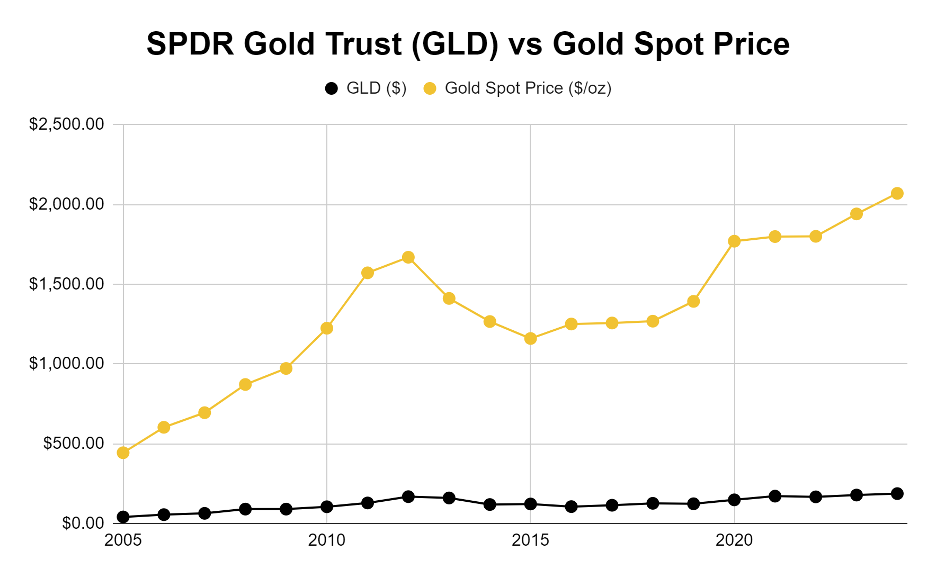

The SPDR Gold Trust (GLD) is by far the most popular and sophisticated gold ETF with over $63 billion of assets under management. As the first publicly traded gold ETF in the US, it has a reputation as the most trustworthy and effective investment of its kind. However, its performance over the past few decades pales in comparison to that of gold.

Source: https://finance.yahoo.com/quote/GLD/history?period1=1104537600&period2=1713744000&interval=1mo&filter=history&frequency=1mo

Advantages of Gold Mining Stocks & ETFs

Affordability

Gold mining stocks and ETFs boast relatively affordable prices when compared to the spot price of gold which continues notching new records. This lower barrier of entry makes it easy for new or budget-conscious investors to diversify their portfolios without breaking the bank. Of course, the rise of fractional gold assets is increasing the financial accessibility of gold for investors who don’t want to spend above the spot price.

Ease of Trading

Another major advantage of gold mining stocks and ETFs is their ease of trading. These securities are publicly traded on standard stock indices such as the S&P 500, Dow Jones, and NASDAQ, meaning they’re accessible on the overwhelming majority of trading platforms. As a result, these gold paper assets can be bought, sold, and traded with the simplicity of run-of-the-mill stocks.

No Storage

Many investors opt for paper gold assets such as gold mining stocks and ETFs due to their non-physical nature. This eliminates the need to find storage options along with safety concerns. However, storing physical gold products is relatively straightforward when working with a reputable precious metals dealer and storage facility.

Dividend Payments

Some gold mining stocks or ETFs offer dividend payments to encourage investors to buy and hold shares for extended periods. For example, GDX offers an annual dividend yield of 1.51%, and Newmont Corporation (NEM) boasts a 2.6% dividend. Physical gold assets don’t offer dividend payments of any kind since there’s no company behind the product that benefits from the investments.

Considerations of Gold Mining Stocks & ETFs

Indirect Exposure

One of the biggest downsides of gold mining stocks, ETFs, and other paper gold assets is their indirect exposure to gold. These securities always keep investors divorced from the inherent value of physical gold assets, no matter how diligently the fund attempts to track it. In reality, these indirect assets are more closely linked to the performance of the US dollar and the stock market than gold.

Lack of Physical Ownership

A lack of physical ownership is another critical negative for gold mining stocks and ETFs. These paper gold assets are effectively receipts demonstrating ownership of a share within a company or fund. However, these paper representations aren’t convertible into anything tangible. This leaves many investors with a justifiable lack of confidence in the stability and security of the assets.

Counterparty Risk

You’re not actually investing in gold when purchasing a gold mining stock or ETF. Instead, you’re investing in the success (or lack thereof) of a company or a fund’s ability to accurately track the spot price of gold. This setup introduces counterparty risk which is the potential for third parties (i.e. mining company CEOs, fund managers, trading platforms, etc.) to default on their obligations or fail to meet your expectations.

Market Volatility

Since gold mining stocks and ETFs aren’t backed by 100% physical gold, they’re shored up with various paper-backed securities. These dollar-linked assets are susceptible to the same market factors as the broader market such as inflation, currency devaluation, interest rates, and investor sentiment. This connection to more traditional markets means paper gold assets are much more volatile than their physical counterparts.

Geopolitical Factors

Although gold mining takes place across the globe, it tends to concentrate in unstable or adversarial regions such as China and Russia. Together, these countries represent nearly 20% of global gold production. in these areas, operations are subject to the whims of geopolitical tensions which adds to the volatility and uncertainty of gold mining stocks. Physical gold is also impacted by global production capacity but to a much lesser extent.

Are gold mining stocks and ETFs worthwhile investments?

The most worthwhile investment will inevitably depend on your specific investment goals, budget limitations, time horizon, and personal preferences. However, if you’re looking for exposure to gold and all the advantages that come along with it, gold mining stocks and ETFs aren’t your best bet. These paper gold assets only offer indirect access to the benefits of precious metals and remain vulnerable to broader market conditions.

Interested in learning more about the advantages of physical gold assets?

Grab a FREE copy of our Precious Metals Investment Guide. It covers everything you need to know about diversifying with gold, silver, and other physical metal investments.