After a sharp surge to a record high of $3,500, gold prices have entered a consolidation trading pattern, prompting some investors to question whether the rally has run its course. Rather than signaling a cooldown, several experts describe this consolidation as akin to a coiled spring.

After a sharp surge to a record high of $3,500, gold prices have entered a consolidation trading pattern, prompting some investors to question whether the rally has run its course. Rather than signaling a cooldown, several experts describe this consolidation as akin to a coiled spring.

The underlying drivers of gold’s rise—geopolitical instability, declining trust in fiat currencies, and a growing dollar rejection by official institutions—remain firmly in place. Gold’s appeal continues to strengthen as pressure builds on the core pillars of the global financial system: international trade is stalled, dollar dominance is eroding, and monetary stability is shaky.

System Issues Foster a Systemic Solution

The US economy—and by extension, the global economy—is entering a more volatile era, where issues that were once considered cyclical are now becoming deeply embedded. Geopolitical fragmentation, unsustainable fiscal policy, and eroding confidence in the dollar-based financial system are no longer temporary concerns. They are structural issues.

In the past, such uncertainty triggered short-lived spikes in demand for safe-haven assets. With macroeconomic instability becoming more persistent, demand for gold is becoming foundational. Central banks, institutional investors, and even retail buyers increasingly view gold not as a tactical, short-term hedge, but as a permanent fixture in their portfolios.

This shift is underscored by gold’s recent reclassification as Tier 1 collateral, placing it on equal footing with fiat currencies and US government bonds. It’s a clear signal that gold’s rising role in the global financial system is fundamental, instead of seasonal.

Gold’s Reserve Renaissance

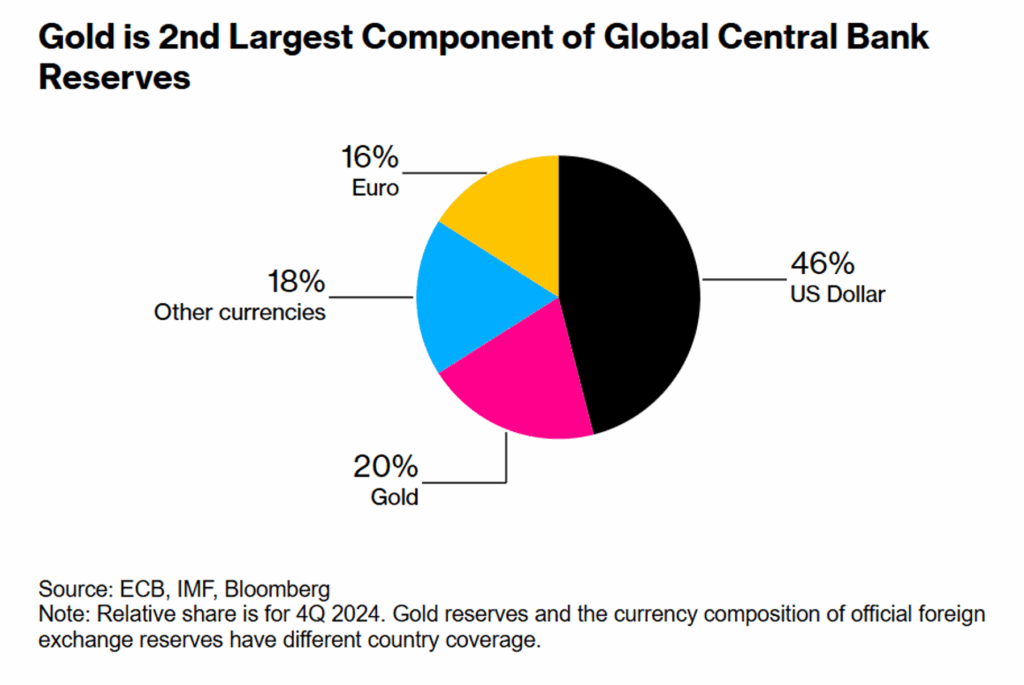

Gold’s resurgence in the global financial system is most evident in its growing share of international reserves. Recently, the yellow metal surpassed the euro to become the second most widely held reserve asset. Over the past decade, gold’s share of global reserves has doubled (from roughly 10% to 20%), leapfrogging the euro’s current 16% share.

This shift has been driven largely by record levels of official sector gold purchases. In each of the past three years, central banks have bought over 1,000 tons of physical gold, more than twice the annual average of the previous decade. The World Gold Council expects 2025 to mark the fourth consecutive year of demand at these historic levels.

Emerging markets have led the charge as they respond to concerns over dollar instability and financial weaponization. Their official gold demand has risen sharply, up 15% in just the past five years. Meanwhile, the US dollar’s share of global reserves has fallen significantly, declining from 70% to 58% over the same period.

Echoes of the 1970s

Some experts are drawing strong parallels between gold’s current trajectory and its historic surge in the 1970s. Back then, gold took off after President Nixon ended the dollar’s convertibility to gold, effectively dismantling the Bretton Woods system. The global economy was thrown into disarray as central banks began to question the dollar’s stability, de-dollarization gained momentum, and geopolitical tensions escalated.

At the same time, the macro backdrop deteriorated, with stagflation fueling demand for safe-haven assets. Against this backdrop, gold skyrocketed more than 2,300%, climbing from $35 per ounce in 1971 to a peak of $850 by 1980.

Despite posting impressive gains and record highs, the current gold rally pales compared to this decade-long bull rally. In this historical context, gold’s recent sideways movement appears less like a sign of weakness and more like a period of consolidation before another potential surge. Some experts are even forecasting that gold could reach $5,000 in the medium to long term.