Following months of sideways trading, the precious metals market has awoken with upward momentum. Gold surged to new highs, and silver capitalized on year-to-date gains with a significant jump above key thresholds. These powerful moves have already quashed previous price forecasts, leaving many investors wondering where gold and silver could go from here.

In this week’s The Gold Spot, Scottsdale Bullion & Coin Founder Eric Sepanek and Sr. Precious Metals Advisor Steve Rand highlight the unprecedented scale of official gold demand, how much higher gold prices could practically go, the outlook for silver, and why the gold price isn’t as important as its value.

Official Gold Consumption Remains Elevated

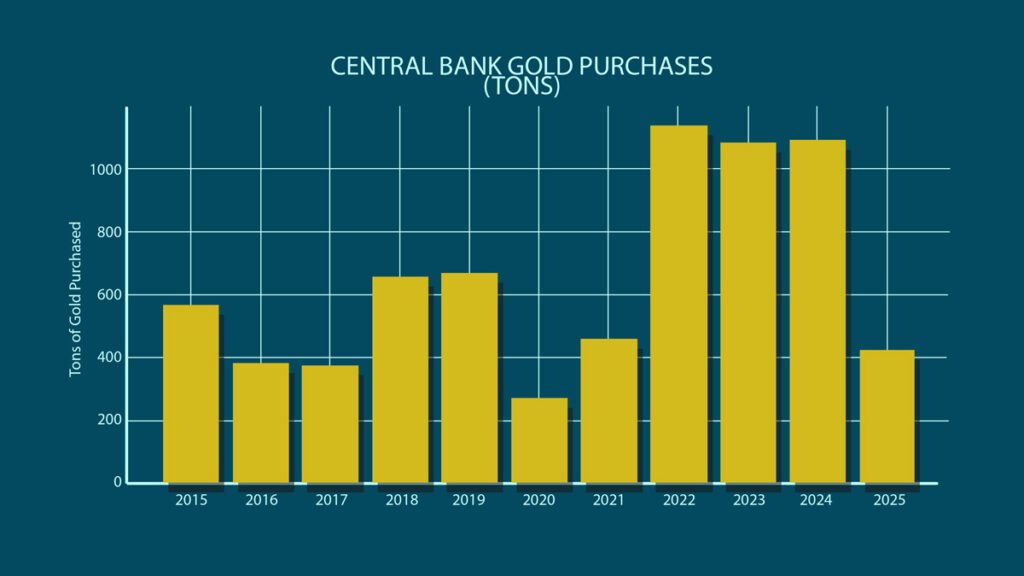

Newcomers to the gold market often underestimate the sheer scale of current central bank gold demand, with purchases rising above 1,000 tons for three years in a row. Historically speaking, this represents exceptionally high interest. Governments were net sellers of the yellow precious metal for years at the turn of the century.

After years of net gold buying, central banks doubled their average purchases and have maintained that level since. The World Gold Council predicts that 2025 will mark the fourth consecutive year of official demand stretching above 1,000 tons, with official buyers claiming 415 tons in H1 2025.

Central Bank Gold Holdings Surpass US Treasuries

This official shift toward physical gold is mirrored by a de-dollarization trend as countries seek to distance their economic and political future from the claws of the USD. For the first time since 1996, central banks hold more gold than US Treasuries as a percentage of their international reserves.

Source: Crescat Capital LLC via Investing.com

This comes shortly after the yellow metal surpassed the euro as the second most widely held foreign exchange asset. More recently, Chinese, Russian, & North Korean leaders met in China for a display of anti-Western strength, underscoring the concerted effort to move away from an American-centric world order.

“Central banks clearly see something negative coming for the US dollar, and they're buying gold to hedge against inflation and the falling value of the dollar.”

Gold Busts Out of Holding Pattern to All-Time High

Earlier in the week, gold spot prices finally blasted through a months-long price ceiling around the $3,400/oz mark, extending to a fresh record high of $3,578.50/oz on Wednesday, September 3, 2025. This bullish swing put fears of a correction to rest, confirming that the sideways trading was merely consolidation before the next leg up. This upsurge also crossed many gold price predictions experts had placed for 2025 and even into 2026, highlighting the metal’s acceleration.

Prices have blown past gold price forecasts put forth by Citi, ING, and UBS, which ranged between $3,450/oz and $3,500/oz, with most expecting these prices by Q4 2025 or Q1 2026. Now, more optimistic gold price outlooks of $4,000/oz and even $5,000/oz are looking increasingly likely.

Silver Edges Past $40 With Bullish Backdrop

As gold notched a new record, the silver spot price claimed its highest mark for the year, reaching over $40/oz. This keeps the shiny metal’s year-to-date gains neck and neck with gold.

We are very bullish on silver.–

Similar to gold, silver has crushed many silver price forecasts for 2025. In fact, the world’s largest private bank recently encouraged investors to go long on silver. Analysts expect further movement due to a variety of bullish factors:

- Supply Shortfall: Silver is entering its fifth consecutive year of a supply deficit, with demand far exceeding available resources. Between 2021 and 2024, total shortfalls reached 678 million ounces. This year, the deficit is projected to hit over 200 million ounces.

- Expanding Industrial Demand: The shiny metal’s role in industrial applications is growing across various sectors. Consider that every Tomahawk missile uses up to 500 ounces of silver that will never be recouped. Plus, silver-heavy AI server farms are proliferating to keep up with the technology’s rapid advancement.

- Silver as Critical Mineral – Silver is poised to join the US Critical Minerals List as policymakers determine the metal is essential to national security and at risk for supply chain disruptions. This shift could mean physical silver is harder to obtain and subject to more federal restrictions, squeezing an already fragile supply.

Silver’s setup is TOO BIG to ignore. Avoid the 22 costly mistakes rookies make by reading our FREE REPORT: Silver, A Sleeping Giant? now! CLICK HERE

Gold is More Than Just Price

Investors have become increasingly focused on price actions throughout gold’s impressive rally over the past few years. However, the yellow metal’s true value is beyond its spot price. Gold’s worth is fully realized when it’s employed as a wealth preserver.

“We need to stop thinking about it as a price. Think about gold as wealth preservation.”

Gold prices have doubled since 2022, indicating accelerating momentum. With robust market-specific fundamentals and a deteriorating global financial system, the yellow metal could double again in the next few years.

Uncover the forces driving gold higher, and why this surge is only beginning. Read “Gold Rush 2.0: A New Era in the Global Monetary Order” today! CLICK HERE

Question or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Comment

Questions or Comments?

"*" indicates required fields