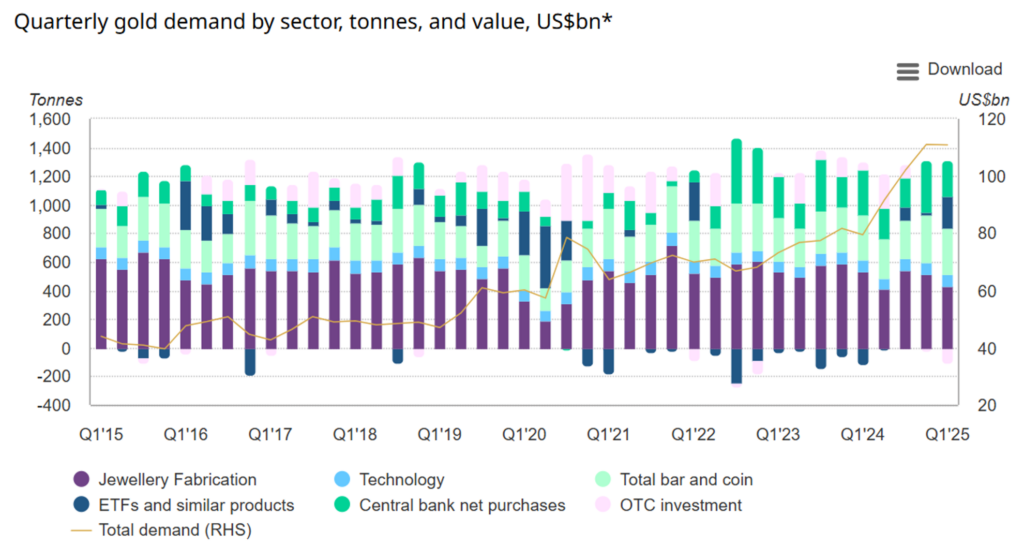

Gold demand kicked off 2025 with a strong start, reaching 1,206 tons in the first quarter. Although this is only a 1% increase year-over-year (YoY), it’s the highest level of consumption for an opening quarter since 2016. This is indicative of the increasing appeal of safe-haven assets and the steady rise of pervasive economic volatility.

In dollar value, total gold purchases nearly touched the record high of $111 billion set in Q4 2024. Even though the amount of bullion purchased only climbed slightly, the overall value surged 40% compared to last year because of elevated prices.

According to the World Gold Council, this steady overall demand is primarily fueled by sustained central bank buying, skyrocketing ETF inflows, and booming investment interest—trends that suggest investors at the national, institutional, and retail levels are turning to physical gold as a hedge against unprecedented uncertainty.

Sustained Official Sector Strength

Central bank demand might have fallen by 33% quarter-on-quarter (QoQ), but Q4 2024 experienced an unprecedented rise in purchases. Q1 2025’s official purchases reached 243.7 tons, averaging roughly 81 tons per month. According to the WGC, this rate is “comfortably within the quarterly range of the last three years,” signaling strong momentum.

At this rate, annual appetite would stretch to nearly 975 tons. This aligns with central bank buying over the past three years, which has totaled more than 1,000 tons annually. UBS recently announced it expects government demand for gold to remain steady at around 1,000 tons, reaffirming this crucial source of consumption.

ETF Inflows Up 1,114%

Over the past few years, retail gold demand has lagged far behind government activity. Recently, this trend has reversed as the average investor steadily turns to the yellow metal, with gold exchange-traded fund (ETF) inflows rising consistently. After two consecutive quarters of outflows, this popular paper gold asset crossed into positive territory in the second half of 2024.

In Q1 2025, gold ETF inflows skyrocketed by 1,114% QoQ, reaching 226.5 tons, casting a long shadow in the prior quarter’s 18.7-ton demand. This marks the highest level of purchases in three years, indicating a strong revival of retail appetite for gold.

Investment Demand Accelerates

While not quite as dazzling as ETF inflows, investment demand was still one of the strongest performers in Q1. In the first three months of 2025, investment-related gold purchases surged by over 200 tons from the previous quarter, reaching 551.9 tons—a 60% QoQ and 170% YoY increase.

Overall demand for gold bars and coins held steady, but the details reveal a shift in investor behavior: gold bar demand rose 14% year-over-year to 257.6 tons, while demand for official coins dropped 32% over the same period. The numbers make it clear that investors are favoring gold bars vs coins.

Persistent Supply Constraints

Demand is a foundational driver of gold’s price action, but the picture isn’t complete without supply. In Q1 2025, total available gold settled at 1,206 tons, notching a 7% drop QoQ and a 1% increase YoY. In the grand scheme, this isn’t a meaningful change as the gold supply has remained relatively stagnant for over a decade.

For reference, the gold supply stood at 1,089 tons in Q1 2015. Over the past 10 years, available bullion has only risen by 10%. All the while, consumption has surged, especially among central banks. This strain between supply and demand creates considerable upward price pressure on the yellow metal as a growing number of buyers compete for limited resources. 2025 is set to mark the fifth consecutive year of a gold supply shortage.

Jewelry Demand Holds Value, Loses Volume

Although total tonnage demand for jewelry dropped to its lowest since the pandemic, higher gold prices kept total spending elevated. In fact, consumer purchases rose by 9% year-on-year, totaling $35 billion.

When measuring consumption in tonnage, jewelry procurements fell by 21% YoY. This sector, which accounts for nearly 50% of overall gold purchases, is likely to face more headwinds as prices continue notching new highs and experts revise their 2025 gold price forecasts to the upside.

What’s driving the rise in gold demand?

Trade War

Trump’s tariff regime has sparked a global trade war that’s caused geopolitical and economic disruption not seen since the pandemic. The uncertainty and sheer scale of this gamble has called the US reputation as a safe-haven into doubt, pushing countries and investors toward gold. Even if the admin takes an off-ramp, billionaire investor Ray Dalio cautions that it’s “already too late” to escape the economic fallout from the trade war.

Geopolitical Tensions

The past several years have been marred by tremendous geopolitical risk. Two hot wars continue raging in the Middle East and Eastern Europe, many other conflicts threaten to escalate, and the global economic order is getting reshuffled. For governments grappling with this instability, gold is the go-to choice.

Stock Market Decline

The stock market, a popular metric for broader economic health, has suffered a brutal beating since the beginning of the year. Popular indices posted their weakest 100-day start to a year in half a century. This reflects a larger decline in traditional instruments, forcing investors to find alternative, safe-haven assets to protect against inflationary pressures.

US Dollar Weakness

The US dollar has plunged in recent weeks, with the DXY dropping from 107 to 99, its lowest in three years. This decline began even before the latest tariffs, reinforcing fears that investor trust is shifting. At the same time, 10-year Treasury yields spiked to 4.5% amid a rare sell-off of US government bonds, signaling waning confidence in America’s traditional defensive assets. These alarming developments have led many experts, like Deutsche Bank, to warn of the dollar losing its safe-haven status.