![]()

Gold prices could challenge $5,000 over the next year or two, claims State Street Global Advisors (SSGA). The wealth management group highlights a resurgence in gold ETF demand amid sustained central bank buying as a key driver of gold’s momentum.

On the macroeconomic and geopolitical sides of the equation, analysts cite accelerated de-dollarization and US-China friction for elevating gold demand.

Stagflation Threats

Although lagging indicators look relatively healthy, many economists warn of the economic challenges that lie ahead.

More specifically, fears of stagflation loom as the corrosive trifecta of a slowing job market, stagnant economic growth, and rising inflation looks increasingly possible:

- Despite a strong employment rate, experts warn that the tariff regime could shrink available jobs in the long run.

- Q1 GDP landed 0.3% underwater, putting the country halfway toward a recession.

- Inflation recently hit 2.3%, yet many believe a prolonged trade war will hoist the cost of living and drive down purchasing power.

Accelerated De-Dollarization

Fears of the dollar losing its position as the world’s reserve currency have simmered for decades, but the heat has been turned up recently as the move away from the greenback intensifies.

Over the past few years, countries have proactively reduced their reliance on the USD and offset those reserves with physical gold.

This trend accelerated sharply in April, as the dollar weakened, bond yields spiked, and the stock market tumbled—meanwhile, gold demand surged to multi-year highs.

This accelerating de-dollarization trend has been helped along by Trump’s protectionist trade policies and resulting trade wars, further harming the USD’s reputation.

US-China Economic Conflict

President Trump’s America-first stance toward China has locked the two economic powerhouses into a trade war, once again. Unlike his first administration, this rift could prove to have permanent consequences for the global financial order. As SSGA analysts highlight, these nations account for roughly 45% of worldwide GDP.

With most countries holding their reserves in US dollars and many supply chains tied to China, this economic battle is sending shockwaves of unpredictability and volatility across the globe. This disruption only polishes gold’s appeal as a safe-haven asset for those seeking protection and value preservation.

“Heightened policy uncertainty surrounding world trade has only exacerbated bullish sentiment towards the yellow metal.”

ETF Buying Explodes

Retail gold buying is gaining momentum as economy-wide uncertainty, volatility, and weakness boost safe-haven demand.

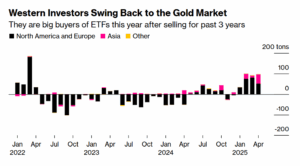

In quarter one, purchases of gold exchange-traded funds (ETFs) surged by more than 1,000% from the previous quarter.

This wave of retail demand is rising with investors pouring more into gold ETFs than in the past three years in April, according to the World Gold Council.

These strong inflows stemmed from both Eastern and Western investors, suggesting a global shift toward gold diversification.

A New Driver Takes the Wheel

Central bank gold demand outpaces retail consumption in tonnage and value, yet the rate of change is significantly greater for ETF inflows. While official consumption has remained elevated at 1,000 tons annually, it hasn’t budged from those levels over the past three years.

As SSGA points out, unless national buying picks up considerably, the current spike in ETF demand is a more impactful driver of gold prices.

$5,000 on the Radar

SSGA analysts assume “$3,000-$4,000/oz is the new normal for gold” amid economic decay at home and a crumbling global financial structure. The yellow metal is emerging as the foundation of a new fiscal system, reflected by sustained central bank demand and a rapid catch-up effort by retail investors.

The asset manager’s outlook is so optimistic that it thinks:

“There is a strong tactical and strategic case to be made that the gold market could even test $5,000/oz over the next 12-24 months in certain macro scenarios.”

While this benchmark might seem high at first, a rising tide of analysts is predicting $5,000 gold in the future, lending credence to the firm’s bold prediction.