As Americans celebrate the United States’ 249th anniversary, the country is reminded of everything that makes them proud to be American, along with the issues that still need fixing. Ironically, one of those problems is front and center as the national debt hits the $37 trillion mark, just in time for the country’s birthday.

In this week’s The Gold Spot, Scottsdale Bullion & Coin Founder Eric Sepanek and Precious Metals Advisor John Karow look back at debt accumulation over the past two and a half centuries, how much the GOP’s reconciliation bill could cost, why Elon Musk is slamming it, and which asset is now in highest demand among central banks.

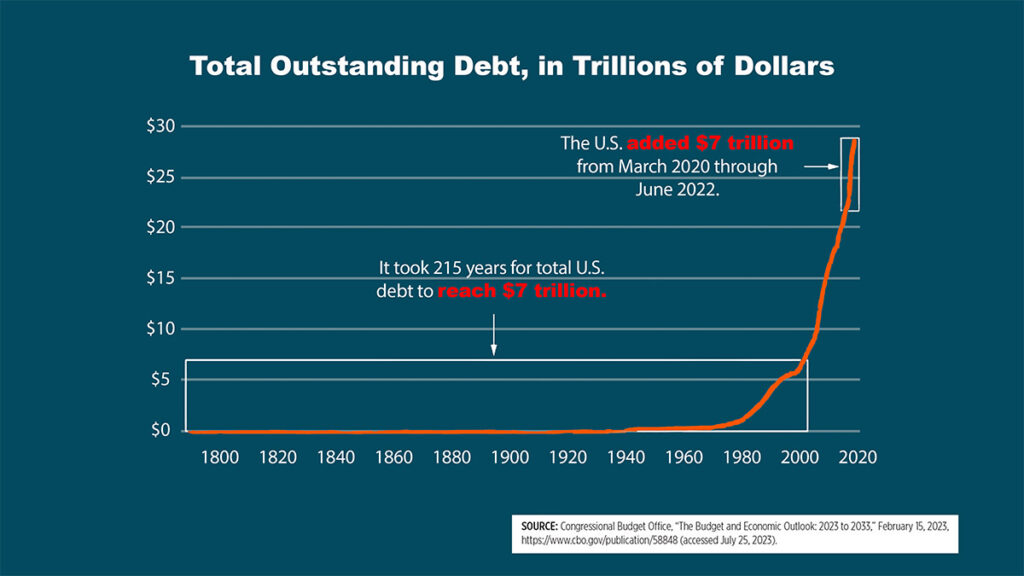

America’s Debt Curve Goes Vertical

Sky-high national debt might seem like a permanent fixture of the economy, but the US debt crisis is actually a unique feature of the last 50 years. For the first 205 years, the United States accumulated only $1 trillion in debt. That means 90% of the country’s debt has been added since 1980 alone.

More alarmingly, the US debt doubled from around $17 trillion in 2013 to over $34 trillion by 2024. The pace is now accelerating. It took only 210 days for the debt to climb from $36 trillion to $37 trillion, the milestone it crossed this week. At this rate, the government is adding $1 trillion in debt in less than a year.

Congress Votes to Add Trillions to the National Debt

With the national debt crossing yet another major threshold, one might expect a serious reassessment of the country’s fiscal path. Instead, Congress appears ready to pile on even more. The so-called One Big Beautiful Bill Act (OBBBA) threatens to add trillions to the already staggering debt, posing a political and fiscal stain on the GOP, which brands itself as the party of fiscal conservatism.

It’s business as usual in Washington. They’re talking about tax cuts and cutting expenses. But the reality is, they’re spending more and more.–

Despite early resistance from budget hawks, the Senate’s version of the omnibus bill is projected to cost $4 trillion, according to the Committee for a Responsible Federal Budget (CRFB), roughly $1 trillion more than the House’s earlier version. While estimates vary slightly, independent financial analysts across the political spectrum agree: the long-term cost of the bill will run several trillion dollars. Alone, the reconciliation measure is expected to raise the debt ceiling by up to $5 trillion.

Elon Musk Pushes Back

Since stepping back as head of DOGE, the federal cost-cutting agency, Elon Musk has emerged as a sharp critic of the GOP’s pricey tax bill. His outspoken opposition has triggered a public clash with former President Trump, who has threatened to pull federal contracts from Musk’s companies and even floated the idea of deporting the South African-born billionaire.

After the Senate passed the legislation, Musk blasted the bill on X (Twitter), calling it a reckless move that adds fuel to an already out-of-control debt crisis.

The latest Senate draft bill will destroy millions of jobs in America and cause immense strategic harm to our country!

Utterly insane and destructive. It gives handouts to industries of the past while severely damaging industries of the future. https://t.co/TZ9w1g7zHF

— Elon Musk (@elonmusk) June 28, 2025

Critics have tried to dismiss Musk’s concerns as self-interest, pointing to potential lost revenue. But the math doesn’t support that claim. Alongside figures like Senators Rand Paul and John Thune, Musk is positioning himself as a genuine deficit hawk, one of the few high-profile voices calling out the dangers of yet another multi-trillion-dollar spending spree.

Update Thursday, July 3, 2025: The House has passed this massive tax-and-spending bill. It now heads to President Trump’s desk for his signature.

Central Banks Can’t Get Enough Gold

With the US economy teetering on the edge of a fiscal cliff and Congress poised to push it further with another massive spending bill, the global financial order is undergoing a quiet but significant shift. According to the World Gold Council’s annual central bank survey, 95% of official reserve managers plan to increase their gold holdings over the next 12 months.

“The central banks aren't comfortable in the world anymore. All that's doing is generating more and more gold buying by the central banks, and I don't see that slowing down any time in the future.”

This expected surge in demand follows three consecutive years of over 1,000 metric tons in central bank gold purchases, more than double the average annual buying rate of the previous decade. As a result, gold has now overtaken the euro to become the second-largest reserve asset globally. The US dollar still holds the top spot, but its share has dropped sharply from 70% to 58% over the past 14 years.

The Bright Future of Gold

As the national debt balloons and fiscal discipline fades, it’s no wonder global trust in the US dollar is eroding. Central banks aren’t waiting for Congress to course-correct. Governments are protecting their interests and wealth with gold.

A deeper story is unfolding beneath the headlines, which represents a seismic shift in the global monetary system. Want to understand why gold is no longer just a hedge but the cornerstone of a new financial era?

Read our full breakdown in Gold Rush 2.0: A New Era in the Global Monetary Order and discover how gold is reshaping the future of the global economy.

Happy 4th of July from the SBC Team!

As we celebrate the birth of our great nation, we want to take a moment to thank you, our valued clients, for your continued trust, loyalty, and partnership. Your support means the world to us.

We hope your Independence Day is filled with family, freedom, fireworks, and a sense of financial confidence. Here’s to protecting what matters and building a brighter future together.

Question or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Comment

Questions or Comments?

"*" indicates required fields