The gold market got the trading week off to a sluggish start this week. Spot gold prices declined and were down by nearly $8 per ounce in mid-afternoon action. The decline in gold Monday should not come as a surprise after the yellow metal had an impressive run higher in recent weeks. The metal now sits just below the key $2,000 level, an area the bulls must overtake in convincing fashion for the market to continue its recent ascent. With numerous potential bullish catalysts to choose from, odds are good that gold is now finally able to stage and maintain a breakout above $2,000 per ounce. This could, in turn, set the stage for a run back towards previous all-time highs and beyond.

The gold market got the trading week off to a sluggish start this week. Spot gold prices declined and were down by nearly $8 per ounce in mid-afternoon action. The decline in gold Monday should not come as a surprise after the yellow metal had an impressive run higher in recent weeks. The metal now sits just below the key $2,000 level, an area the bulls must overtake in convincing fashion for the market to continue its recent ascent. With numerous potential bullish catalysts to choose from, odds are good that gold is now finally able to stage and maintain a breakout above $2,000 per ounce. This could, in turn, set the stage for a run back towards previous all-time highs and beyond.

Israeli/Hamas War Escalation Raises Humanitarian Concerns in Gaza

In addition to the Fed, interest rates and inflation, the gold market is now also having to consider the potential effects of the Israeli/Hamas war. Just a couple weeks old now, this war has already taken thousands of lives, seen hundreds kidnapped, taken prisoner and other negative effects. The war may be nearing a point at which the death and destruction increase dramatically. Israeli defense forces have already begun to invade Gaza. This area is full of civilians and non-combatants, however, who are feeling the effects of the war firsthand. Electricity and internet have been shut off in the region, making it nearly impossible for many to communicate with loved ones. As Israel moves further into the region, the fighting may increase as well, with more combatants being killed as a result.

Thus far, other nations such as Iran and the U.S. have stayed out of the fray. If Iran were to get involved, it would almost certainly invite heavy action from the U.S. The United States already has significant fire power located within the region, including its largest carrier the U.S.S. Gerald Ford. The U.S. has the capability to not only put troops on the ground, in a hurry, but to launch tomahawk missile offensives that could severely damage or totally destroy enemy locations far inland. Whether the U.S. does get directly involved remains to be seen, but any U.S. military action may attract the attention of other nations that have thus far stayed out of the conflict.

Global Tensions Grow: Russian/Ukrainian Conflict Sparks Nuclear Worries

The Israeli/Hamas war isn’t the only war, either. The Russian/Ukrainian war also rages on. The threat of that conflict turning nuclear at some point has been increasingly discussed. If it does turn nuclear at some point, the United States and other nations would almost certainly feel compelled to enter the conflict. This could, in turn, lead the conflict into becoming the Third World War.

Gold Market Remains Cautious as Fed Monitors Inflation and Interest Rates

Back home in the U.S., the metal still watches the Fed and interest rates closely. Inflation has come down in recent months, yes, but it has not come down nearly enough for the Fed to simply abandon ship on its policy. The Fed is likely to leave rates at current levels for some time, and as long as bond yields keep rising, it may not need to tighten rates any further in the months ahead.

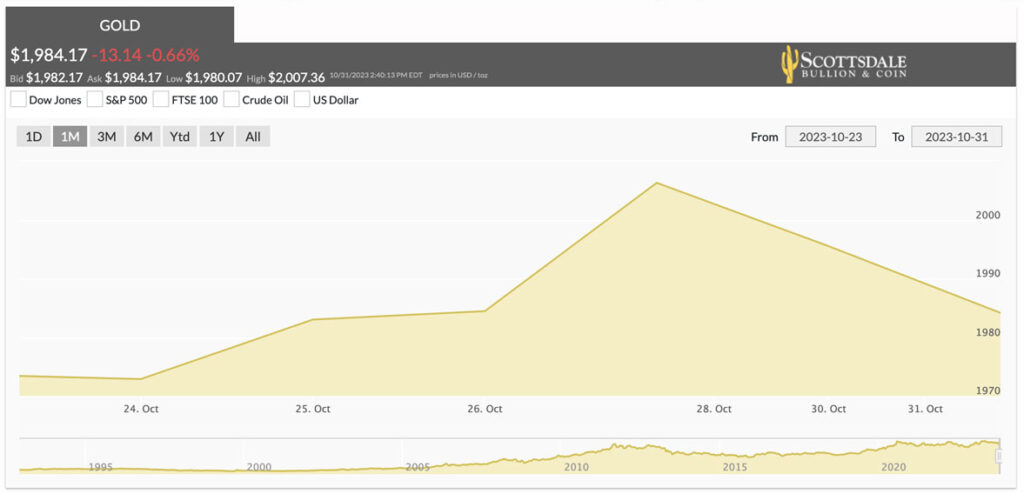

To follow the action in precious metals prices, check out our spot gold and silver price charts. They offer daily, weekly and yearly charts, plus the option to overlay crude oil and US dollar for reference.