Analysts see potential Federal Reserve rate cuts as a key driver behind gold’s latest rally. After nearly a year of holding steady, the central bank appears ready to resume its easing cycle, leaving investors to wonder whether this shift will finally break gold out of its holding pattern or if it’s already priced in.

In this week’s The Gold Spot, Scottsdale Bullion & Coin’s Sr. Precious Metals Advisor Steve Rand and Precious Metals Advisor Brian Conneely examine the likelihood of interest rate cuts in September and beyond, their typical impact on gold prices, and just how high the yellow metal could climb soon.

The Outlook for Fed Rate Cuts in 2025 and Beyond

Over the past few years, the interest rate environment has been more volatile than usual, staying near zero through the post-pandemic recovery before entering one of the fastest hiking cycles in decades in 2022 and remaining high.

By the end of 2024, the Federal Reserve pivoted to cuts with uncharacteristic speed. Officials lowered rates three times in the second half of the year, but the easing cycle came to a sudden halt as mixed economic data (spurred by tariff uncertainty) clouded the central bank’s outlook, forcing policymakers into a wait-and-see position.

Following months of dashed hopes and heavy pressure from the president, the Fed appears poised to implement the first rate cut of 2025. According to the CME FedWatch tool, the market assumes an 84.9% (at the time of filming on 8/20/25) chance the central bank will cut rates following the mid-September meeting. A standard 25-basis-point (bps) reduction is expected, bringing the target rate from 4.25%–4.50% down to 4.00%–4.25%

The expected September rate cut is unlikely to be a one-off. Instead, experts see it as the restart of the Fed’s paused easing cycle. Goldman Sachs projects additional quarter-point cuts in October and December, followed by two more reductions in 2026.

What Happens to Gold Prices When Interest Rates Fall?

Many analysts see this long-anticipated rate cut as a tailwind for gold, which has traded in a narrow range since reaching record highs in April. Historically, the yellow metal has often moved opposite to monetary policy, climbing when borrowing costs decline.

During an easing cycle, the returns on interest-bearing assets, such as money markets, annuities, high-yield savings accounts, and CDs, shrink, reducing their appeal and lowering the opportunity cost of holding gold.

Softer policy also tends to undermine the US dollar, since dollar-denominated assets like Treasuries and deposits lose their relative advantage against higher-yielding alternatives overseas. At the same time, looser credit conditions can fuel inflation expectations, further strengthening gold’s safe-haven appeal.

“Rate cuts make interest-bearing investments less attractive, which lowers the value of the dollar. When that happens, the cost of living rises. This is what makes gold look more attractive.”

How Far Can Fed Rate Cuts Lift Gold?

It’s difficult to isolate the exact impact of rate cuts on gold, since the precious metal’s price is influenced by many factors at once. Still, some experts have put numbers to the relationship. Julius Baer, a Swiss private banking group, conducted a study showing that gold prices climb more than 15% in the year following an initial rate cut—if that cut coincides with an economic downturn.

While the US economy avoided a full recession in the first half of 2025—rebounding from a –0.3% GDP contraction in Q1 to a 3% surge in Q2—many economists caution that risks remain. July’s unexpectedly weak job numbers, combined with record downward revisions from the prior two months and a sharp rise in the producer price index, have raised doubts about the economy’s underlying strength despite record stock market highs.

Analysts at Wells Fargo note that, under supportive conditions, gold has historically rallied about 20% in the 24 months following the start of a Fed easing cycle.

Central Bank Gold Buying Remains Strong in 2025

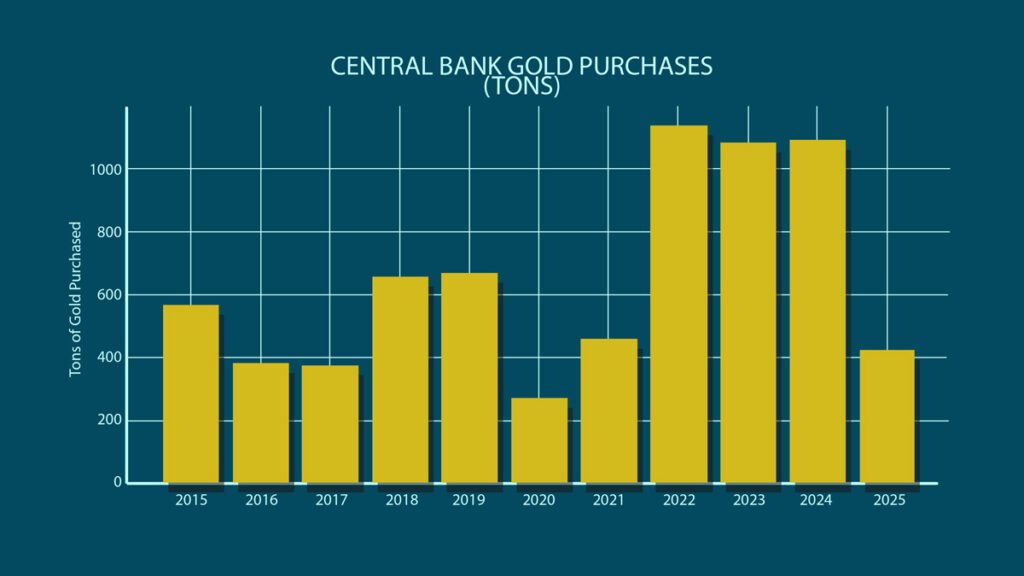

Rate cuts may give gold’s rally an added lift, but central bank demand remains the true backbone of its multi-year climb. After years of subdued gold buying, official sector demand surged past 1,000 tons in 2022 and has held near that level ever since.

With robust physical gold bullion purchases in the first half of this year, analysts expect central banks to once again reach that record mark by year-end.

Since 2022, central bank buying is up 150%. This is sustained and ongoing.–

How High Could Gold Prices Go in Q4 2025 & In 2026?

The perennial question in the gold market—where prices are headed—is drawing unusual consensus amid a weak macroeconomic backdrop, an expected easing cycle, and persistent geopolitical instability. Below are some of the top gold price forecasts for 2025 and 2026:

Goldman Sachs

- $3,700 by Q4 2025

- $4,000 by Q3 2026

Citigroup

- $3,500 by Q4 2025

J.P. Morgan

- $3,675 by Q4 2025

- $4,250 by Q4 2026

ING

- $3,450 in Q4 2025

- $3,500 by Q1 2026

UBS

- $3,500 by Q4 2025

- $3,700 by Q2 2026

Bank of America

- $4,000 by Q3 2026

Gold’s Fast-Track Rally

Looking at gold’s past performance offers perspective on where it may be headed and how quickly it could get there. When measured in $1,000 milestones, the metal’s rise has clearly accelerated.

- It took gold 37 years to climb from the 1980s crash to the $1,000 mark.

- The move to $2,000 was much quicker, taking just 12 years.

- From there, the leap to $3,000 came in only 5 years, cutting the timeline in half once again.

Now, with momentum building, the climb to $4,000/oz could happen within a single year, highlighting the lightning pace of gold’s growth.

Free Report: Gold Rush 2.0

Curious how Fed rate cuts could reshape gold’s future? Our latest analysis, Gold Rush 2.0: A New Era in the Global Monetary Order, unpacks why the yellow metal is gaining strength and where experts see prices heading in 2025 and beyond. Discover the forces pushing gold toward new highs. CLICK HERE TO READ NOW!

Question or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Comment

Questions or Comments?

"*" indicates required fields