Gold prices soared to an all-time high following the Federal Reserve’s long-awaited rate cut, signaling bullish horizons for precious metals across the board. The central bank’s easing posture adds more weight to the US dollar’s mounting pressures as investors seek reliable assets.

In this week’s The Gold Spot, Scottsdale Bullion & Coin’s Precious Metals Advisors Tim Murphy and Brian Conneely discuss how the Fed’s monetary policy impacts gold prices, why official and institutional investors are stocking up their gold reserves, and how tectonic geopolitical and economic shifts prop up gold’s role as a safe haven.

The Long-Anticipated 25-Basis Point Cut

Following months of telegraphing a late Q3 cut, the Federal Reserve reduced interest rates by 25 basis points following its highly anticipated September meeting. Withstanding months of blistering attacks and personal criticism from the White House – resulting in a Fed credibility crisis – the central bank finally saw the economic data needed to justify rate cuts.

According to the Federal Open Market Committee press release, the rate cuts were made due to the following macro realities:

- Moderating economic activity in H1 2025

- Softening job market

- Rising unemployment rate

- Increasing and elevated inflation

The Summary of Economic Projections (SEP), which forecasts the Fed’s interest rate policies, suggests two more 25-basis-point cuts in 2025 and one quarter slash in 2026.

Gold’s Popped to New Highs

It has long been established that interest rate cuts are bullish for gold, as the opportunity cost of owning non-yielding assets diminishes. After the rate cuts were announced, gold spot prices characteristically moved upward, notching an all-time high at $3,707.40/oz (intra-day). Although prices have since settled, they remain near historic levels. Plus, the future is looking bright as gold futures for December hit $3,717.80/oz. Many people even think these rate cuts could push gold past $4,000/oz.

The Three Demand Sources Driving Today’s Gold Market

Central Banks Keep Piling In

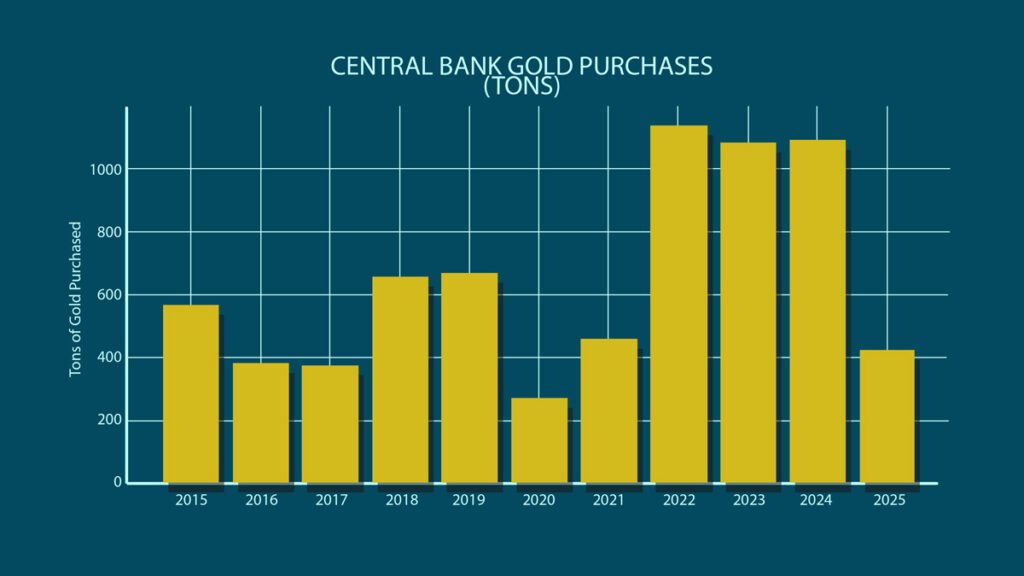

Central bank buying has been the cornerstone of gold’s meteoric rise over the past few years, with official demand clearing 1,000 tons for the past three consecutive years. That’s more than double the average of roughly 400 tons for several years prior. The World Gold Council (WGC) and other experts point to robust H1 gold demand to suggest 2025 consumption will reach over 1,000 tons again.

Institutions Boost Allocations

This sustained surge in central bank gold purchases is mirrored by growing interest among institutional money. Many banks, hedge funds, and investment brokers are encouraging investors to beef up their gold holdings. For example, BlackRock, the largest asset manager in the world, is now encouraging a 2% to 4% gold allocation to investors’ portfolios.

Many prominent figures advise for even higher positions. Billionaire investor Ray Dalio recommends a 15% gold allocation. Jim Cramer suggests 10%, while Peter Schiff touts a position of 10% to 20%. Morgan Stanley CIO recently suggested a 60/20/20 portfolio strategy that includes 20% gold. CPM Group leads the pack with a bullish 25% to 30% holding for optimized portfolio protection.

Retail Investors Still Lagging (For Now)

While central banks have enjoyed a head start and institutional buyers have quickly caught up, retail investors remain mostly flat-footed. Gold exchange-traded funds (ETFs) saw their largest semiannual inflow in five years, about $38 billion in the first half of 2025, yet everyday investors are still largely sitting on the sidelines. That dynamic bodes well for long-term gold performance, since rallies often accelerate once retail participation kicks in.

“When the public jumps in because of fear and greed...that's when things really, really get exciting. Prices are only going to go up.”

The Global Shift That’s Driving Gold Higher

The Fed’s current rate cut cycle is a boon to gold and a burden to the US dollar. The central bank’s intervention is yet another cog in a new economic and geopolitical machinery that’s squeezing the dollar’s value and removing it as a safe-haven asset.

Trump’s aggressive tariff policy and multifront trade war have further alienated countries seeking to distance themselves from US financial influence, speeding up the de-dollarization process. That’s to say nothing of the impact of the national debt crisis or growing fears of stagflation. Furthermore, geopolitical tensions from the Middle East to Eastern Europe have splintered traditional alliances and pushed others together, fomenting an anti-Western bloc.

“All of this is very, very bullish for gold and silver.”

The backdrop of all this reshuffling is the dollar’s demise and gold’s larger role in the global shift. Foreign governments, especially those in the BRICS Nations, see the writing on the wall, turning to gold to fortify their economies and stabilize their currencies. Institutional investors are following suit, hedging portfolios against a US economy facing structural headwinds.

If you’re interested in learning more about how gold can protect your wealth amid global economic uncertainty, check out our FREE Gold & Silver Investor Report.

Question or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Comment

Questions or Comments?

"*" indicates required fields