While markets reacted positively to the Federal Reserve’s long-anticipated interest rate cuts, a far more telling move flew under the radar. A short-term cash injection into the financial system, though smaller in scale and less publicized, hints at underlying fissures in the country’s economy—more than the standard headlines might suggest.

In this week’s The Gold Spot, Scottsdale Bullion & Coin’s Founder Eric Sepanek and Sr Precious Metals Advisor Steve Rand discuss the warnings Ray Dalio is sending out to investors, what the Fed’s economic stimulus says about financial stability, and why gold is rising as the safe-haven of choice amid fiscal turbulence.

Ray Dalio’s Warnings Grow

Ray Dalio is a household name among investors in both equity and precious metals markets. The billionaire founded Bridgewater Associates, one of the largest hedge funds on the planet, reflecting his wealth of industry knowledge.

Over the years, Dalio has earned a reputation for making startling yet accurate market predictions, especially when they run counter to the mainstream consensus.

Recently, the famed investor has been raising the alarm bells about the US economy, pointing to several deep-rooted vulnerabilities, including:

Unsustainable National Debt & Deficits

Ray Dalio warns that the US is approaching a point where its debt burden could trigger an “economic heart attack” — a sudden breakdown caused by years of chronic deficit spending. With annual deficits nearing $2 trillion and interest payments now exceeding defense spending, the government is increasingly borrowing to pay the interest on what it already owes.

Overdependence on Top Earners

Another sign of a waning economy is the outsized reliance on the top 1%. Dalio highlights how the rising wealth of these top earners masks the losses for those in lower-income strata, revealing a topsy-turvy economy. The bottom 60% struggle financially, a symptom of a country’s declining fiscal health.

Monetary Policy Creates Illusion of Stability

The legendary investor also points to the illusion of strength and stability achieved by the Fed’s ongoing stimulus into the economy, even as asset prices remain at record highs across markets. Dalio explains this as “stimulus into a bubble,” arguing that the economy is fundamentally weak, but visually strong.

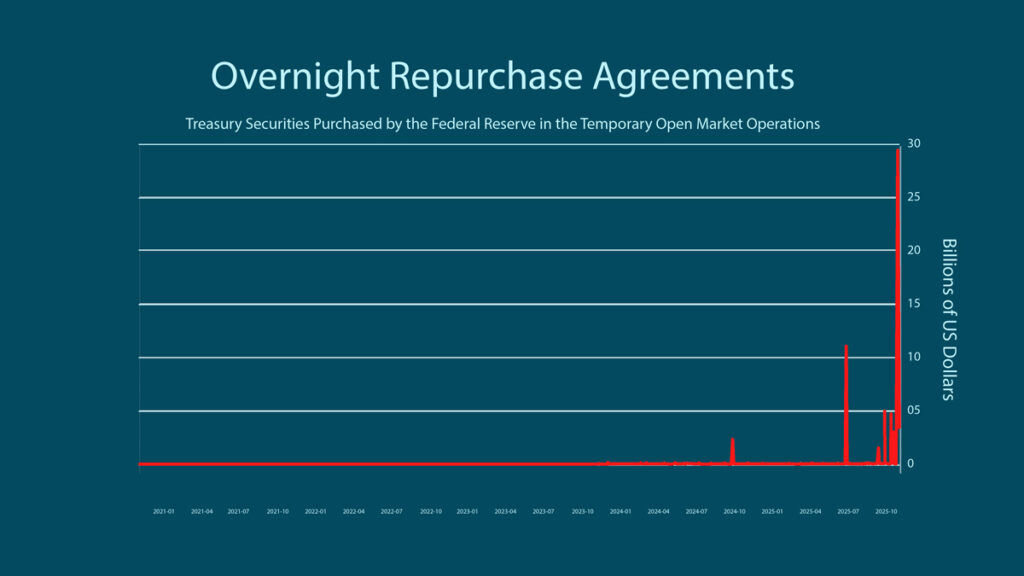

Fed Makes Largest Single-Day Economic Injection

Dalio’s latest warning regarding the Fed’s overreliance on economic stimulus follows the agency’s largest single-day injection into the economy in the past five years. On October 31, the central bank pumped $29.4 billion into the economy via a repurchase agreement. Effectively, the government gave the banking industry cash in exchange for Treasurys, providing the country’s largest lenders with instant liquidity.

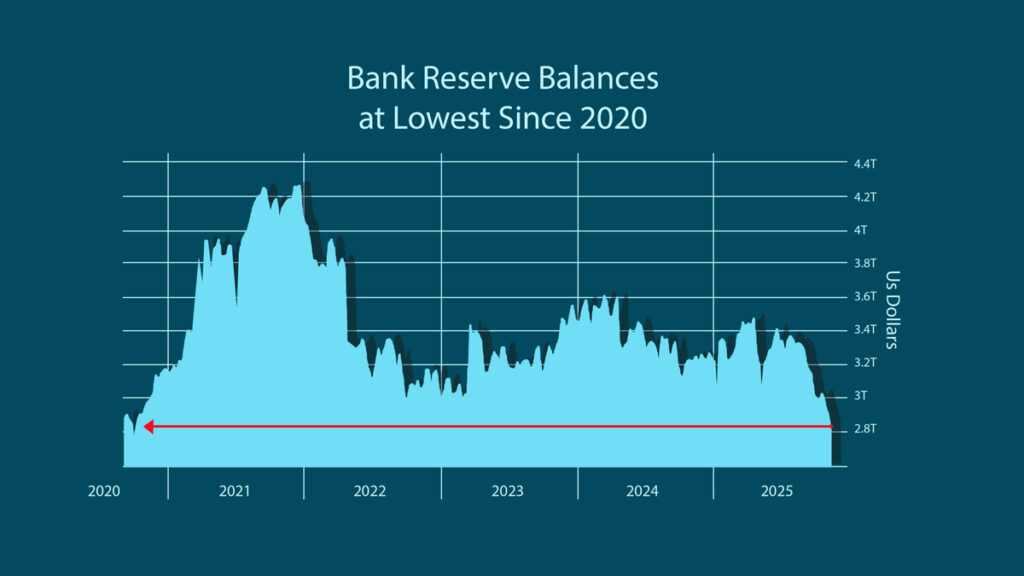

US Bank Reserves Plummet to Four-Year Low

The Fed’s recent intervention was in response to rapidly dwindling US bank reserves. The central bank’s quantitative easing, primarily in the form of lower interest rates, is liquidating its balance sheets, leaving major banks with less liquid cash. Last week, these bank reserves fell to $2.8 trillion, reaching a four-year low and sparking concern of a liquidity crisis. With the Fed intervening through a multi-billion-dollar shot to the economy’s arm, investors are increasingly alarmed by the state of markets.

This half-decade record stimulus comes as other stress signals emerge. The government is in uncharted territory as it enters the longest shutdown in US history. Although policy issues often take center stage, government funding remains at the heart of the debate, exacerbating further fiscal dysfunction. Meanwhile, the Fed is set to halt its balance sheet runoff earlier than anticipated, a subtle acknowledgement that liquidity is a legitimate concern.

US Treasury Market Wobbles

This broader weakness in the US economy is also reflected in an embattled Treasury market, where demand for government debt has begun to falter. Most notably, major foreign central banks have been selling US Treasurys and increasing their gold reserves instead, a trend tied to the growing global de-dollarization movement.

Nations seeking to reduce their exposure to the US economic system and political risk are diversifying away from the dollar and shifting toward physical gold, which has regained prominence as a Tier 1 asset. This shift has helped support gold prices even as broader markets show instability.

Weak demand for Treasurys threatens the bond market because fewer buyers force yields higher and bond prices lower, tightening financial conditions. For instance, the Fed’s most recent $29.4 billion liquidity injection briefly eased that pressure as the 13-week bill yield slipped from 3.78% to 3.72%.

Yet the improvement is temporary. Lower yields make Treasurys less appealing going forward, meaning the government must work even harder to attract buyers in a market already pulling away.

“This is something people need to keep their eyes on right now because it affects everybody.”

Why Dalio Recommends a 15% Allocation to Gold

In light of these fiscal hurdles, Ray Dalio advises allocating around 15% of a portfolio to physical gold. This echoes a growing chorus of experts advising investors to adopt a 60/20/20 portfolio split. These bold calls come as the value and credibility of fiat currencies continue to erode. For the first time since 1996, central banks hold more gold than US Treasurys.

Source: Crescat Capital LLC via Investing.com

The national debt has climbed to $38 trillion, pushing the debt-to-GDP ratio to 125% and driving annual interest payments past $1 trillion. Dalio notes that gold has historically preserved wealth during periods of currency devaluation due to its stability, privacy, and longstanding acceptance among governments and institutions.

“Gold is a hedge against uncertainty, foreign currency devaluations, and inflation. That’s why governments are going to gold as a way to protect against falling purchasing power. That’s exactly what investors should be doing right now.”

Protect Your Wealth from Economic Weakness

Gold is taking center stage as a stand-in for the dwindling dollar and weakening Treasury market. This is proven by the global central bank shift into the yellow metal, as the USD gets tossed to the side. Major financial institutions and reputable voices are encouraging investors to diversify more into gold to protect their wealth.

If you’d like to learn how to position yourself before the shift accelerates, check out our FREE Precious Metals Investment Guide. You’ll learn how to avoid the 22 most critical mistakes investors make.

Question or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Comment

Questions or Comments?

"*" indicates required fields