Oil prices have rebounded slightly since suffering a tremendous drop over the last few months. In the last couple of weeks, the price has reached back into the 50’s, which is still extremely low, but not as bad as it has been. Optimistic investors are hoping that this is a sign of prolonged rally that may eventually get oil prices back to a healthy level. Many banks, however, have been issuing reports to their investors with a more pessimistic outlook.

According to online sources, Citibank has issued the following statement to its clients:

“The recent rally in crude prices looks more like a head-fake than a sustainable turning point – The drop in U.S. rig count, continuing cuts in upstream capex, the reading of technical charts, and investor short position-covering sustained the end-January 8.1% jump in Brent and 5.8% jump in WTI into the first week of February.

Short-term market factors are more bearish, pointing to more price pressure for the next couple of months and beyond – Not only is the market oversupplied, but the consequent inventory build looks likely to continue toward storage tank tops. As on-land storage fills and covers the carry of the monthly spreads at ~$0.75/bbl, the forward curve has to steepen to accommodate a monthly carry closer to $1.20, putting downward pressure on prompt prices. As floating storage reaches its limits, there should be downward price pressure to shut in production.

The oil market should bottom sometime between the end of Q1 and beginning of Q2 at a significantly lower price level in the $40 range – after which markets should start to balance, first with an end to inventory builds and later on with a period of sustained inventory draws. It’s impossible to call a bottom point, which could, as a result of oversupply and the economics of storage, fall well below $40 a barrel for WTI, perhaps as low as the $20 range for a while.”

$20 a barrel could be catastrophic for the economy, even for a short period of time. Many oil companies are trying to cut costs by shutting down their rigs at a torrid pace, but this has had very little effect on the supply. With supply outpacing demand, prices should continue to suffer.

In an interview with CNBC, Barclays analyst Michael Cohen commented on the supply issue:

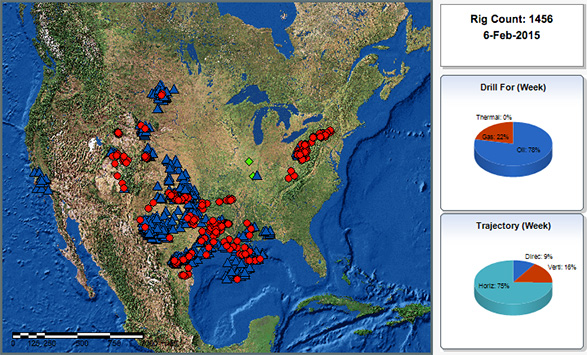

“What we saw in the last couple weeks is rig count falling pretty precipitously by about 80 or 90 rigs per week, but we think there are more important things to be focused on and that rig count doesn’t tell the whole story. In addition, there is an excess supply of about a million barrels of oil a day.”

The bottom line is that if oil prices remain low for much longer, many energy companies will go out of business. This will have a domino effect on the economy, since any financial institution that owns a piece of their debt will see their portfolios put under a tremendous amount of stress.

On the flipside, as these low oil prices continue to punish the global economy, safe-haven investments such as gold should start to see a bump as investors look to protect themselves from an economic meltdown.