The U.S. economy is still too weak to stand on it’s own and the Fed knows it.

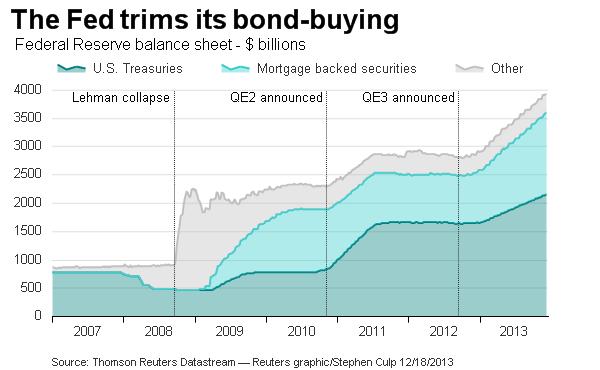

Federal Reserve chairman, Ben Bernanke, recently announced that the Fed would begin tapering of its billion-dollar bond-buying program. Starting in January, the Fed will buy $35 billion a month, down from only $40 billion a month, of mortgage-backed securities and $40 billion, down from only $45 billion of long-term Treasury Bills.

According to the Federal Reserve, the economy is strong enough to withstand some tapering, but inflation is enough of a concern to make the tapering a very gradual one. It seems that the tapering will continue to be methodic as long as the data on inflation and the slow-to-recover housing market remains less than encouraging.

While tapering was the headline, the additional announcement that short-term interest rates will remain low for another 2-3 years may have the strongest effect on the market. This is bad news for the bond market, since it relies on decent interest rates, but it is good news for the stock market. This piece of the report encouraged stock investors and the market climbed to record levels post-announcement.