The ever-expanding US national debt has surpassed $37 trillion, marking yet another troubling milestone in the nation’s accelerating march toward a potential fiscal cliff.

These increasingly abstract numbers still carry concrete consequences, with the mounting debt threatening to deepen the ongoing cost-of-living crisis, erode the dollar’s remaining credibility as the world’s reserve currency, and further harm the demand for US treasuries.

The window to avert the long-term consequences of a full-blown debt crisis is narrowing rapidly. Increasingly, investors are shifting capital away from the dollar and toward traditional safe-haven assets.

The Significance of $37 Trillion Debt

The national debt might be the headline number, but the $37 trillion figure brings a host of equally alarming metrics into focus. Taken together, these key measurements of economic health paint a troubling picture of the nation’s fiscal outlook.

- The debt-to-GDP ratio is 120% and could extend to 200% by 2047.

- The federal deficit stretched to $1.83 trillion in 2024 and is on pace to nearly hit $2 trillion in 2025.

- Debt interest payments cost the government $1 trillion annually, and that number is projected to reach $1.8 trillion by 2034.

Government Spending Picks Up

As the national debt blows past yet another record, federal spending is accelerating, not slowing down. The GOP-led Congress successfully passed the One Big Beautiful Bill Act, despite warnings from nonpartisan fiscal watchdogs and growing concern among Republican fiscal hawks.

The legislation is expected to add trillions to the national debt in only a few years. Some of the most costly provisions in the bill include:

- Tax cut extensions projected to add around $4 trillion over the next decade

- A debt‑ceiling increase allowing $4 to $5 trillion more borrowing

- A $1.1 trillion increase in defense and border spending

Fiscal experts across the political spectrum agree that Trump’s signature legislation will significantly accelerate the national debt.

Analyses from the Tax Foundation, the Congressional Budget Office (CBO), Yale’s Budget Lab, and the Penn Wharton Budget Model all project that US debt could surpass $52 trillion within the next decade (although many of their estimates land trillions higher).

Grounding the Sky-High National Debt

A figure as vast as $37 trillion can seem abstract, causing many investors to feel removed from the realities of the national debt. However, the consequences of ongoing fiscal mismanagement extend far beyond Washington. Consider that:

- The US government is on track to spend more on servicing the national debt than on defense and Medicare combined.

- At current levels, the federal debt equates to approximately $100,000 per person and nearly $275,000 per household.

- The national debt is set to shrink the economy by $340 billion in the next decade and $1.8 trillion over the next 50 years.

- The availability of domestic jobs could fall by 1.2 million in 2035 and up to 2.7 million in 2055.

These unsettling figures make clear that the national debt is not just a policy issue, but a financial strain with broad implications for every American.

What’s on the Line

The health of the entire US economy, and, by extension, the financial security of everyday Americans, is at risk due to the surging debt. Some very specific issues have been rising recently in light of the $37 trillion debt milestone:

Rising Inflation & Cost of Living

Although inflation has settled near the Federal Reserve’s target of 2%, some see rates kicking up along with debt.

Former Secretary Laurence Summers warns that even a few more trillions added to the debt, which seems inevitable at this point, could drive persistent inflation and even increase the risks of stagflation.

These concerns are backed up by a Mercatus Center study that found a single percentage point increase in the debt-to-GDP ratio causes roughly a 4.6 basis point rise in long-term interest rates, a common proxy for inflation.

Eroding Household Purchasing Power

Debt accumulation doesn’t just burden the federal budget. It also erodes the buying power of everyday Americans.

Estimates from the Yale Budget Lab indicate that a long-standing deficit rise equal to just 1% of GDP could slash the average household’s purchasing power by $300 to $1,250 over five years.

At the same time, mortgage holders could experience an annual housing costs surge by $600 to $1,240 due to rising interest rates in response to elevated federal borrowing. In essence, deficit spending quietly taxes consumers through reduced affordability and higher financing costs.

Risk of Higher Taxes

The cost of servicing the US debt rises in lockstep with the growing deficit. By 2035, interest payments are projected to consume nearly one-third of all federal revenue. That would exceed what the government spends on major programs.

This crowding out of core budget priorities threatens to force difficult fiscal decisions. Broad-based tax increases or cuts to essential services could become unavoidable, placing even more pressure on the average household.

Even over a single year, it is clear that rising national debt often goes hand in hand with higher tax burdens.

Between 2023 and 2024, the US national debt rose by 7%, climbing from $33.17 trillion to $35.46 trillion. During that same period, federal tax revenue surged by 10%, increasing from $4.44 trillion to $4.92 trillion.

Waning Dollar Confidence

The federal government has undermined global confidence in the dollar through a mix of fiscal mismanagement and geopolitical overreach.

On the fiscal side, a $37 trillion national debt, ballooning deficits, and rising interest costs are raising serious concerns among foreign governments about the dollar’s long-term stability.

Since the US used the greenback as a financial weapon against Russia by cutting off access and imposing sanctions, many emerging economies have begun to view the greenback as a much riskier asset.

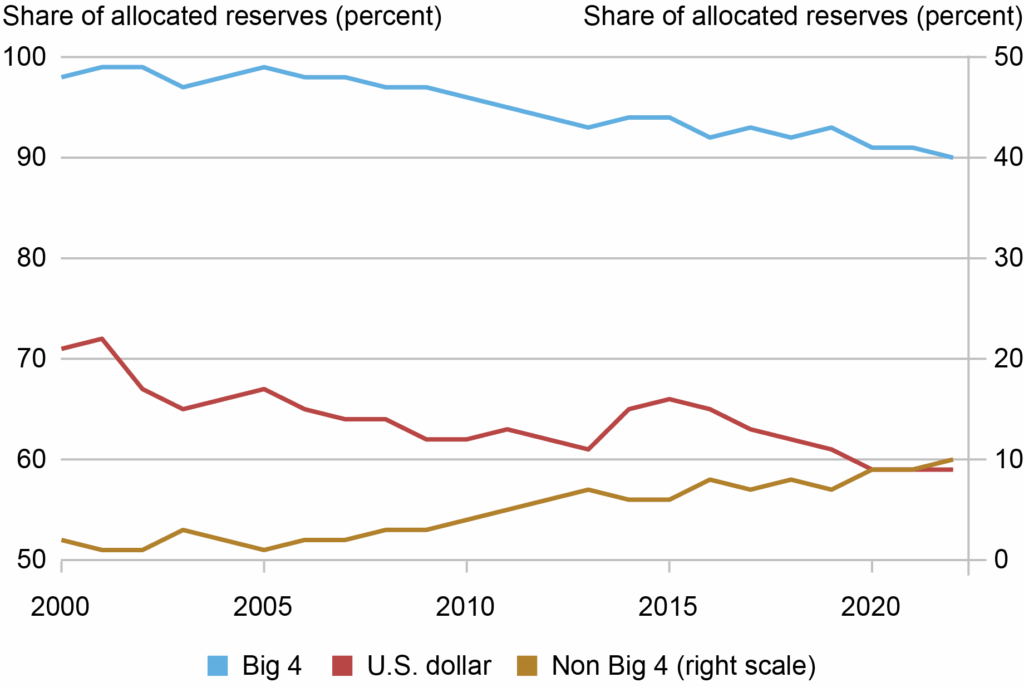

Together, these pressures have triggered a full-blown crisis of confidence. The dollar’s share of global foreign reserves has dropped to just 58%, its lowest level in decades.

Source: Federal Reserve Bank of New York

The result is more expensive borrowing for the US and more dollars flowing back to domestic markets, harming American investors the most.

Weakening US Treasury Demand

The national debt time bomb is putting serious pressure on one of the last foundations of fiscal stability. US Treasuries allow the government to borrow at a relatively low cost, but that advantage is starting to erode.

As global demand for Treasuries declines, yields are rising, and America’s borrowing is becoming more expensive.

After Trump’s tariff announcement in April, the 10-year Treasury yield surged by more than 0.5% in under a week. It was one of the sharpest short-term increases in decades and a clear sign of the market’s sensitivity.

The outlook becomes even more troubling when viewed in a broader context. In less than four years, bond yields have jumped from under 1% to over 4%.

Calvin Yeoh, portfolio manager at Blue Edge Advisors, described the sell-off as “a fire sale of Treasuries.” Moody’s echoed that view by cutting the US’s final perfect credit rating.

Although Treasuries have recovered slightly, the global trend remains clear. Foreign governments are continuing to reduce their holdings. In April 2025, China sold off more than $8 billion in US debt. In the first quarter alone, total foreign net sales of Treasuries reached $254 billion.

A Debt-Burdened Dollar Gives Rise to Gold

The US debt crisis is unfolding in real time with the trillion-dollar milestones arriving at an accelerating pace. The dollar’s world reserve status is quickly fading as exponential debt growth weighs on the currency’s value, stability, and confidence. As the foundation of the global financial system cracks, central banks, institutional investors, and everyday investors are voting with their wealth for gold as the de facto replacement.

To see why gold is gaining ground at every level of the global economy, and what that could mean for your portfolio, check out our exclusive guide: Gold Rush 2.0: A New Era in the Global Monetary Order. It explains how the yellow metal is evolving from a cyclical financial hedge to a permanent foundation of the burgeoning financial system.