On October 22, America’s national debt crossed $38 trillion after notching one of its quickest trillion-dollar hikes in history. This unprecedented spike follows a half-year borrowing pause as the debt ceiling was suspended from January to July.

On October 22, America’s national debt crossed $38 trillion after notching one of its quickest trillion-dollar hikes in history. This unprecedented spike follows a half-year borrowing pause as the debt ceiling was suspended from January to July.

Experts point to the alarming acceleration of US debt accumulation, noting that each trillion-dollar milestone is arriving faster than the last. Some warn that the $39 trillion mark could be reached within just a few months.

Understanding the $38 Trillion Debt

The national debt has been in mind-bending territory for decades, making it difficult for most people to truly grasp. Even written out in full — $38,000,000,000,000 — the number feels abstract. Breaking it down into more tangible terms helps investors understand the weight of this ever-climbing figure.

If the debt were divided evenly among the US population, it would amount to roughly $111,000 per person and $287,000 per household. For perspective, the median individual income in the US is about $45,140, while the median household income stands at $83,730.

Put another way, the national debt now exceeds the size of the US economy — the largest in the world — by roughly 125%. It’s even greater than the combined economies of the United Kingdom, India, China, Japan, and Germany, all global powerhouses in their own right.

The debt-to-GDP ratio has been climbing for years and is now approaching historic highs. Outside of major wars, this level of debt is virtually unprecedented. By contrast, nations in the European Union have signed an economic treaty, placing a target ceiling on the debt-to-GDP ratio at 60%, less than half that of US debt.

US Debt is Growing Faster Than Ever

The sheer size of the US debt is alarming on its own, but the speed at which it’s growing makes it even more troubling. The jump from $37 trillion to $38 trillion ranks among the fastest trillion-dollar increases in history — an extraordinary surge that unfolded in just over two months.

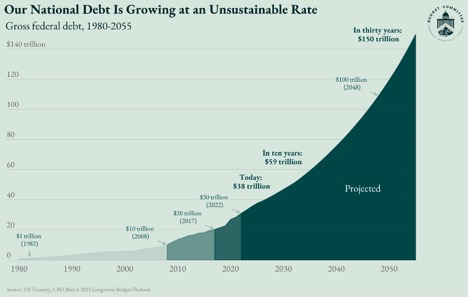

To put this in perspective, the federal debt stood at $5.7 trillion in 2000, a figure that now seems like a rounding error in today’s debt landscape. The history of US national debt clearly shows that the problem is getting exponentially worse.

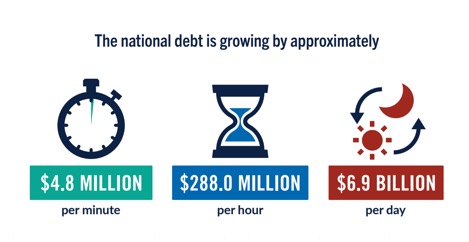

The nation is currently adding $6.9 billion every day, $288 million every hour, $4.8 million every minute, and roughly $80,000 every second.

Source: PGPF

This debt spiral shows no sign of slowing. Analysts warn the $39 trillion mark could arrive within months, while the House Budget Committee projects a staggering climb to $59 trillion within a decade, $100 trillion by 2048, and $150 trillion within 30 years.

Source: House Budget Committee

The Forces Pushing US Debt Higher Than Ever

Rising Interest Costs

Interest payments represent the fastest-growing portion of the federal budget and one of its largest overall. Right now, the US is spending an eye-watering $3 billion per day just to service its mountain of debt.

These costs have grown so quickly that interest on the debt now surpasses defense spending, even as the defense budget has expanded considerably under the Trump administration. The US is increasingly going into more debt just to cover the cost of existing debt, creating a negative feedback loop that digs the country deeper into the red.

The Weight of Entitlement Spending

Politicians often talk about “trimming the fat” from the national budget, but they frequently ignore the real weight dragging it down: entitlement programs. Together, Social Security, Medicare, and Medicaid account for roughly 46% of all federal spending, according to the Congressional Budget Office (CBO).

This mandatory spending acts as a permanent anchor on the nation’s finances, growing automatically each year as the population ages and healthcare costs rise. Without meaningful reform — a politically difficult task that would require both austerity measures and major legislative changes — these programs will continue to consume an ever-larger share of the federal budget, leaving little room for fiscal flexibility or debt reduction.

Persistent Federal Deficits

The primary mechanical driver of federal debt growth is persistent budget deficits. Elected officials repeatedly fail to spend within their means, as outlays have outpaced revenues every year since 2001, the last year the U.S. had a balanced budget. Instead of correcting course in the face of a $38 trillion debt hole, politicians continue expanding budgets and cutting taxes.

For example, the One Big Beautiful Bill — the signature tax and spending legislation under the Donald Trump administration — is projected by the non-partisan CBO to add about $3.4 trillion to the deficit over the next decade.

US Debt Shines Bright on Gold’s Future

The aggressive growth of US debt is taking a serious toll on the country’s fiscal positioning on the domestic and international fronts.

The US dollar is weak right now, struggling to recover from a globalized de-dollarization effort. The entire Treasury market is seeing decreased demand as falling bonds reflect investors’ shifting appetite.

The situation is so dire that all three major credit rating agencies downgraded the US’s status, considerably damaging the country’s global fiscal reputation. In place of a stable dollar, once regarded as the world’s reserve currency, gold is reasserting itself at the center of global finance. The banking industry has officially adopted it as a Tier 1 asset, and some of the largest financial players are advocating that investors diversify their portfolio with more gold.