Every Friday, Kitco News does a survey of industry experts and asks them to predict what gold prices will do the next week. Last week, the majority of those surveyed said they were looking for gold prices to increase this week. As of 11:45 a.m. EDT Friday, Comex gold futures for June were up $16 for the week.

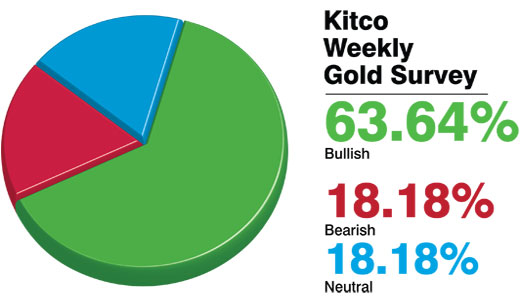

Yesterday, there were 22 responses to the gold survey, and 14 see prices up, while four see prices down, and the final four predict no change. Market participants include investment banks, futures traders, bullion dealers, and technical chart analysts.

One participant, Bob Tebbutt of Armour Asset Risk Management, said he is bullish on gold because he believes the weakening U.S. dollar should continue to give gold a boost.

Jeffrey Nichols, managing director at American Precious Metals Advisors, said, “Safe-haven factors, such as simmering tensions between Russia and the Ukraine, plus continued uncertainty over global economic growth may also support gold.”

Nichols went on to say that, “There is a shifting sentiment on Wall Street with regard to equities versus gold. Last Year, to an important extent, gold-price weakness reflected hedge funds and other institutional investors switching from gold, especially gold ETFs (exchange-traded funds), into equities, especially the tech stocks. Now, the momentum is reversing – causing some investors to reallocate, this time reducing their stock-market exposure once again in favor of gold.”

The more bearish participants seem to believe that gold is “bumping into technical chart resistance between the areas of $1,325 and $1,330 and is unlikely to move above there in the short term.”

Jordan Eliseo, chief economist for Australian Bullion Company, was one of the neutral participants. He stated that, “Continued weakness in equity markets, alongside falling bond yields, could see bullion supported, but a stabilization in risk assets and a calming of tensions in the Ukraine could see some money flow out of the sector. Technically gold looks solid, but there is no immediate bullish catalyst.”

Gold prices closed today at $1,317.97 an ounce.