While the gold and silver markets have been roaring to record highs, the platinum market has fallen off the radar for many investors. Last year, the metal seemed prime for upward movement given steadily rising demand and limited availability.

In this week’s The Gold Spot, Scottsdale Bullion & Coin Founder Eric Sepanek and Precious Metals Advisor John Karow review prior platinum market predictions, the severity of supply deficits, and why platinum prices might have more room to run in 2026.

A Call That Aged Well

Similar to today, platinum was virtually ignored in 2024 as investors remained glued to the remarkable gains of gold and silver. However, a deeper analysis of the white metal’s supply-and-demand dynamics pointed to a potential breakout. Back in May of last year, we tipped off our audience about potential upside in the platinum market.

Short on supply, increased demand. That smells like upside.–

At the time, the limited supply of platinum was being squeezed, not by retail investors, but by major industrial players. That tension between waning physical availability and competitive physical demand signaled a possible breakout, and our prediction proved correct.

An Explosive 2025 for Platinum

While the gold rally eclipsed the $4,000 mark and the silver squeeze propelled prices to record highs, platinum quietly put on a stellar performance of its own. In 2025, the metal price has surged by more than 100%. Platinum prices entered the year slightly over $900/oz and currently stand within spitting distance of $2,000/oz.

Price action was steady throughout the first half of the year, barely reaching over $1,000/oz before June. Since then, however, platinum has exploded upward. Aside from a few periods of consolidation here and there, prices have been rising steadily. This stellar price action confirmed our earlier predictions and delivered healthy returns for listeners who acted.

A Relentless Structural Shortfall

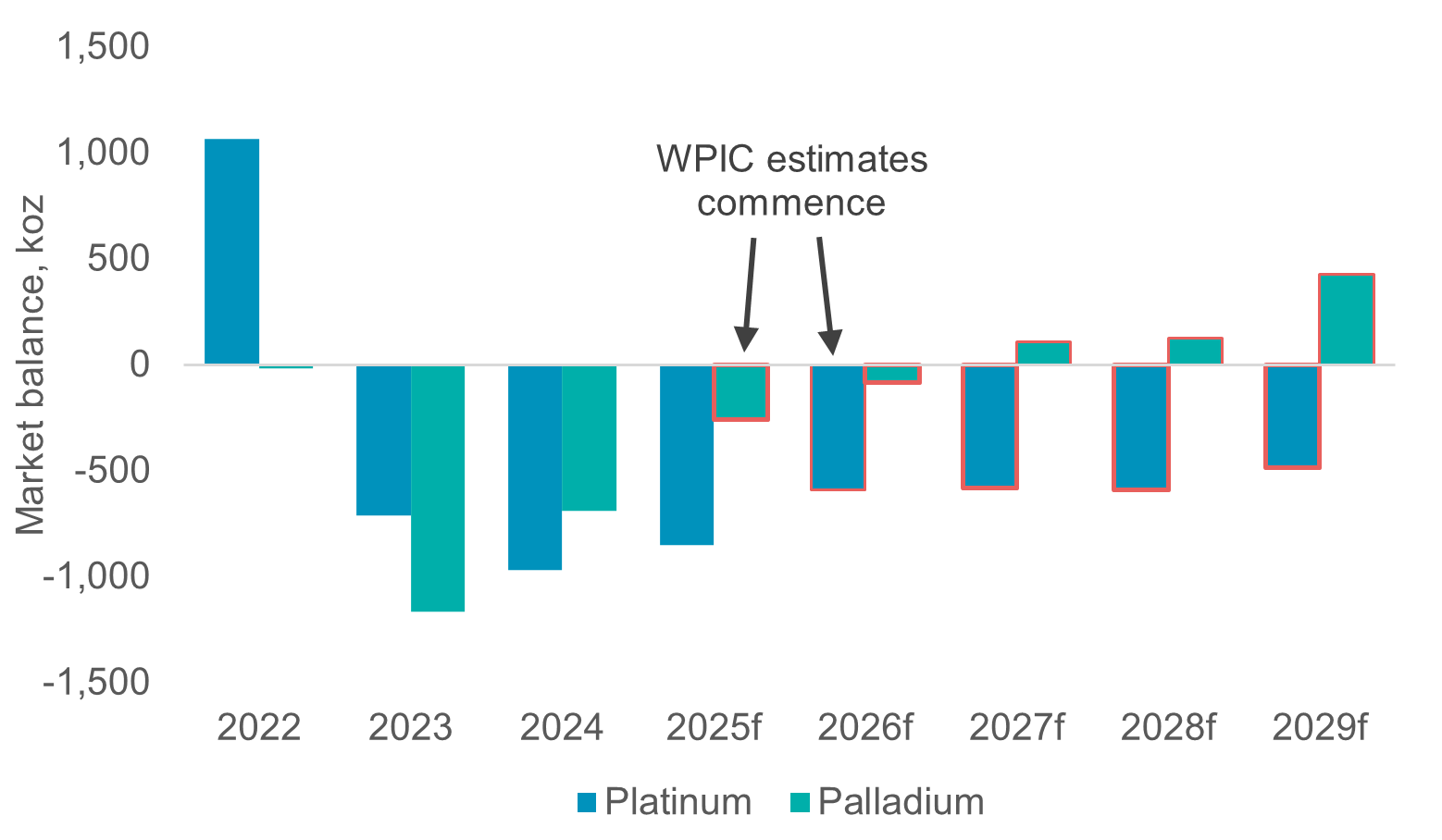

The platinum market has been plagued by a supply shortfall for three years in a row, with demand exceeding supply once again in 2025. In 2023, the market posted a deficit of approximately 710,000 troy ounces (koz). In 2024, the shortfall expanded further to around 939 koz. By 2025, another deficit of nearly 692 koz was recorded.

“These shortages of metal are going to keep the pressure upward on the prices.”

The supply side of the equation isn’t likely to improve in the near future, either. According to the World Platinum Investment Council, the platinum market will post deficits for the next several years. Between 2026 and 2029, the group predicts deficits will average 620 koz annually. Put another way, global demand will outpace the yearly available supply by 8%.

Chart image source: World Platinum Investment Council

Chart image source: World Platinum Investment CouncilAbove-Ground Platinum Stocks Are Being Drained

The above-ground stockpiles of physical platinum are running dry. In 2024, available reserves sat around 3,828 koz. By 2029, these stockpiles are expected to plummet by 80%, falling to around 731 koz. Anything below 1,000 koz is historically tight. Once visible and invisible inventories fall this low, any supply disruption or demand surprise becomes explosive.

Mine Supply Fails to Keep Up

While the available supply of physical platinum is disappearing from the market, mine production is contracting. The global mine supply is expected to contract by 1.5% annually through 2029. Even the metal’s sharp price rally is failing to elicit a meaningful response from producers.

There is simply no appetite for large new growth projects, and no material supply response is expected within the forecast window. The decline in platinum production is largely driven by persistent structural constraints in South Africa, which accounts for the bulk of global platinum output. Rather than expanding, the global mine base is slowly shrinking, locking in supply tightness for years to come.

“The people who create the supply can't just turn on the faucet and create more platinum. It has to be dug out of the ground, refined. It takes a long time to get there.”

Investment Demand Adds Fuel to the Fire

Investment demand has become a key force intensifying platinum’s supply imbalance. In 2025, investment buying reached roughly 742 koz, a multi-year high that coincided with already constrained physical availability.

Chart image source: CME Group

Chart image source: CME GroupChina played an outsized role, with platinum bar and coins demand jumping about 73% as investors increasingly favored physical exposure. At the same time, platinum ETFs continued to accumulate metal, further reducing available supply. Unlike speculative paper flows, this demand removes physical platinum from circulation.

Platinum in 2026: Selloff or Surge?

Some research suggests a potential sell-off in platinum ETF holdings could return metal to the market and temporarily relieve supply pressure. However, that outcome is far from certain. ETF investors have so far shown little urgency to exit, even as deficits persist and physical availability tightens.

Without a meaningful liquidation, the market remains structurally constrained. With the mine supply unable to respond quickly, inventories already drawn down, and demand holding firm, platinum deficits appear likely to extend into 2026. Even after recent gains, inflation-adjusted prices remain below prior highs, leaving meaningful upside if current conditions continue.

“I think it's going to continue to rise. Platinum, it's got more room to go.”

Platinum remains $800/oz below the inflation-adjusted high, leaving historical room for growth. The white metal might just be a few months from joining gold and silver above all-time highs and far into price discovery mode.

Similar demand pressures have been weighing on the tight silver supply, pushing silver prices to all-time peaks. If you’d like deeper context on how these imbalances set up prices for higher growth and how you can best position your portfolio, grab a FREE copy of our Silver Investor Report.

The Silver Bullet Gift Set is Nearly Gone!

With only 3 days remaining for local pickup and very limited inventory left, the Silver Bullet Gift Set is close to selling out. This strictly limited holiday release will not be restocked this season. Each set includes a 1 oz .999 fine silver bullet, a custom revolver-style holder, and premium gift packaging, making it a standout gift for collectors, gun enthusiasts, and silver investors alike. Call 1-888-652-1966 to claim your gift set before they run out.

Question or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Comment

Questions or Comments?

"*" indicates required fields