In early October, gold eclipsed the $4,000/oz threshold and quickly surpassed that milestone by nearly 10%. This pop was followed by a swift pullback before prices leveled out. This rapid succession between a record-setting surge and a considerable dip has investors asking a familiar question: Is gold’s rally facing a potential reversal or gearing up for more growth?

In early October, gold eclipsed the $4,000/oz threshold and quickly surpassed that milestone by nearly 10%. This pop was followed by a swift pullback before prices leveled out. This rapid succession between a record-setting surge and a considerable dip has investors asking a familiar question: Is gold’s rally facing a potential reversal or gearing up for more growth?

The World Gold Council (WGC) — one of the most respected authorities in the market — tackled that very question in its latest report. By comparing the current rally to past bull runs and examining the macroeconomic forces behind it, the group offers a perspective that may surprise even seasoned investors.

Gold’s Knee-Jerk Moves Raise Questions

When gold blasted through $4,000/oz, it marked the 45th record high of 2025. Within a few weeks, those numbers were old news as the yellow metal spiked to a fresh peak of $4,356/oz on October 20th. It only took another week before those nearly 10% gains were erased. Now, gold prices hover around the $4,000/oz mark.

When measured in $500 increments, gold’s momentum is picking up steam. The yellow metal leaped from $3,500/oz to $4,000/oz in a mere 36 days. That’s an extraordinary pace compared to the historical average of nearly three years for a $500 move.

Rapid Growth With Stable Roots

The extraordinary speed of gold’s rise in pure dollar terms might lead some investors to believe a blow-off top is on the horizon — the kind of massive sell-offs that often follow parabolic moves. Yet, analysts at the WGC urge investors to view this seemingly frantic acceleration in context. As gold’s price climbs higher, each $500 jump represents a smaller share of its overall value.

For example, when gold advanced from $1,500/oz to $2,000/oz, it had to rally by 33%. The move from $3,000/oz to $3,500/oz required about 16.7%, and the latest spike from $3,500/oz to $4,000/oz was 14%. This remark isn’t meant to distract from gold’s power, but rather to show it’s on a more solid footing than the explosive price action alone might indicate.

WGC directly compares the yellow metal’s current price action to the lead-up to gold’s 2011 bull run, when it exploded by roughly 45% in less than a year. In both cases, gold was advancing at a sustainable pace of roughly 0.5% daily.

What’s Undergirding the Rally

According to the WGC, gold’s rally kicked off in mid-October 2023, when prices hovered around $1,850/oz. This multi-year upswing has been supported by various macroeconomic trends, fiscal policy decisions, and geopolitical shifts, including:

- Safe-Haven Demand: Investment consumption among institutions and retail investors, especially in the West, has kept steady demand-side pressure on the gold market, burdening the relatively stagnant gold supply.

- Dollar Instability: The USD’s status as a world reserve currency is under threat as a punishing de-dollarization effort and domestic financial foibles undermine its value and credibility.

- Interest Rate Cuts: Following a long pause, the Federal Reserve resumed its easing cycle, making non-yielding assets more attractive. Experts expect the slashes to continue through 2026, further increasing the appeal of non-yielding assets, such as gold.

- Overheated Equities: The stock market’s unmetered growth amid rising inflation and a softening job market leads many to anticipate a serious correction, further boosting safe-haven demand.

Gold Remains in the “Early Innings”

Those factors might be providing the foundation for the gold rally, but they don’t necessarily guarantee its continuation. Moving forward, WGC sees a handful of reasons to believe gold’s crossing of the $4,000 threshold indicates further growth instead of a reversal.

Young Rally

Compared to past periods of sustained growth, gold’s current advance is still relatively young. The last three structural upcycles — during the stagflation of the 1970s, in the aftermath of the 2008 financial crisis, and leading up to the pandemic — lasted an average of 1,062 days. By contrast, the yellow metal’s current secular uptrend has spanned just 757 days, suggesting there may be plenty of room left to run.

Source: WGC

Historically Lacking ETF Inflows

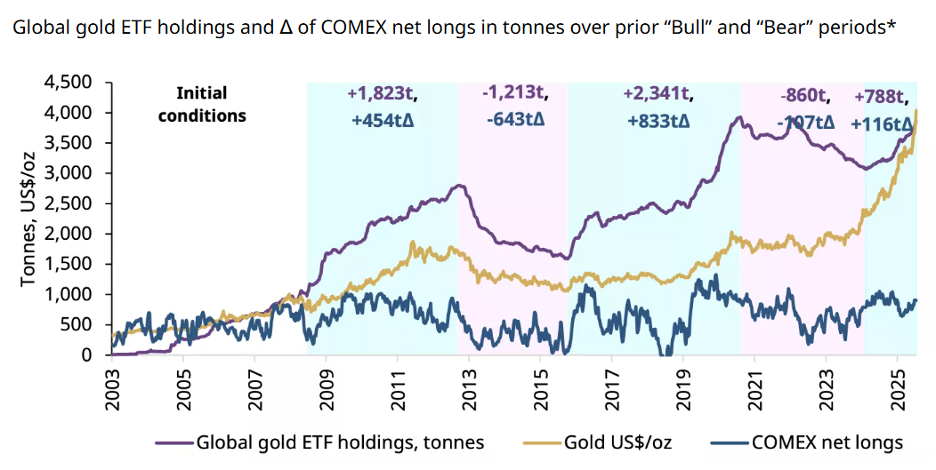

Another reason to believe gold hasn’t peaked yet is the status of gold exchange-traded funds (ETFs). As one of the most popular investment vehicles for the yellow metal, ETFs are often used to gauge market strength. Global gold ETF holdings remain about 2% below the all-time highs reached in late 2020.

Source: WGC

Analysts note that the move from $3,500/oz to $4,000/oz coincided with ETF inflows of just 128 tonnes, much lower than levels typically seen during speculative phases. Furthermore, the accumulation that began in May 2024 has only brought in around 788 tonnes, roughly one-third of the demand recorded during previous long-term advances.

Broader Participation & Investments

While gold is becoming more attractive due to internal strength and challenging economic conditions, it’s also becoming more accessible. Low-cost ETFs continue to expand, giving retail investors easier exposure to an increasingly expensive precious metal. Meanwhile, the launch of 1-oz COMEX futures has lowered the barrier to entry in the futures market, where traditional 100-oz contracts once kept smaller investors on the sidelines.

On the institutional front, both India and China have eased restrictions on gold ownership. Most notably, Beijing now allows major Chinese insurance firms to hold gold, marking a significant step toward broader institutional participation.

Poor Macroeconomic & Geopolitical Outlook

The grim economic and geopolitical backdrop that has helped spur gold demand is unlikely to improve, warns the WGC. The Fed’s ongoing rate cuts reflect an uncertain domestic economy marred by stubborn inflation, spiraling national debt, and a weak dollar. That picture doesn’t improve when looking globally, with fractured trade relations and rising tensions.

Early Innings of a New Phase

In light of these factors, analysts at the WGC report there are “reasons to believe that gold’s run has not run out of steam,” further saying the market is “likely in the early innings of the next accumulation phase.”

They acknowledge that the market could experience some turbulence on track to higher prices, but their outlook remains optimistic.

“In our view, gold’s strategic strengths continue to balance the tactical risks as this new stage unfolds.” — The World Gold Council