As cash’s share of everyday transactions declines, digital payments become the norm, and officials fast-track cryptocurrency adoption, many investors are wondering: Is the US becoming a cashless society?

Although people have pondered a world without cash for decades, no point in history has seen more concrete developments to bring about that reality.

Governments are openly discussing reducing the use of hard money, optimizing cashless payments, and even digitizing legal tender. At the same time, consumers and businesses have turned toward non-cash payments for efficiency and convenience.

The pandemic-era accelerated these trends as lockdowns forced commerce online and governments reenvisioned domestic and international trade payments.

While the road to a cashless society is still being paved, it’s picking up pace. Investors who want to prepare their wealth for this rapidly approaching future properly should get an accurate picture of cash’s role in the future.

The Evolving Consumer Payment Landscape

Every year, the Federal Reserve releases a Diary of Consumer Payment Choice survey, which offers insights into how payment behavior shifts over time. Here’s what the latest findings say about the evolving payment landscape.

Cash Continues Decline as Digital Methods Expand

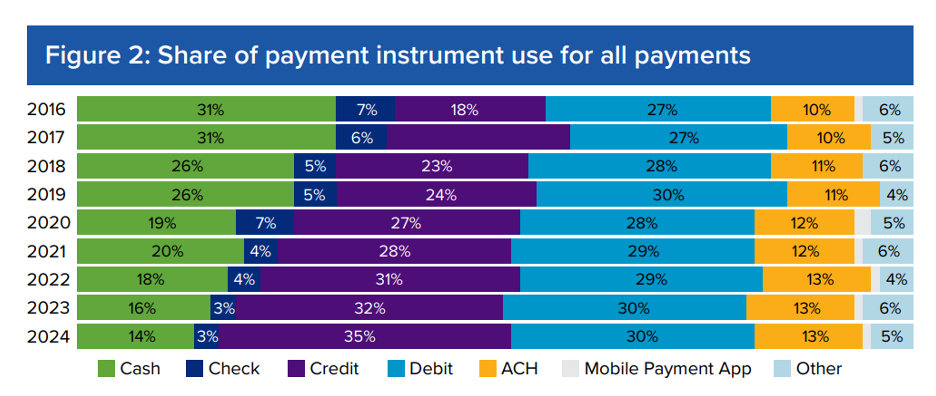

In 2024, cash accounted for only 14% of total payments, nearly halving since 2019. On the flipside, noncash transactions soared from 74% to 86% during the same period. Put another way, non-cash payments grew at an average annual rate of 3%, while the share of cash transactions shrank by more than 11% per year.

If current trends persist, cash could represent just 7% of consumer payments by 2030, with the remaining 93% dominated by cards, digital wallets, and bank-linked transfers, underscoring the country’s steady march toward a cashless economy.

Cash Transactions Hold Steady, But Total Payments Increase

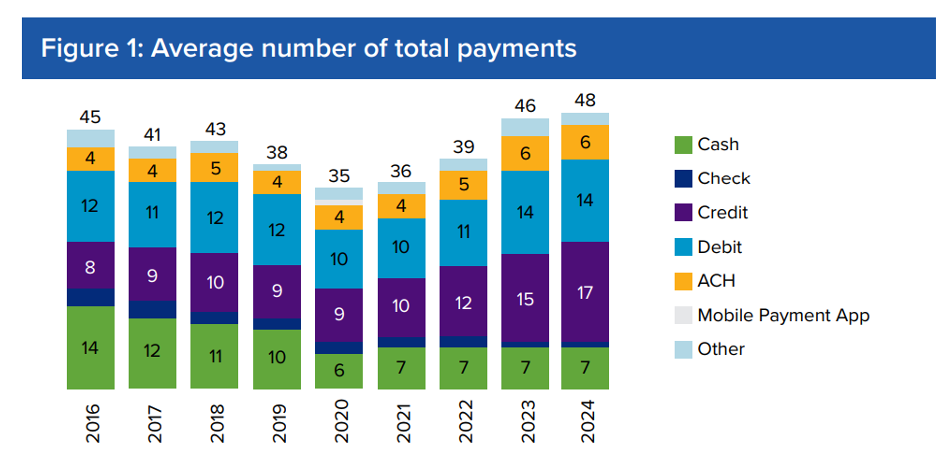

Cash’s share of overall transactions fell to an all-time low of 14% in 2024, but this shift isn’t simply due to Americans using less physical money. Fed data shows that the average number of monthly cash payments has held steady at 7 since 2021.

What’s changing is the rapid growth of digital, card, and bank-based payments, which are expanding the total number of monthly transactions from 35 in 2020 to 48 in 2024.

As a result, even though cash usage hasn’t dropped in absolute terms, its relative share continues to shrink. This shows that cash is being crowded out, not by declining use, but by the accelerating preference for and diversification of alternative payment methods.

Two-Thirds of Cash Payments Are Not by Choice

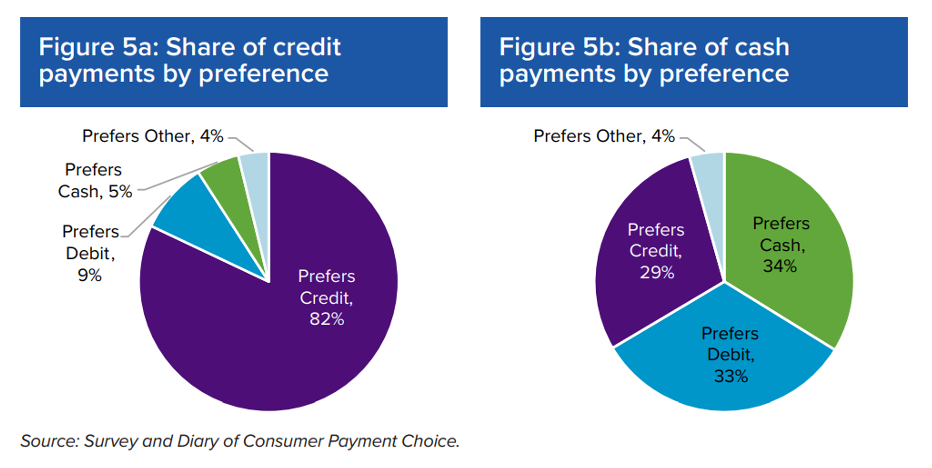

If the adage that “cash is king” still holds, it’s an unpopular monarch. The Fed’s findings show that even when cash is used, it’s often out of necessity, not preference. This could occur when digital payments aren’t accepted or simply not functioning.

Two-thirds of all cash payments are made by people who actually prefer to pay with cards. By contrast, over 80% of credit and debit card transactions come from consumers who prefer those specific methods.

As a result, cash is increasingly taking a backseat, used more as a fallback than a first choice, undermining its staying power in a payment system increasingly driven by digital tools and consumer convenience.

Generational Shift Drives Drop in Cash Transactions

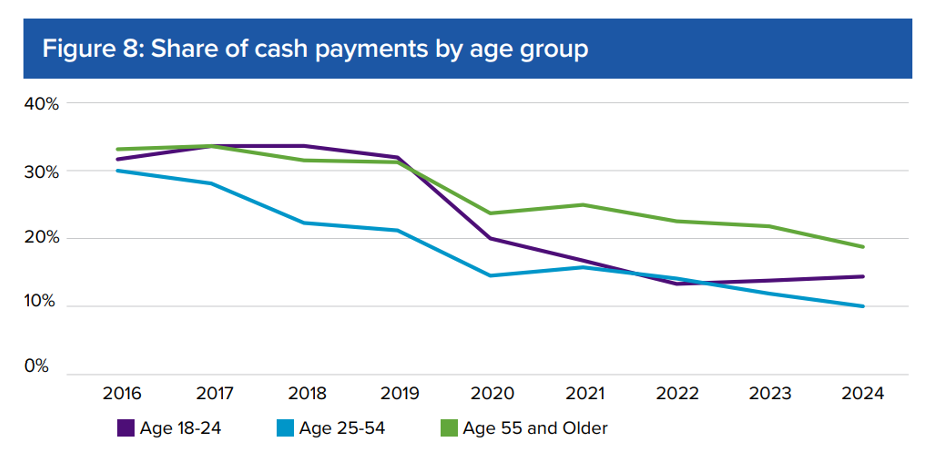

When you break down cash usage by age group, the picture becomes even clearer. Cash is quickly falling out of favor, especially among younger generations. In 2024, just 10% of payments made by adults aged 18 to 24 were in cash, well below the national average of 14%. Adults aged 25 to 54 used cash 5% less than those 55 and older.

Younger consumers use cash less and are also moving away from it faster. In 2016, cash made up about 30% of payments across all groups, with little variation by age. Over the past eight years, a clear generational divide has emerged. Today’s younger, digitally fluent consumers are increasingly bypassing cash altogether. This shift is likely to accelerate as they enter their prime earning and spending years.

Reduction in Circulating Cash

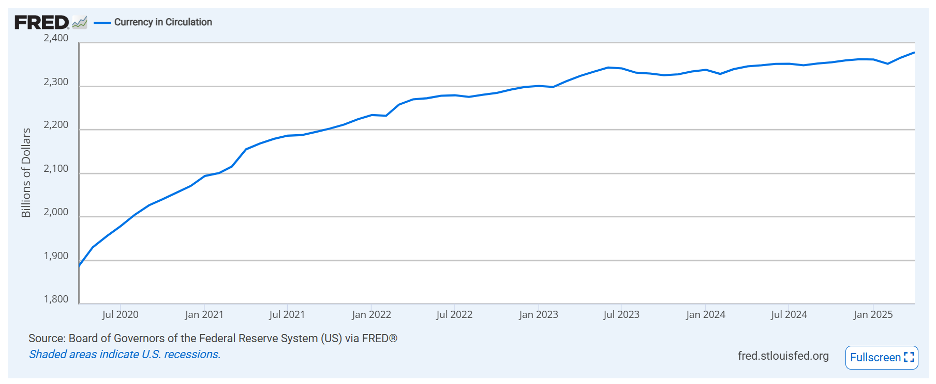

Another crucial metric for determining the country’s changing relationship with cash is tracking how much currency flows within the economy. As of June 2025, the US circulates approximately $2.38 trillion of hard currency. This is a stark jump from $1.76 trillion in 2019.

The primary driver behind the massive surge in circulating cash was the federal government’s attempt to stimulate growth by injecting hundreds of billions of liquid assets into the economy. The amount of physical currency in circulation has plateaued since early 2023, signaling a shift in monetary policy and a downsized demand for cash.

Public Using Cash as a Store of Value

While the near-doubling of cash in circulation over the past few years might imply rising demand for cash-based transactions, a closer look tells a different story. People aren’t spending more cash simply because there’s more of it available.

In fact, as of 2024, 82% of all US currency by value was held in $100 bills, a denomination rarely used for everyday purchases. These high-value notes are increasingly being used as a store of value, not a medium of exchange, suggesting cash is now more about preserving wealth than facilitating payments.

The Business Shift Away from Cash

On the merchant side of the equation, many businesses are adopting cashless payments for a more streamlined transaction process, with some even eliminating hard money as a form of payment altogether.

A Post-Pandemic Pivot

In the wake of pandemic-era closures, the share of cashless businesses doubled. At a similar time, Square–one of the world’s most popular point-of-sale systems–reported cash payments had shrunk to less than one-third of total transactions.

Rebound, Not a Reversal

Cash has since clawed back some of those losses as the economy returned to business-as-usual, yet the arc is still bending toward less reliance on hard money.

Data gathered from the Fed suggests only 60% of companies in the US accept cash, leaving 40% that presumably only take cashless forms. In a nationwide survey of small businesses, 19% of owners claimed to cease accepting cash as payment or intended to phase it out in the future.

There’s a debate around whether this rise in cashless transactions is driven by consumer preferences or merchant restrictions. Regardless, it’s evident that the payment landscape is experiencing a significant drop in cash transactions and a growing proportion of cashless options.

How Politics Pushes Us Toward a Cashless Future

While consumer and business habits shape the visible data, political forces often steer the direction behind the scenes. The positions of influential lawmakers, the agendas of fiscal policymakers, and proposed legislation offer critical clues about the future of the US as a cashless society.

Here are some of the most impactful developments:

US CBDC

The idea of a Central Bank Digital Currency to replace or supplement the US dollar has been a hot topic of debate for many years. Dubbed informally as a “digital dollar,” this potential rollout remains in experimental and non-committal phases.

In 2022, President Biden signed Executive Order 14067, directing the government to look into the possibility of a CBDC. Officials have adamantly repeated that the Fed “would only proceed with… a CBDC with an authorizing law.” In other words, it would need congressional approval to move forward with the development.

FedNow Instant Payments

While its CBDC approach remains experimental, the Fed developed a fully digital payment system with the launch of FedNow. This government-backed payment platform aimed to enable instant transactions between financial institutions and their customers. Through this interbank system, banks and credit unions can transfer funds in near real time.

Although FedNow focuses on the digital transaction of real dollars, it could support a broader shift toward a cashless economy if implemented at scale. While individuals, businesses, and third-party payment providers won’t use FedNow directly, they’ll still benefit from the speed and efficiency it provides.

Crypto Integration

No administration has moved faster to integrate cryptocurrency into the US financial system than Trump 2.0. A skeptic during his first term, the president has since been the biggest champion of crypto, launching his own memecoins, tearing back regulations, and pushing for official adoption.

- The SEC removed a rule requiring banks to treat customer-held crypto as liabilities.

- The OCC and FDIC expanded the scope of legal crypto activities and removed pre-approval hurdles.

- The DOJ disbanded its primary crypto crimes unit.

- A congressional resolution blocked new IRS reporting rules for crypto brokers.

- The federal government is exploring a Strategic Bitcoin Reserve and Digital Asset Stockpile.

Is the US a cashless society?

No, the US is not a cashless society…yet. Developments in the private and public sectors seem to be tipping the economy in a cashless direction. Customers are demonstrating an increasing preference for cashless payment methods, and businesses are more than willing to oblige.

For years, the Fed has been looking into the development and adoption of a US CDBC that could potentially replace the physical dollar. At the same time, the Trump admin is fast-tracking the official integration of crypto into the country’s official reserves and banking system.

While fiat currency still plays a foundational role in the economy, it’s fair to say the US is well on its way to becoming a cashless society.