Gold is on its way to reclaim $3,450/oz over the next few months before hitting a record above $3,500/oz this year, according to a recent forecast by ING Group. Following months of consolidation, the Dutch bank expects gold prices to break out as several bullish macroeconomic factors align.

A mix of long-awaited rate cuts, steady government consumption, and awakened investment demand could extend the gold rally. Analysts predict the yellow metal’s momentum will carry through next year with several record-high price targets set in 2026.

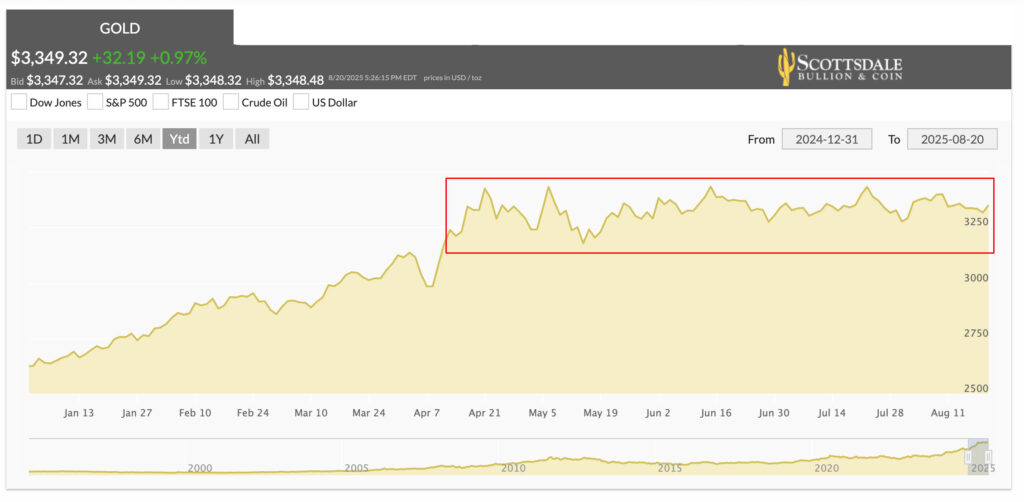

Gold’s Takeoff, Holding Pattern, & Potential Breakout

Following a steady upward trend in 2024, gold has charted a more erratic path, yet managed to surpass last year’s impressive gains of 25%. Within the first four months of 2025, gold surged by more than 33%, reaching a new peak of $3,500/oz by late April. Since then, however, prices have entered a high-level consolidation pattern.

Over the past four months, gold has bounced between $3,200 and $3,450. This relatively tight range usually signals price consolidation from the recent run-up rather than weakness. In other words, technical indicators suggest gold may be gearing up for its next leg higher, not losing steam before a correction. ING confirmed this upbeat outlook in a recent report, predicting higher prices on the horizon.

Rate Cut Boosts Incoming

After years of aggressive rate hikes, the Federal Reserve reversed course with a decisive 50-basis-point cut in September 2024. However, persistent inflation and other lingering economic headwinds forced policymakers to immediately pause the easing cycle. Nearly a year later, markets are betting heavily that the Fed will resume that path, pricing in a 94% probability of a rate cut this September.

A US-based ING economist believes this will be the first of three total rate cuts in 2025 before two more in 2026. This forecast is more optimistic than the average prediction, yet underscores the bank’s gold-positive outlook. Any number of rate cuts is likely to boost the appeal of gold as the opportunity cost of owning non-yielding assets evaporates.

Dynamic Gold Demand Supports Prices

Sustained demand remains a key pillar of gold’s strength, and a core reason for ING’s higher forecast. Total H1 gold consumption climbed to its highest level since 2022, continuing the unprecedented buying trend of recent years. Inflows were dynamic, with official institutions and retail investors contributing to demand.

Central Bank Gold Demand

In Q2, official gold purchases totaled 166 tons in Q2, bringing H1 purchases to 415 tons overall.

Source: ING 1

Although this quarter saw a 33% decline from Q1, the World Gold Council still anticipates annual purchases to hit 1,000 tons. In the future, ING expects central banks to continue stockpiling gold as part of broad de-dollarization efforts and as a hedge against economic uncertainty.

Analysts point to China’s nine-month gold-buying spree as another considerable tailwind keeping prices elevated.

Source: ING 1

Over the past 7 years, the People’s Bank of China has been steadily ramping up its monthly gold purchases. The country’s reserves have surged from under 60 million to 73.96 million troy ounces.

ETF Buying Roars Back

ING analysts also highlight rising retail demand to underpin their heightened gold price prediction. In Q2, gold exchange-traded fund (ETF) purchases reached 170.5, extending H1 totals to 397.1. Despite representing a 25% quarter-over-quarter pullback, these ETF inflows were a whopping 2,528.6% increase year-over-year.

Source: ING 1

Setting New Targets

Source: ING 1

Following months of sideways movement, gold is on the brink of a significant swell. In light of this bullish setup, ING has raised its year-end benchmark from $3,200 to $3,450, marking a 7.8% boost in expectations. Furthermore, the bank sees prices moving higher throughout 2025, with a high of $3,550 set for mid-2026.