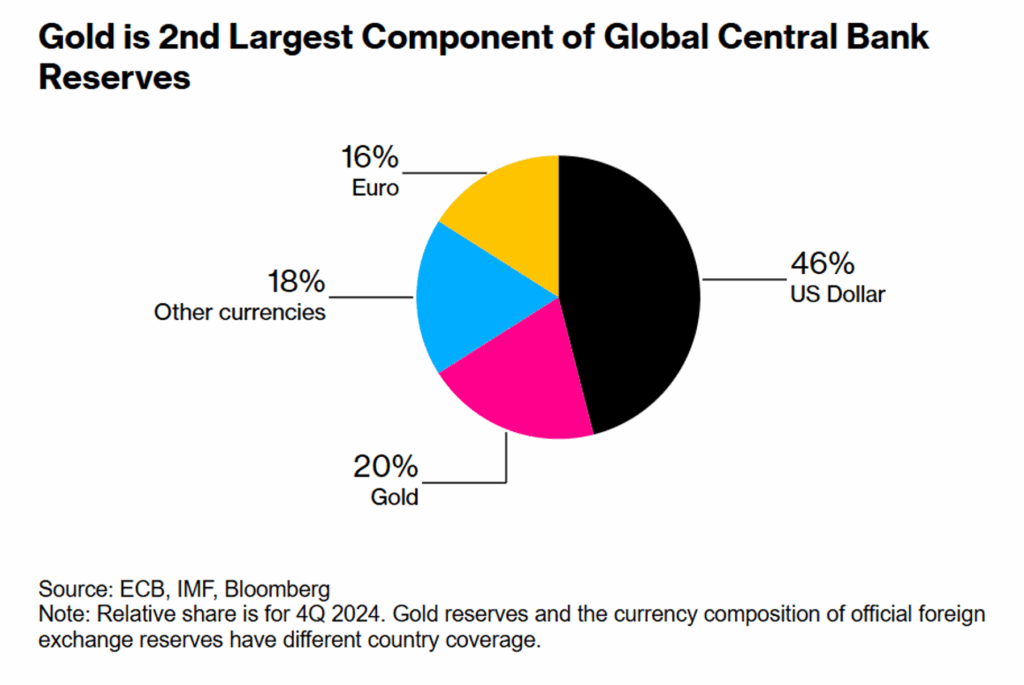

Gold has surpassed the euro as the world’s second-largest reserve asset, comprising 20% of central bank holdings compared to the European currency’s 16%.

This systemic shift is reflective of an evolving global financial landscape as governments grow skeptical of fiat currencies and an interconnected economy. Central banks have doubled their annual gold consumption since 2022 following the Russian invasion of Ukraine and the subsequent economic fallout.

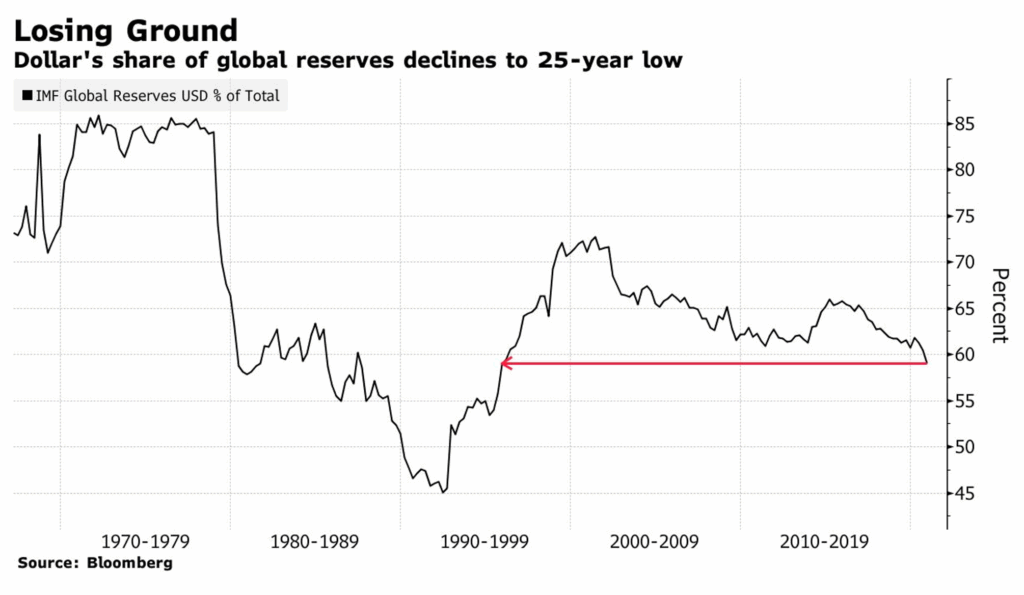

Beyond merely protecting against financial instability, gold’s rising share of global reserves is the result of a movement away from the Western-led global financial system. At the same time, the dollar is ceding ground to foreign currencies and the yellow metal.

Gold Gains Ground in Global Reserves

The yellow metal has taken a commanding lead over the euro to claim the second-largest share of global central bank reserves. Gold’s allocation stands strong at 25% higher than the euro’s. This is the most prominent role gold has played in the global financial system since the gold standard was abandoned.

Gold now eclipses the combined share of all other foreign currency reserves held by central banks, trailing only the dollar. At its current trajectory, gold could claim half the dollar’s reserve position within a few decades.

Central Banks Drive Gold’s Rising Share

Official demand has been a key driver behind gold’s surge to record highs and its rise to the second-largest global reserve asset. Between 2022 and 2024, central banks purchased over 1,000 tons of gold, twice the annual average of the previous decade.

The World Gold Council and other experts expect this trend to continue into 2025. This ongoing gold-buying spree has pushed central bank demand from just 10% of total gold demand in the 2010s to 20% today.

A Broken Gold–Yield Correlation

It’s not just how much gold is being bought; it’s who’s buying it. Since 2022, emerging economies like Russia, China, India, and Turkey have led the charge, signaling a turn away from Western financial dominance and a bid for economic sovereignty.

This shift in gold demand—driven largely by emerging markets while major economies like the US remain on the sidelines—reflects a deeper geopolitical realignment. According to the ECB, Western sanctions on Russia following its 2022 invasion of Ukraine have helped trigger a modern-day gold rush.

From 2008 to 2022, gold prices typically moved in the opposite direction of real yields, rising alongside inflation as investors sought protection from currency devaluation. Yet, in recent years, gold has continued climbing even without strong inflationary pressure, signaling that geopolitical tension has become an increasingly powerful driver of international gold demand.

Where does the dollar stand?

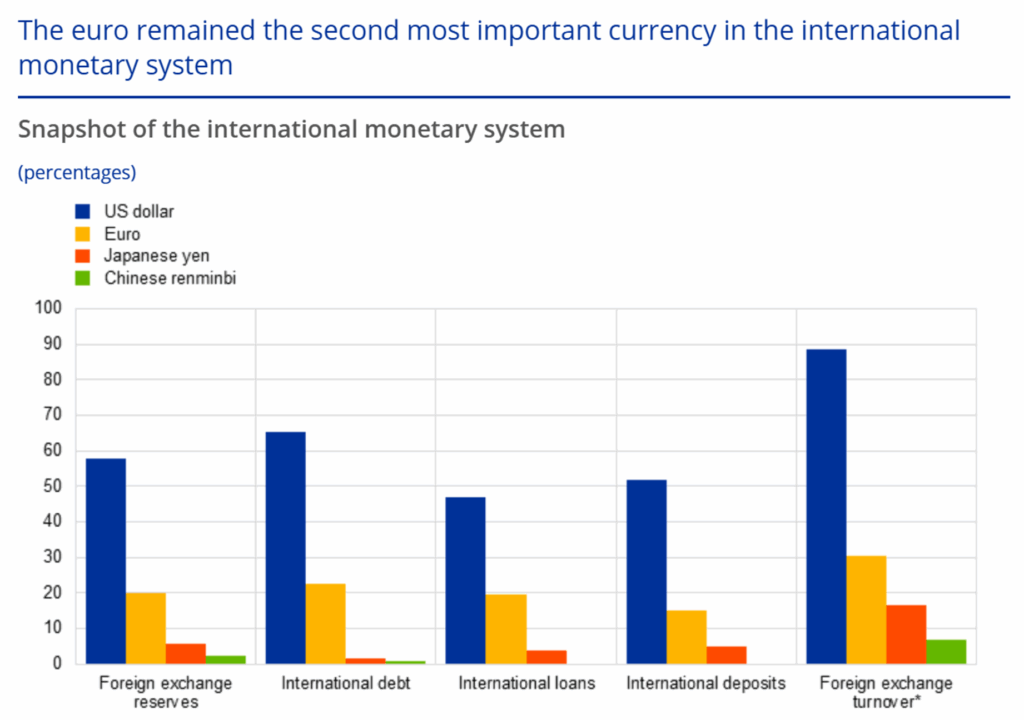

While gold and the euro contend for second place in global reserve holdings, the US dollar remains the world’s reserve currency. It maintains the top position across the international monetary system in foreign reserves, international debt, and more.

However, many challenges threaten to shake the USD’s foundation as the top reserve asset, including a growing debt burden, a global de-dollarization movement, and the relative rise in foreign currencies.

The dollar’s share of global reserve assets has fallen from 70% in 2000 to around 58% in 2025. In other words, the US dollar has lost 12% of its share of global reserves to foreign currencies and gold over the past 25 years.

Gold’s Return to the Core of Global Finance

The geopolitical forces driving a shift away from the dollar-dominated, fiat-based system are ushering in a new era of gold reliance. This transition became more formalized when gold was recognized as Tier 1 collateral under Basel III banking regulations.

In simple terms, the global financial system now treats gold with the same level of trust and liquidity as cash or government bonds—a major milestone in gold’s modern monetary comeback. Gold’s overtaking of the euro as the second most held reserve asset could signal another stage in its slow resurgence on the world stage.