While gold and silver are stealing the spotlight, platinum is quietly outperforming both in 2025. Once known as the “rich man’s gold” due to its historically higher price compared to the yellow precious metal, platinum has slipped in recent years. Could it be staging a comeback?

In this week’s The Gold Spot, Scottsdale Bullion & Coin Founder Eric Sepanek and Precious Metals Advisor Brian Conneely break down platinum’s recent surge, what’s fueling the platinum rally, and how the conflict in the Middle East could affect the broader precious metals market.

Platinum is on the Rise

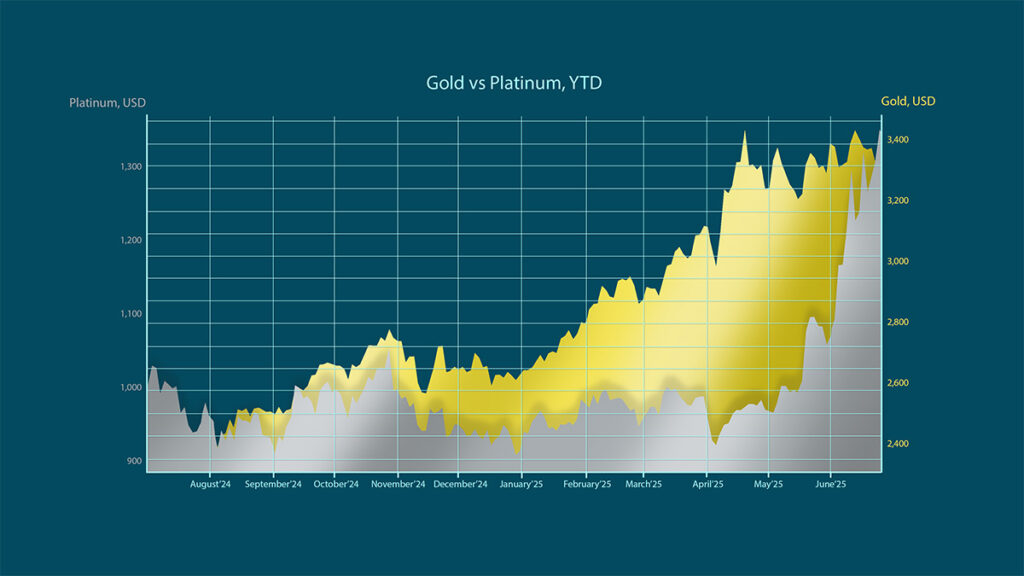

For years, the platinum spot price has traded within a tight window from just below $900 an ounce to slightly above $1,000 an ounce (oz). Since mid-May, the metal has been rising confidently out of this channel, surging from $1,000/oz to more than $1,400/oz, an impressive over 40% jump. When measured from the beginning of the year, platinum’s gains extend to over 55%, nearly double that of gold’s year-to-date return.

Platinum Demand Consistently Outstrips Supply

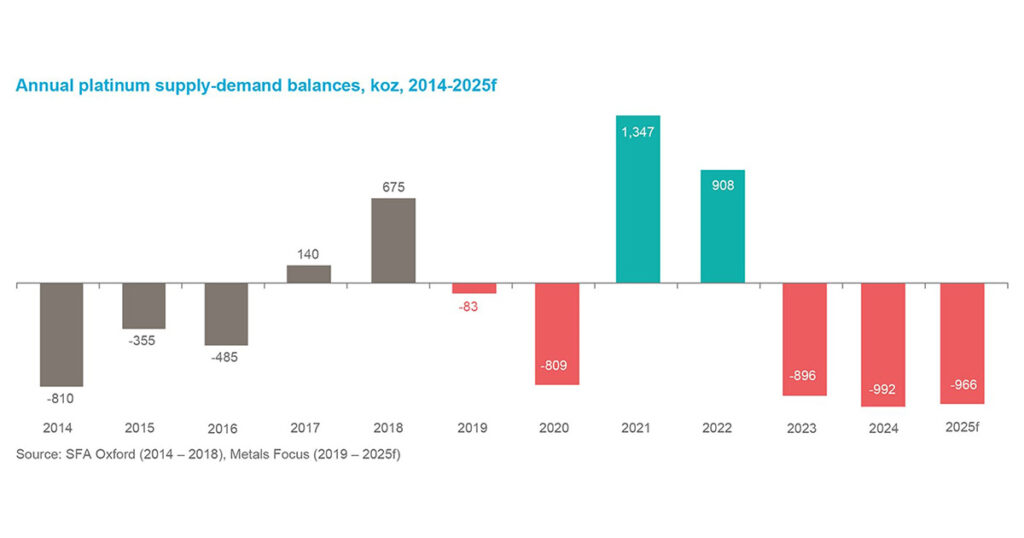

Despite a projected 4% year-over-year decline in total platinum demand for 2025, the market remains faced with a substantial supply shortfall. The platinum deficit is expected to reach 966 thousand ounces (koz) this year, following consecutive deficits of 992 koz in 2024 and 896 koz in 2023, underscoring a persistent imbalance between supply and demand.

Chart source: WPIC

The supply side remains exceptionally constrained. In the first quarter of 2025, mining output dropped 13% year-over-year, marking the lowest quarterly production since Q2 2020, when COVID-19 lockdowns disrupted global operations. Although demand is forecasted to soften slightly—pressured in part by new auto tariffs and emerging trade barriers—it still far exceeds available supply, continuing to put upward pressure on prices.

Chinese Jewelry Market Swaps Gold for Platinum

Jewelry accounts for upwards of 29% of the platinum market demand, making the sector a major influencing factor of prices. The metal’s hypoallergenic properties make it a popular alternative to gold and silver, which can cause irritation in some individuals when worn. China—home to one of the world’s largest jewelry sectors—is currently swapping out some gold for platinum due to the yellow metal’s sticker shock.

So far this year, Chinese jewelers have imported 11.5 metric tons of platinum. Total Chinese investor demand is also forecast to reach 668,000 ounces in 2025, signaling growing interest among everyday people and the jewelry industry.

Banking Giants Sleeping on Platinum?

Just as gold’s rally seemed to polish the banking industry’s crystal ball on precious metals, some of the world’s biggest banks remain blind to platinum’s momentum, holding to stagnant or even bearish forecasts despite its sharp rise.

Platinum Price Forecasts for 2025

| Financial Institution/Analyst | Platinum Price Predicted (Per oz.) | Time Frame |

|---|---|---|

| Investing Haven | $1,250 | 2025 |

| Heraeus | $1,220 | 2025 (High) |

| JP Morgan | $1,200 | 2025 |

| TD Securities | $1,175 | 2025 (Average) |

| Commerzbank | $1,150 | EOY 2025 |

| UBS | $1,100 | Mid-2025 |

| World Bank | $1,002 | 2025 |

Notably, platinum has already surpassed these 2025 forecasts, suggesting that platinum prices will either settle later in the year or that the banking sector is systemically underestimating the precious metal’s potential.

“We think the experts might be wrong about platinum. The numbers definitely show that there's a huge lack of supply versus demand.”

Gold & Silver Shine Bright

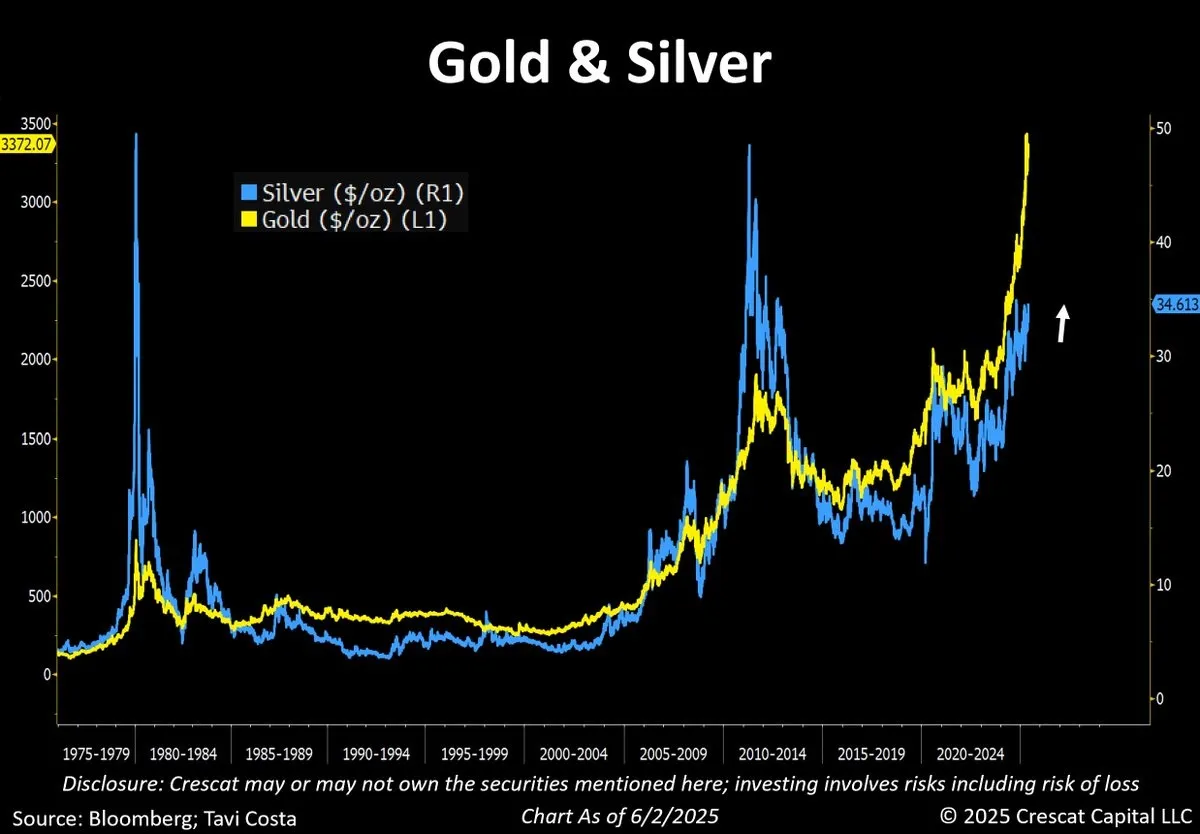

Gold and silver remain favorites among major banks, with many signaling higher forecasts for both metals, though the outlook for gold is especially bullish. This is reflected in strong and sustained demand from official, institutional, and retail investors alike. Meanwhile, silver’s breakout to a 14-year high above $35/oz has sparked renewed excitement, with many now calling for a potential surge in silver prices.

👉 Suggested Video: Silver’s Breakout Is Gaining Steam: Is a Historic Rally Ahead?

The Middle East Uncertainty

A dense fog of war is settling in the Middle East as confusion surrounds the Israel-Iran War. After bombing Iranian nuclear sites, US President Donald J. Trump claimed the targeted sites had been “fully obliterated.”

Unfortunately, an early US intelligence report suggests these raids set back the country’s nuclear program by a few months–a stark contrast to President Trump’s claims of total victory. Israeli intelligence sources indicate the strikes hindered the Iranians’ nuclear ambitions by years, while admitting it’s too early to know for sure.

After Trump posted to Truth Social about a ceasefire brokered between the warring parties, both Israel and Iran exchanged missile fire, casting the stability of the conflict further into doubt.

I think the Middle East war is going to continue to make the marketplace, both the Dow Jones and the gold market, hard to speculate. I find this to be unpredictable.–

Domestic Fiscal Volatility Persists

While global headlines focus on conflicts abroad, Americans are grappling with economic challenges at home. The US is contending with slowing output, stubborn inflation, growing recession risks, and widespread uncertainty. Major institutions, such as the IMF and OECD, have already downgraded global growth forecasts for 2025, citing US trade barriers as a key driver of economic strain.

The Trump administration’s unpredictable tariff policies remain a major wildcard, making it harder for the Federal Reserve to respond decisively. While the Fed is still expected to cut rates this year, the timing remains uncertain. This instability is fueling demand for safe-haven assets as investors seek to preserve their wealth by investing in precious metals.

Protect & Preserve Your Wealth

With platinum’s price rally gaining momentum, supply deficits deepening, and global instability rising, now may be the time to reassess your precious metals strategy. Whether you’re interested in gold, silver, or platinum, speaking with a knowledgeable precious metals advisor can help you align your investments with your long-term goals.

Reach out to a Scottsdale Bullion & Coin advisor today to explore your best options. Contact us today by calling toll-free at 1-888-812-9892 or using our live chat function.

Learn More About Platinum

Question or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Comment

Questions or Comments?

"*" indicates required fields