The recent escalation in warfare between Iran and Israel has sent shockwaves through global markets, driving up prices for both gold and gasoline. This surge is rooted in a combination of geopolitical uncertainty, supply chain concerns, and the economic dynamics that govern these critical commodities. Below, we examine the factors driving the rising prices of gold and gas, considering the interplay between market psychology, regional instability, and global trade dynamics.

The Geopolitical Backdrop

The Middle East has long been a flashpoint for geopolitical tensions, and the current conflict between Israel and Iran has intensified fears of a broader regional war. On June 13, 2025, Israel launched strikes targeting Iran’s nuclear facilities and military leadership, prompting Iran to retaliate with missile attacks on Israeli cities. This tit-for-tat escalation has heightened global uncertainty, with markets reacting swiftly to the potential for further disruption in a region critical to global energy supplies.

Why Gas Prices Are Rising

1. Disruption Risks in the Strait of Hormuz

The Middle East accounts for about a third of the world’s oil production, and the Strait of Hormuz—a narrow waterway controlled by Iran—is a critical chokepoint through which roughly 20% of global oil supply flows. Iran has historically threatened to block this route in response to Western pressure or military actions, and the current conflict has renewed fears of such a disruption. Even a temporary closure could remove millions of barrels of oil per day from the global market, driving prices higher.

The Petrodollar: A Retrospective

How To Prepare For The Impending Dollar Failure

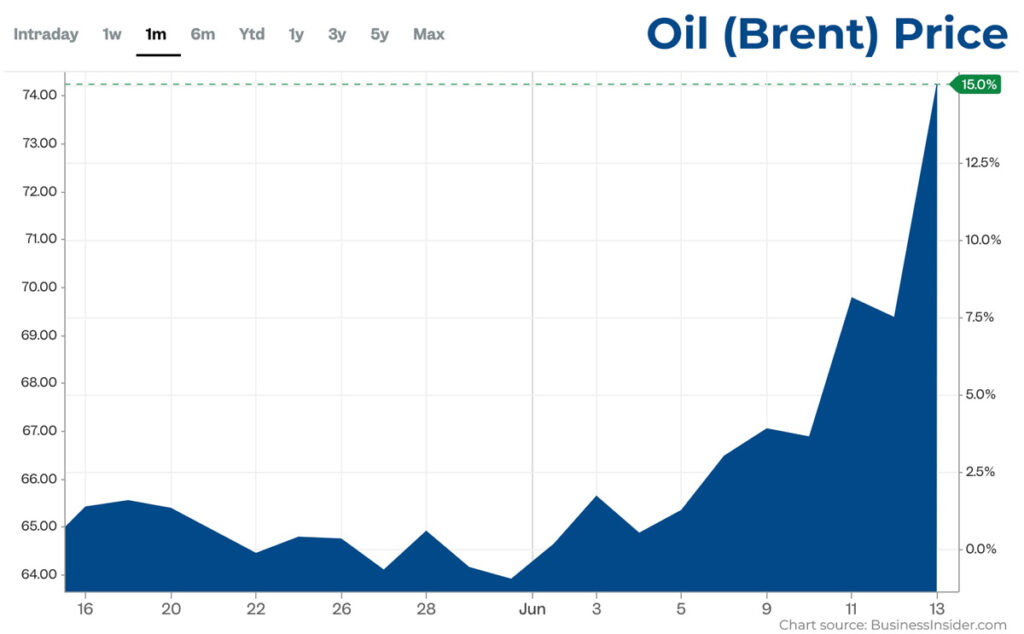

Get Report – It’s Free!Following Israel’s attacks, Brent crude, the global oil benchmark, surged more than 10% before settling 7% higher at $74.23 per barrel, its highest level since January 2025. U.S. West Texas Intermediate (WTI) crude also rose 7.26% to $72.98 per barrel. Industry analysts warn that a severe escalation, such as strikes on Iranian oil infrastructure or a blockade of the Strait of Hormuz, could push oil prices to $100 or even $120 per barrel, potentially translating to a significant increase in U.S. gas prices from the current $3.14 per gallon to as high as $5.13.

2. Regional Supply Concerns

Iran produces approximately 3.3 million barrels of oil per day, accounting for around 3% of global output. While sanctions have limited its exports, Iran remains a significant player, primarily supplying China. Any damage to Iranian oil facilities or a broader conflict involving other regional producers like Saudi Arabia, Iraq, or the UAE could further tighten global supply. For instance, Iran could target oil infrastructure in neighboring countries, as it did in 2019 with Saudi facilities, exacerbating supply fears.

3. Inflationary Pressures

Rising oil prices directly impact gasoline prices at the pump, as crude oil is the primary component of fuel. Higher fuel costs also ripple through the economy, increasing transportation and production expenses, which can fuel inflation. This is particularly concerning for U.S. consumers, as relatively low gas prices have helped keep inflation in check. A sustained oil price spike could reverse this trend, potentially delaying Federal Reserve interest rate cuts and adding economic pressure.

Why Gold Prices Are Rising

1. Safe-Haven Demand

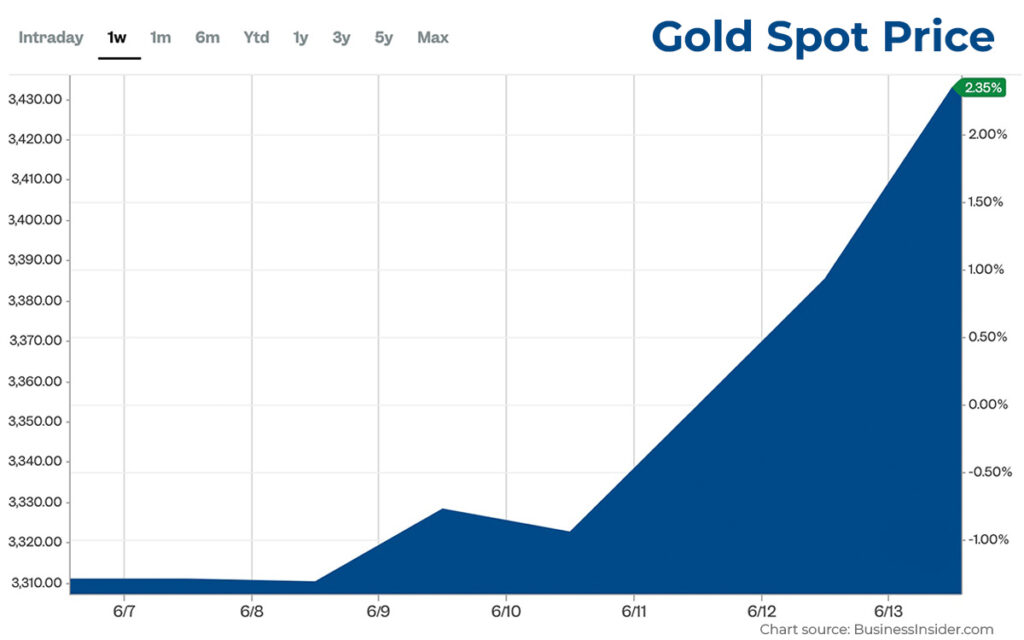

Gold is often referred to as a “safe-haven” asset, sought by investors during times of geopolitical and economic uncertainty. The escalation between Iran and Israel has driven investors to gold as a hedge against potential market volatility and global instability. On June 13, 2025, spot gold prices rose about 1.4% to $3,433 an ounce, approaching the record high of $3,500 set in April.

2. Market Volatility and Economic Uncertainty

The conflict has contributed to a broader sell-off in global stock markets, with the Dow dropping 770 points (1.79%), the S&P 500 falling 1.13%, and the Nasdaq declining 1.3% on June 13. As equities falter, investors often shift capital to gold, which is perceived as a stable store of value. The uncertainty surrounding the conflict’s duration and scope—coupled with concerns about inflation driven by higher oil prices—further bolsters gold’s appeal.

3. Currency Dynamics

Geopolitical tensions often strengthen the U.S. dollar, as investors seek safety in U.S. assets. However, gold prices can still rise in dollar terms due to heightened demand. The interplay between a stronger dollar and rising gold prices highlights the dual nature of gold as both a commodity and a financial asset during crises. Additionally, central banks and investors in emerging markets, such as China, may increase gold purchases to diversify reserves amid global uncertainty.

Interconnected Dynamics of Gold and Gas

The simultaneous rise in gold and gas prices is not coincidental but reflects interconnected market dynamics:

- Inflation Expectations: Higher oil prices fuel inflation, which erodes the purchasing power of fiat currencies. Gold, often viewed as an inflation hedge, benefits from these expectations as investors seek to preserve wealth.

- Geopolitical Risk Premium: Both commodities carry a “geopolitical risk premium” during conflicts. For oil, this premium stems from fears of supply disruptions; for gold, it reflects its role as a safe-haven asset. The current escalation amplifies these premiums, driving prices higher.

- Global Economic Impact: A prolonged conflict could disrupt global trade routes and energy supplies, potentially slowing economic growth. This scenario would likely increase gold demand while sustaining elevated oil prices, as markets brace for supply constraints and economic uncertainty.

Mitigating Factors and Outlook

While the current trajectory points to higher prices, several factors could temper the rise:

- OPEC+ Spare Capacity: OPEC and its allies, including Saudi Arabia and Russia, have spare production capacity equivalent to Iran’s output (about 3.3 million barrels per day). This could offset disruptions if Iranian exports are curtailed, potentially capping oil price spikes.

- U.S. Strategic Reserves: The International Energy Agency and the U.S. Strategic Petroleum Reserve could release emergency stockpiles to stabilize oil prices, as was done in 2022 following Russia’s invasion of Ukraine.

- De-escalation Efforts: Diplomatic interventions by the U.S. or other global powers could reduce tensions, limiting the conflict’s impact on markets. However, U.S. officials have stated they were not involved in Israel’s strikes, and President Trump’s rhetoric suggests further escalation is possible.

Conversely, a severe escalation—such as Iran closing the Strait of Hormuz or targeting regional oil infrastructure—could push oil prices to $100–$120 per barrel and gas prices significantly higher. Gold prices could also test or exceed their April 2025 high of $3,500 an ounce if safe-haven demand intensifies.

Escalation Could Create a Perfect Storm

The escalation in warfare between Iran and Israel could create a perfect storm for rising gold and gas prices. Gas prices are climbing due to fears of supply disruptions in the Middle East, particularly through the Strait of Hormuz, coupled with the region’s critical role in global oil production.

Gold prices are surging as investors seek safety amid geopolitical uncertainty and market volatility. While mitigating factors, such as OPEC’s spare capacity and strategic reserves, could limit price spikes, the risk of a broader conflict keeps markets on edge. For consumers, this could mean higher costs at the pump and beyond, while investors may continue to flock to gold as a hedge against an uncertain future.

As the situation evolves, the extent of price increases will depend on the duration of the conflict, the involvement of other regional players, and global responses. For now, both the gold and gas markets reflect the heightened risks associated with a volatile geopolitical landscape.