Washington is speedrunning toward a $42 trillion debt despite claims of reduction. Fraud is bleeding the government by almost $1 trillion annually, even though DOGE has claimed to target theft. Plus, gold has traded above $3,000 an ounce for the entire month. Let’s piece it all together.

In this week’s The Gold Spot, Scottsdale Bullion & Coin Founder Eric Sepanek and Precious Metals Advisor John Karow address the bipartisan spending problem, why fraud remains a significant problem (despite DOGE’s efforts), and the reasons gold keeps chugging along to new peaks.

An Expensive “Big, Beautiful Bill”

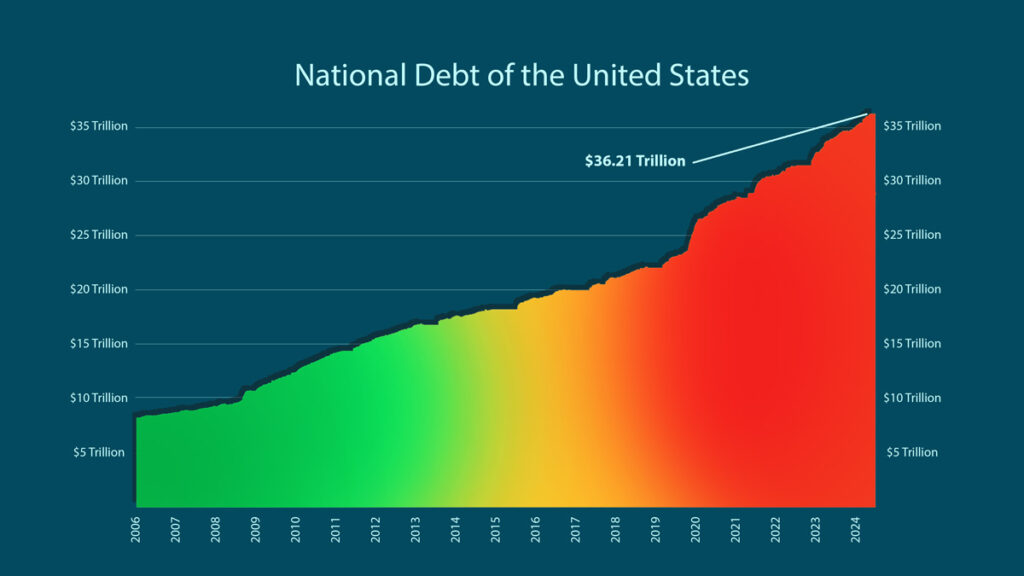

Congressional Republicans are scrambling to cement Trump’s 2017 Tax Cuts and Jobs Act into law. Dubbed the “Big, Beautiful Bill,” this legislation is projected to cost $5.7 trillion over the next decade. For perspective, the national debt only hit $5 trillion in 1995. The government is now attempting to approve a level of debt that originally took the United States 219 years to accumulate within a single decade.

Instead of taking difficult steps to reduce core spending, the Republican-led House and Senate are safeguarding pork-barrel projects and performatively cutting around the edges. No meaningful discussion about deficit reduction can happen without addressing entitlement programs such as Social Security, Medicare, and Medicaid, which account for nearly half of the federal budget.

I just don’t see how we’re going to get out of this entitlement spending trap.–

Despite the Department of Government Efficiency’s (DOGE) best efforts, the cost-saving group has only been able to reduce costs by $170 billion, according to the official government website. However, the team admits it’s only been able to substantiate around one-third of those savings, calling into question the remaining portion.

DOGE’s future is up in the air, too, with Elon Musk leaving to concentrate more on his many companies. Recently, Rep. Jared Moskowitz of the Congressional DOGE caucus declared the project “dead,” stating that the caucus had only met twice in a five-month period. “DOGE was a complete failure. Complete failure. Nothing has been made more efficient,” Moskowitz claimed.

“We're approaching $37 trillion in debt. If Congress does what it's talking about doing in the next 10 days, they're going to add another $5 trillion, which makes $42 trillion in debt two years from now.”

The Government Is Failing To Eliminate Fraud

The elimination of “waste, fraud, and abuse” has become a rallying cry for Trump 2.0, but the “fraud” part is becoming a sticking point. So far, DOGE cuts have primarily focused on wasteful Congressionally approved spending, not outright fraud.

Recently, 60 Minutes aired a piece covering the breadth and cost of outright theft from the US government. In its investigation, the team found that:

- The US loses close to $1 trillion annually, accounting for up to 15% of the federal budget.

- More than $280 billion was stolen from pandemic-era relief programs, including unemployment insurance and Paycheck Protection Program (PPP) loans.

- International crime rings, particularly from China and Russia, are behind a large portion of this fraud.

Why Gold Is Still Growing?

This month marks the first time in history gold has traded over $3,000/oz, marking a major milestone in the precious metal’s rally and underscoring its fierce momentum.

Here’s why this unprecedented growth is likely to continue:

Gold is Tier 1 Collateral

Gold’s classification as Tier 1 collateral puts the metal on par with the US dollar and government bonds in the eyes of the global banking sector. This incentivizes central banks and other major financial institutions to hold more gold, driving up demand.

Persistent Global Uncertainty

The world is facing systemic uncertainty on geopolitical and economic fronts. Fiscal recklessness, market volatility, hot wars, and a deteriorating economic order are driving safe-haven demand on all investor levels.

Central Bank Gold Hoarding

Official central bank gold consumption has spiked over the past three years, reaching more than 1,000 tons annually. With gold demand reaching a nine-year high in Q1 2025, this trend of reserve growth is expected to continue.

De-Dollarization Accelerates

The global move away from the dollar is accelerating as the US’s fiscal situation deteriorates, the government increases dollar weaponization, and foreign countries seek economic independence. Gold has arisen as the go-to foundation for stability in the midst of de-dollarization.

Is Now The Time To Buy Gold?

With gold prices pulling back slightly after a record-breaking run, now is a great time to take advantage of the dip. After all, many experts are already predicting prices could reach $4,000/oz or higher soon.

Whether you’re eyeing gold, silver, or rare coins, opportunities in the precious metals market don’t last long. Reach out to your dedicated precious metals advisor today to discuss current pricing and explore the best opportunities available right now. Get in touch with us by calling our toll-free number at 1-888-812-9892 or using our live chat function.

💡 Be sure to inquire about the coin market, which is currently experiencing lower-than-usual dealer premiums, positioning investors for excellent buying opportunities.

Question or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Comment

Questions or Comments?

"*" indicates required fields