The risk aversion currently being seen in global financial markets may provide the gold market with a much-needed boost. Over the weekend, Israel was attacked by Hamas in a large and orchestrated fashion. Israel has since declared war on Hamas, and the conflict has some very uncertain consequences. Over 1500 have already been reported dead, and prisoners have been taken on both sides. Thus far, the marketplace reaction to the violence in the region has been somewhat muted. This would seem to suggest that the market is not concerned about the conflict spreading and inviting additional actors such as Iran or the U.S. into action.

U.S. Involvement Looms as Israel Declares War on Hamas – Market Reacts Cautiously

As a major ally of Israel, the U.S. has already taken some action, however, sending the U.S.S. Gerald Ford supercarrier group into the region. While almost certainly more of a show of force than anything else, the group does give the U.S. the ability to act and act quickly if tensions were to rise even further. The U.S. has also said that it would provide Israel with munitions and supplies as needed to battle Hamas. The conflict is in its early days, and hopefully it will be resolved soon. If not, the possibility of it spreading does exist and any involvement by the U.S.,Iran or other actors could signal the beginning stages of a prolonged military conflict within the region.

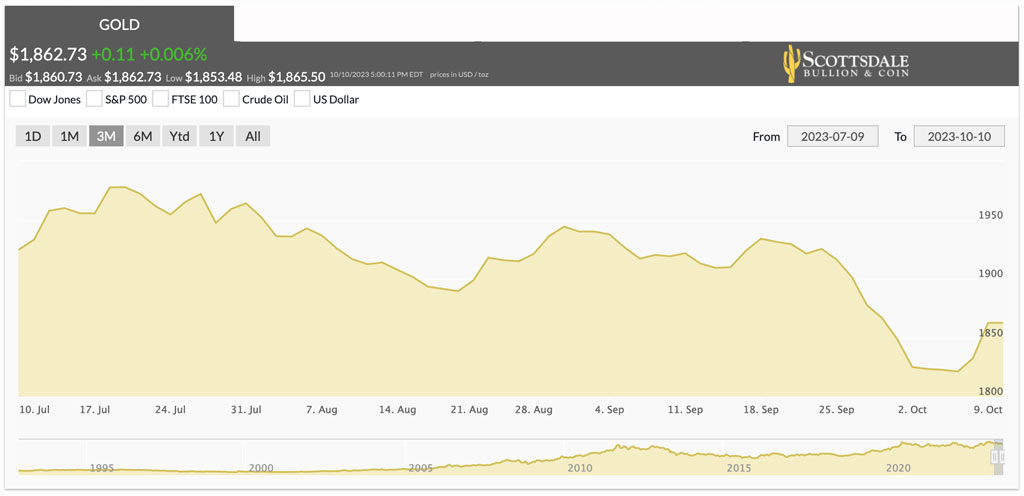

The many unknowns surrounding the war have given investors reason to seek quality instruments. Gold has been bought aggressively in recent days and may even challenge the $1,900 level in the days ahead. Involvement by the U.S. or other global actors would likely fuel even more demand for gold, and the yellow metal could take off on a flight to safety bid. Such a flight to safety could not only send the price of gold quickly back above the $2,000 level, but could also propel the metal beyond its previous all-time highs.

Gold’s Potential Soars Amidst Uncertain War as Investors Flock to Safety

The gold market remains vulnerable to other global markets, especially interest rates. The yield on the benchmark 10-year note has down ticked a bit so far early this week, as flight to safety buying has fueled the decline in yields. The note is still fetching a hefty yield of 4.67%, however, and may remain a key roadblock to higher gold. The Fed held rates steady at its most recent meeting last month, but whether the Fed stays put remains unknown. Rates may have to go even higher from current levels to get inflation on the path to the central bank’s desired 2% annual target. The Fed could also elect to keep rates higher for longer, as has been widely discussed in the financial media in recent months. Whatever the case may be, the gold bulls may be simply biding their time until the Fed signals a course reversal. Such a signal could come at the first signs of a recession.

Gold Holds Steady Despite Challenges, Offering Long-Term Investment Opportunity

The gold market has held tough in recent months despite rising interest rates and other bearish factors. This could be viewed as a bullish signal for long-term investors and may keep buyers entering the market regardless of how low gold prices go. The yellow metal may already present an excellent value for the patient long-term investor.

Gold Market: Bulls vs. Bears Battle at $1,900 Level

The bears may still be in control on gold’s daily chart. Friday’s outside day and Monday’s gap up open may both signal a bottom has been reached. The bulls need to take out solid resistance at the $1,900 level to attract more buying and fresh momentum. The bears will look to take the market lower and test the $1,800 level.