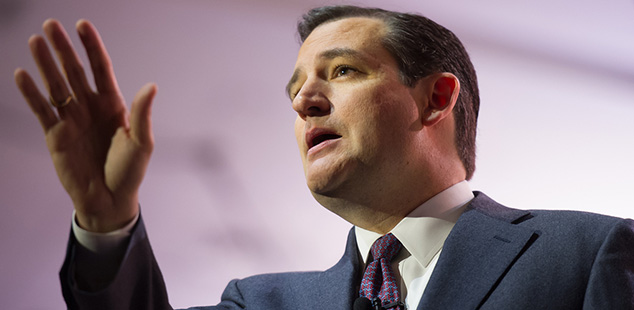

With just one comment during the recent Republican debate, candidate Ted Cruz sent heads across the economic spectrum shaking, some in enthusiastic support, others in a negative disbelief. Cruz expressed the opinion:

“I think the Fed should get out of the business of trying to juice our economy, and simply be focused on sound money and monetary stability, ideally tied to gold.”

Precious Metals as Currency

For those unaware of the issue of a precious metal-denominated currency, it is not new to the American political process. In fact, the “Cross of Gold” speech by William Jennings Bryan in 1896, in which he argues for “free silver,” is still seen as one of the most significant speeches in American political history. Today, however, virtually no one can relate to a time when the U.S. currency supply was tied to gold or any commodity.

Additionally, many are unaware of the fact that the 2012 Republican platform endorsed the idea of returning to a “metallic basis for U.S. currency.” Under such a plan, all printed and minted currency would be freely exchangeable into gold at a set or floating exchange rate.

Gold Standard Supporters

Today, of course, the Fed controls money supply (as do central banks in most other countries) with its controls and policies, with no physical backing of the price of money. Moreover, most economists, academics and pundits are all quite vocal about resisting such calls to a gold standard.

Notwithstanding what some see as a somewhat quixotic stand, there is a very strong and vocal minority that continues to fight for a return to the gold standard. One of the most prominent of these individuals is Sean Fieler, a wealth hedge-fund manager who supports a number of conservative perspectives.

The nonprofit American Principles Project provides a focal point for a number of those who support the gold standard, including Fieler. Another member of this group, Robert Mercer, has, in fact, donated more than $11 million to a super-PAC that supports Cruz, making him the largest individual donor in this campaign.

Fieler has been very active in promoting the use of gold as legal tender, helping initiatives that have seen several states pass such laws. However, until Congress changes the laws that mandate the payment of income taxes on any gains from buying gold and silver and converting them to cash, using precious metals as money is still a non-starter.

Reigning in the Fed

Regardless of the history of gold and silver as currency, the entire issue is seen as a very complex one. While it is appropriate to be skeptical of many arguments by economists, they do point out that today’s financial markets require the flexibility of a non-backed currency to effectively use monetary policy. The arguments are that the ability to print money is a primary tool for fighting inflation (as with Paul Volker during Carter’s term) and for reinvigorating stalled economies. Of course, the actions of the Fed over the past decade are one reason many argue this power should not reside in a small number of government officials.

While it is unlikely there will be any solid action on the gold standard in the near future, many conservatives loudly applaud Cruz for his willingness to make the issue a more public one.

Additional Sources:

http://www.bloomberg.com/politics/articles/2015-11-05/gold-standard-backer-finds-friend-in-cruz