Gold Rush 2.0: A New Era in the Global Monetary Order

Gold’s unstoppable rally is fueled by more than just inflation and uncertainty. A tectonic shift in the global monetary system is cementing the metal’s role as a core pillar of financial stability. While retail investors hesitate at record-high prices, central banks and major financial institutions are steadily topping up their gold bullion reserves.

Understanding what’s really driving gold’s momentum—beyond headlines and short-term hype—is essential for any investor looking to protect wealth, anticipate market shifts, and position themselves for what could be a new era in global finance.

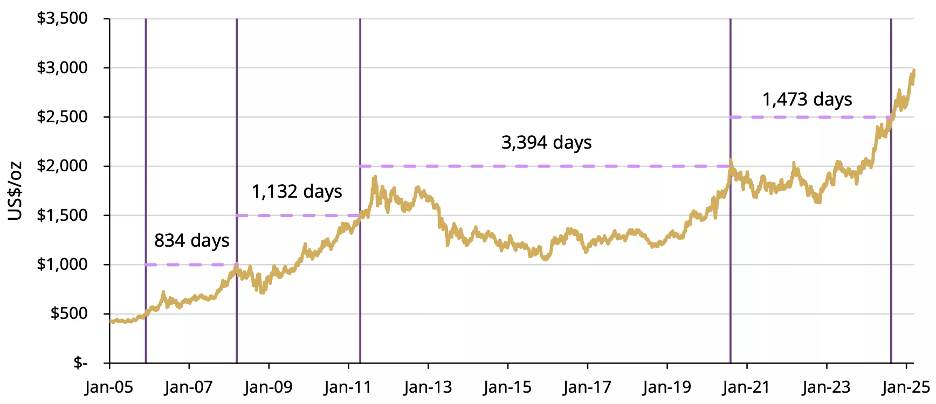

Gold is Rising Faster Than Before

Gold hit $1,000/oz in March 2008, 38 years after the US left the gold standard. Prices doubled to $2,000/oz by August 2020 amid COVID-era turmoil, marking a 100% gain within 12 years. On March 14, 2025, gold crossed $3,000/oz for the first time. The $500 jump from $2,500 to $3,000 took just 210 days, far faster than the historical average of 1,700+ days per $500 increase. Yet, the climb from $3,000 to $3,500 was even steeper, taking just 39 days, signaling a major acceleration in gold’s rise.

Three Eras of Gold Demand

Gold's broad role as a store of value and hedge against volatility has always driven demand and price increases. However, according to J.P. Morgan, the yellow metal's relationship to the economic and geopolitical landscape has changed over time, reshaping how markets view the metal.

Thus, today's gold rally isn't only a continuation of historical forces but a reflection of a deeper, structural reordering. Understanding how the backdrop of gold demand has changed over time helps reveal why gold's momentum may be more enduring than ever before.

1. Inflation Hedge (1970s–1990)

What?

From the abandonment of the gold standard to the early 1990s, gold prices exhibited an inverse relationship to the US dollar.

Drivers

When the dollar fell, its relative weakness to other currencies spurred foreign demand for the yellow metal at relatively low prices.

Future Outlook

J.P. Morgan views the dollar as a “benign” influence on gold because the USD is already overpriced, trading up to 15% above its fair value. It is unlikely to continue rising, reducing its impact on the yellow metal.

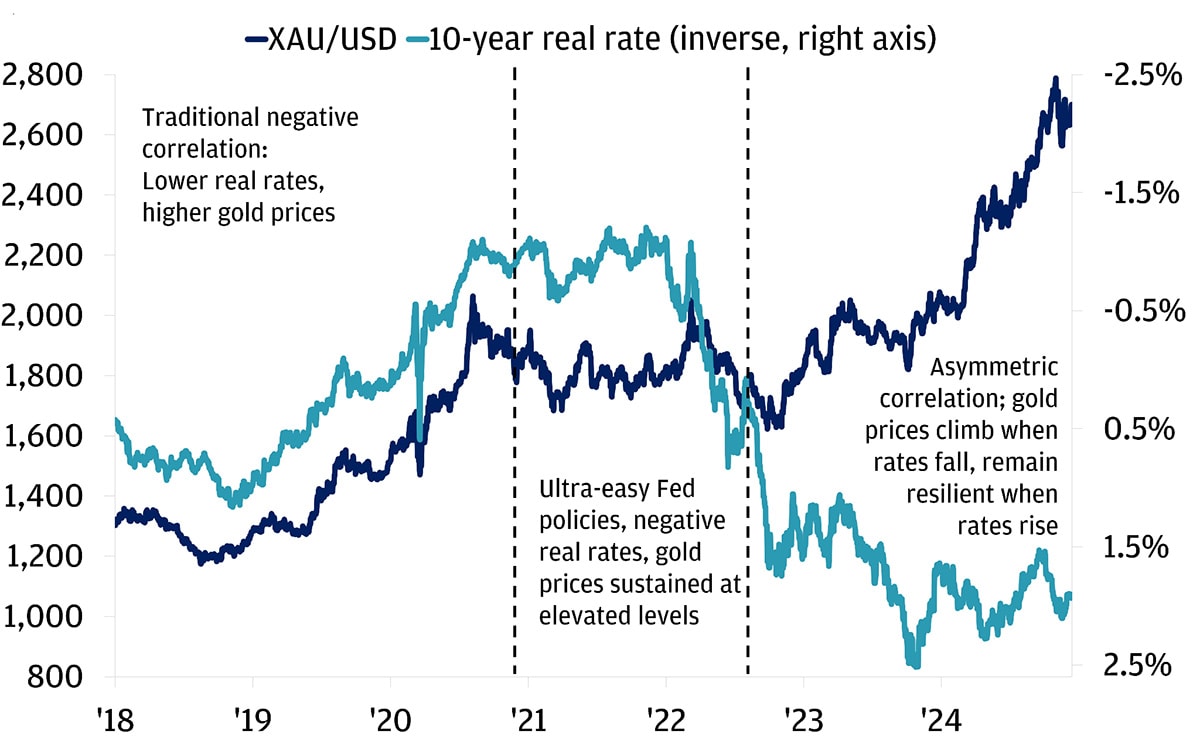

2. Real Yield Anchor (1997–2021)

What?

Between the late 1990s and 2021, gold prices maintained a robust inverse relationship with US real yields (interest rates adjusted for inflation). In other words, gold would rise when real yields fell and vice versa.

Source: J.P. Morgan

Drivers

A fall in real yields, especially into negative territory, coincided with a rising demand for non-yielding assets as the opportunity costs fell. Long-standing low yields since the ‘90s, exacerbated by quantitative easing in the aftermath of the 2008 GFC, elevated gold’s appeal significantly.

Future Outlook

Gold severed this relationship in 2022 when prices rose steadily while the Fed hiked rates aggressively to combat the inflationary pressures of the post-pandemic economy. Analysts view this as a temporary divergence, pointing out how the yellow metal responds asymmetrically to yields. It tends to dip less when yields surge, but spike more sharply when yields drop.

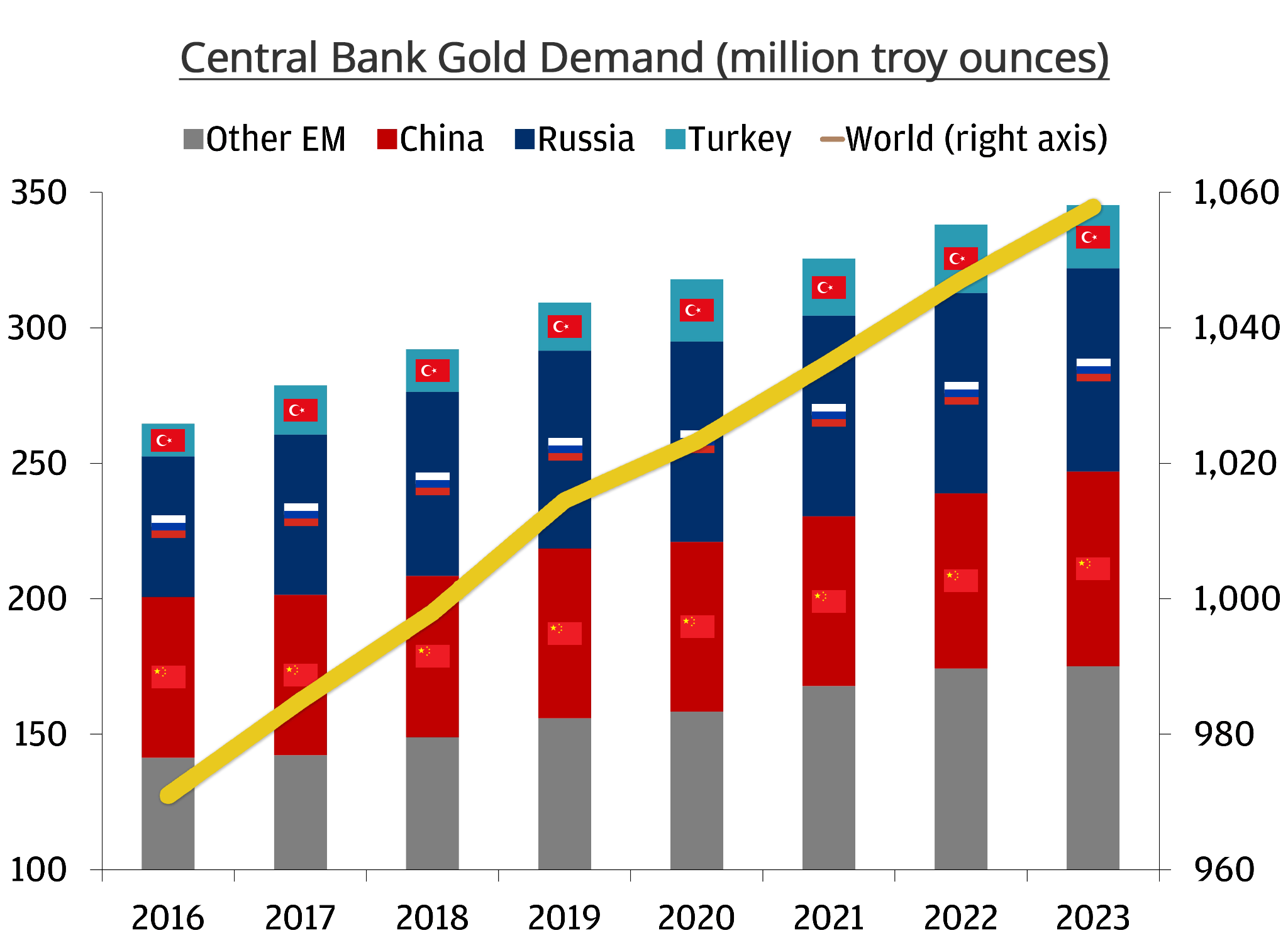

Geopolitical Hedge (2022–Present)

What?

Since 2022, an unprecedented and sustained surge in central bank demand has been the primary catalyst for gold’s record-setting rally. Official consumption doubled from 2021 to 2022 and has remained above 1,000 tons for the past three years, with experts expecting the trend to continue in 2025.

Driving Forces

Governments have been motivated to diversify their reserves away from the US dollar and into gold, especially since the de-dollarization movement gained momentum. This strategic shift away from the greenback comes on the heels of financial debauchery at home (marked by $36 trillion debt) and dollar weaponization (sparked by the US-led sanctions against Russia). Now, emerging market governments account for a disproportionate amount of gold consumption, seeking to mitigate dollar risks.

Source: J.P. Morgan

Future Outlook

Robust central bank purchases of physical gold have driven gold prices higher, despite a strong US dollar and rising real yields, signaling a fundamental shift in historical market dynamics.

Trump 2.0 Fuels Dollar Exodus and Modern-Day Gold Rush

I think Trump is a catalyst, an accelerant, but sort of saying it’s [because] of him is wrong…it was in play for more than a decade…it’s a real turning point in the global economy.–

The dollar’s weakness and weaponization throughout administrations have accelerated the global transition away from the dollar, thereby increasing gold consumption. However, the Trump administration’s disruptive international policies, such as global tariffs, withdrawal from global agreements, skepticism of long-time partnerships, and broad use of sanctions, have put this process into overdrive, further pushing countries away from the US dollar.

The dollar is losing its safe-haven status as countries lack confidence in the country’s fiscal stability. Decades of overspending and federal deficits have ballooned US debt levels to roughly 10% of total global debt. With no party committing meaningfully to closing the gap between expenses and revenue, this trend is likely to continue. On the international front, the US has ramped up its use of the dollar as a cudgel to force foreign countries into compliance. These risks are becoming too great for countries seeking a stable economic foundation.

Gold Returns to the World’s Financial Core

The flipside of the dollar’s crumbling hegemony is gold’s reintegration into the foundations of the global financial system. Although central banks have consistently maintained considerable reserves even after the gold standard, the yellow metal recently achieved a pivotal milestone that marks a monumental shift in how gold is treated.

Recently, gold was reclassified as Tier 1 collateral under Basel III banking reforms. Now, the metal carries a zero-risk profile similar to cash and government bonds, making it more appealing for central banks, bullion banks, and other financial institutions to hold. It’s a technical shift with massive symbolic weight: gold is once again being treated as real money.

In an apparent nod to this significant development, Trump put out a Truth post: “THE GOLDEN RULE OF NEGOTIATING AND SUCCESS: HE WHO HAS THE GOLD MAKES THE RULES.”

As de-dollarization accelerates, Gold is becoming the cornerstone reserve asset, reclaiming its dominance in the global banking sector.

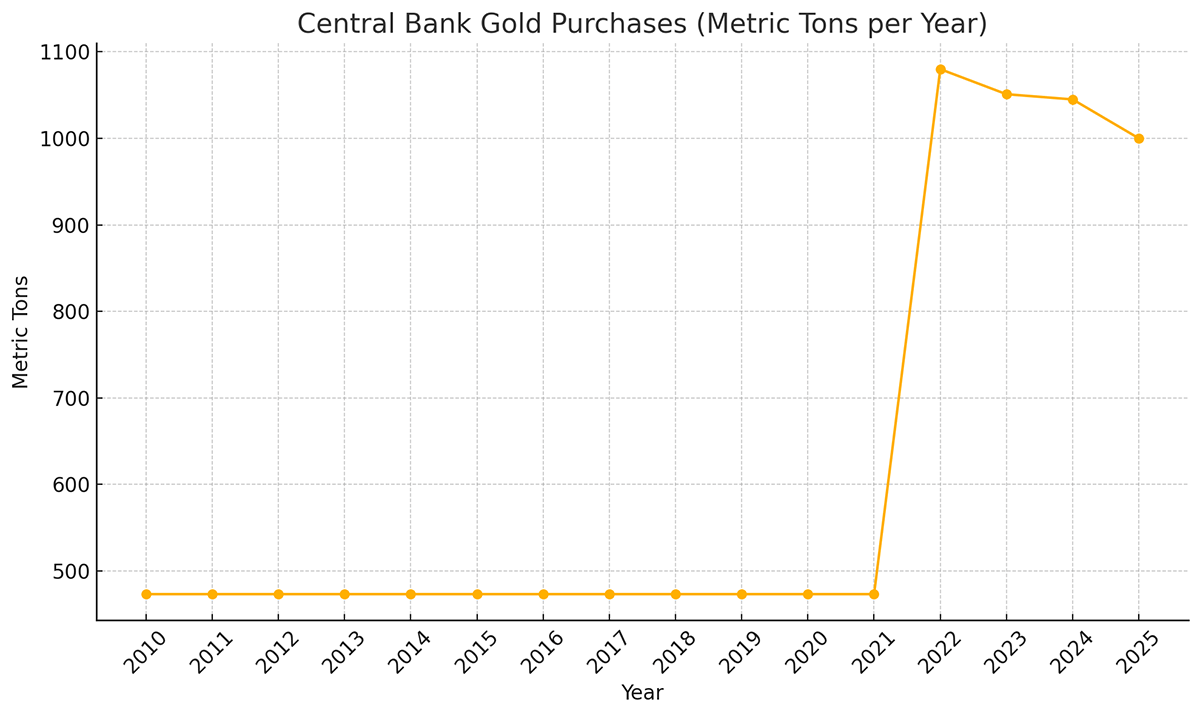

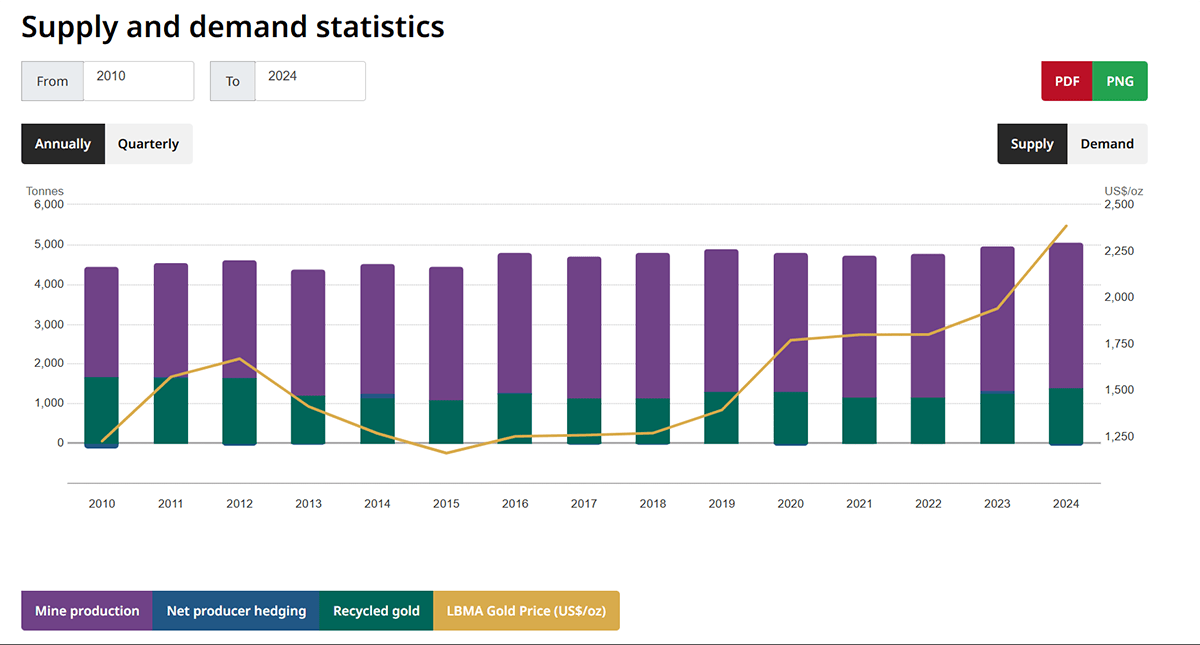

Central Bank Buying Picks Up Steam

- 2010 to 2021: Averaged 473 metric tons per year.

- 2022: 1,080 tons

- 2023: 1,051 tons

- 2024: 1,045 tons

- 2025*: ~1,000 tons

This sustained surge—more than double the previous decade’s average—signals a long-term strategic shift, not a short-term trend.

Booming Demand Hits Supply Squeeze

Source: World Gold Council

A historic rise in central bank demand is colliding with stagnant supply, exacerbating upward price pressures. Mining production has remained flat since 2018, primarily due to lower ore grades, higher mining costs, and stricter government regulations. All gold ever mined is roughly 208,874 metric tons, which could comfortably fit into five Olympic swimming pools. Experts anticipate that this supply-demand imbalance will persist far into the future, particularly with consumption remaining 100% above the averages of the previous decade.

Is now the right time to buy?

Many investors question if now is the right time to buy gold as prices rest near all-time highs. These are likely the same people who flinched in at prices in 2008, 2011, or 2022 before the yellow metal surged to another record, putting to rest doubts about its momentum and strength. Tellingly, those claiming gold is “too expensive” often don’t say the same about real estate, stocks, or many of the other markets approaching record peaks.

Gold is used to bear the brunt of market skepticism, but this time, it’s coming primarily from retail investors. In contrast, central banks and major financial institutions—representing the wealthiest, most knowledgeable, and most experienced investment minds globally—are continuing to pour into gold, regardless of the price. That’s because they understand the structural shift that has occurred, cementing gold’s role in the global financial system.

“Bullion prices have surged dramatically, capturing widespread attention. While coin premiums are poised to rise, these price movements stir psychological reactions among the general public, unlike the calculated responses of central banks and major hedge funds. The notion that gold is “too expensive” is driven by emotion, not evidence. As global markets increasingly seek the stability of gold, time will reaffirm its enduring value, spurring renewed public demand for coins. This will likely push premiums to the elevated spreads historically observed, as available coins dwindle.”

Gold’s Forecast Hits $4,000 and Beyond

What once seemed nearly impossible just a few years ago is now becoming reality: a growing number of experts are forecasting $4,000, $5,000, and even higher gold prices:

“Gold prices could reach as high as $4,500 per ounce in an extreme risk case by the end of 2025.”

–Goldman Sachs

“[$4,000 an ounce] is a well-informed prediction. I think that's a reasonable number.”

–John Paulson, Founder of Paulson & Co

“A path toward $4,000 an ounce for gold could require something that’s typically a matter of time: reversion in silly-expensive risk assets, notably cryptocurrencies.”

–Mike McGlone, Senior Commodity Strategist at Bloomberg

“We are targeting a gold price of $4,000 per ounce by the end of this year and $5,000 by the end of 2026.”

(His forecast is based on the sustained accumulation of gold reserves by central banks.)

–Ed Yardeni, President of Yardeni Research

“I think gold will make it to $4,000. I’m not sure that’ll happen this year, but I feel like that’s the measured move.”

–Jeffrey Gundlach, CEO of DoubleLine Capital

“The gold price could get a further significant boost, probably toward $4,000/oz.”

–Société Générale (SocGen)

“[L]ooking 12 months forward, north of $4,000, we think, would be a new reasonable price target for gold, with key drivers being still emerging market central banks.”

–Grace Peters, Global Head of Investment Strategy at JPMorgan

“With gold expected to rise to $4,000 and beyond, now is the perfect time to invest.”

–Peter Schiff, Financial Commentator