Gold is back in the spotlight as the Federal Reserve’s latest rate cut, rising US debt, and major shifts in London’s bullion market send investors flocking toward safety.

In this week’s The Gold Spot, Scottsdale Bullion & Coin Precious Metals Advisors Steve Rand and Brian Conneely discuss the impact of the recent rate cut, how gold market shifts could lift the lid on prices, what the future of US debt signals for precious metals, and why investors shouldn’t sweat gold’s recent pullback.

Fed Rate Cuts Boost Gold’s Appeal

On Wednesday, the Federal Reserve slashed interest rates by another 25 basis points — the same reduction as the September cut. This marks a continuation of the group’s easing policy, a reversal following over a year of steady rates amid a volatile economy.

The quarter-point reduction comes as the labor market softens, inflation remains above target, and macroeconomic indicators flash warning signals. Fed Chair Jerome Powell compared the interest rate easing to slowing down when driving in the fog, referring to the widespread economic uncertainty.

With the range now at 3.75% and 4%, interest-bearing assets are becoming less attractive to investors looking for a reliable return. The combination of inflationary metrics and a decreased appetite for yielding instruments is a serious boon to gold demand.

The London Gold Market Shake-Up

London is the global hub of gold trading. Behind the scenes, a handful of banks have dominated the trade of physical and paper gold. JPMorgan, UBS, HSBC, and China’s ICBC Standard have been the sole members of the London Precious Metals Clearing Limited (LPMCL), the clearing house that ensures trades are completed smoothly and properly.

This near-monopolistic control over the gold market has affected price movement and vaulting costs. The yellow metal’s rising demand is loosening that stranglehold as Morgan Stanley and Citigroup join the group. This diversification leads to healthy competition, which can lower clearing and vaulting fees, minimize counterparty risks, and boost investor confidence.

“For a long time, there's been control by these big banks to keep gold prices contained. More competition is good. Overall, this should be very, very good for gold in the long run.”

US Debt Sprints to $38 Trillion

The US national debt climbed another $1 trillion between August and December, reaching an eye-watering $38 trillion! This last trillion-dollar sprint marked the fastest growth since the pandemic, indicating an alarming acceleration of spending and borrowing. The neck-breaking pace isn’t subsiding, with the government on track to pile on $20 trillion over the next decade, putting the debt on course to hit nearly $60 trillion by 2035.

The current economic slump, characterized by a slowing job market, stubborn inflation, and frayed trade relations, further exacerbates the debt dilemma. The debt-to-GDP ratio, which measures the US national debt relative to economic output, has spiked to around 125%. Many economists believe a 200% ratio is the “point of no return,” where an economy cannot recover.

This exponential debt accumulation has eroded the US’s reputation as a reliable place to invest. This is reflected in the global de-dollarization push and the downgrades from all three major credit rating agencies. As the debt burden weighs heavily on the broader economy, it serves as a tailwind for gold prices, which tend to rise in tandem with deficits.

“The direction things are going is unsustainable, and it’s only a matter of time before things start falling off a cliff.”

Gold’s Exponential Rise

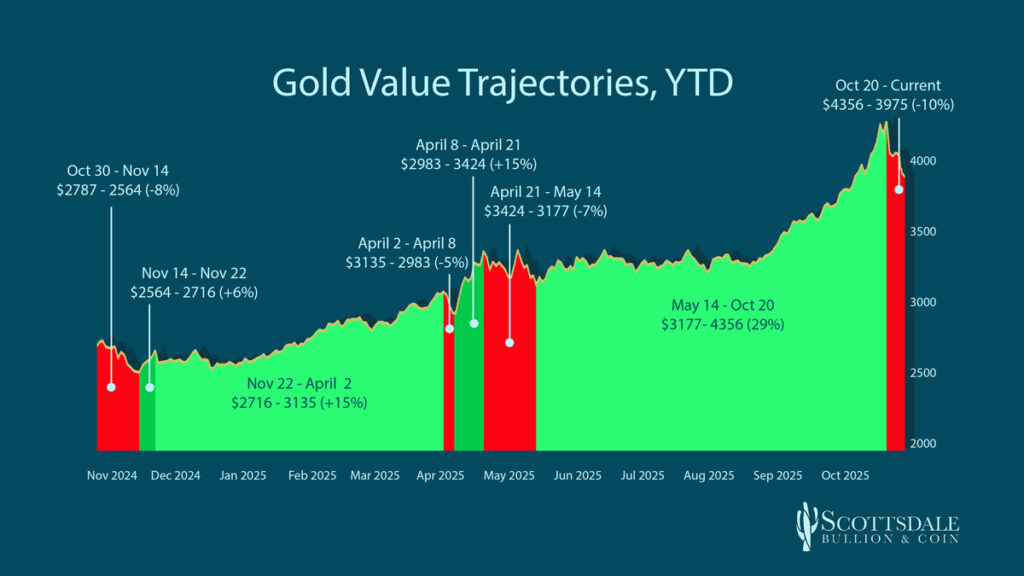

After crossing the $4,000/oz threshold, gold prices skyrocketed to nearly $4,400/oz. Over the past week, the yellow metal has cooled off by around 10%, retreating to the $4,000/oz floor. Instead of a broader downtrend, the market views this temporary dip as a buying opportunity to dollar cost average to a lower price point.

A look at gold prices over the past year reveals that each modest dip has been followed by an immediate rebound, recovering those losses and often extending into months-long surges to new highs.

Following various dips over the past year, the most recent 10% drop was a shakeout of short-term, speculative buyers, rather than long-term investors. Throughout gold’s meteoric rise, central banks and institutional investors have continued accumulating more physical gold bullion, undeterred by the price action.

“Think like Central Banks! Central banks accumulate gold as strategic insurance against systemic risk, not as a tactical trading instrument. Institutional holders with multi-decade time horizons view 10% corrections not as cause for concern, but as validation of their patient, conviction-based approach to wealth preservation.”

Short-Term Dips, Long-Term Confidence

Investors who have concerns about gold’s next moves only have to look at general economic trends and official gold consumption. Markets remain uncertain, and demand for gold is rising. The underlying support structures of gold’s strength remain intact, suggesting that gold prices will continue moving higher.

Instead of presenting a risk, these dips represent a healthy consolidation and buying opportunity. Amid gold’s breather, more and more experts are calling for $5,000 gold.

If you’re eager to learn more about how gold can help you secure your wealth, check out our free Precious Metals Investor Guide.

Question or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Comment

SUGGESTED READING

SUGGESTED READING

Questions or Comments?

"*" indicates required fields