As the country’s economic output slows and debt skyrockets, alarm bells are sounding across financial and political circles about fiscal stability. The United States has already lost its perfect credit rating, and with mounting deficits and unchecked spending, concerns are growing that a tipping point may be near.

In this week’s The Gold Spot, Scottsdale Bullion & Coin’s Precious Metals Advisor’s Steve Rand and Brian Conneely discuss the skyrocketing debt-to-GDP ratio, why investors should care, and how countries are turning to physical gold to shield against the economic repercussions.

What is Debt-to-GDP Ratio & Why It Matters

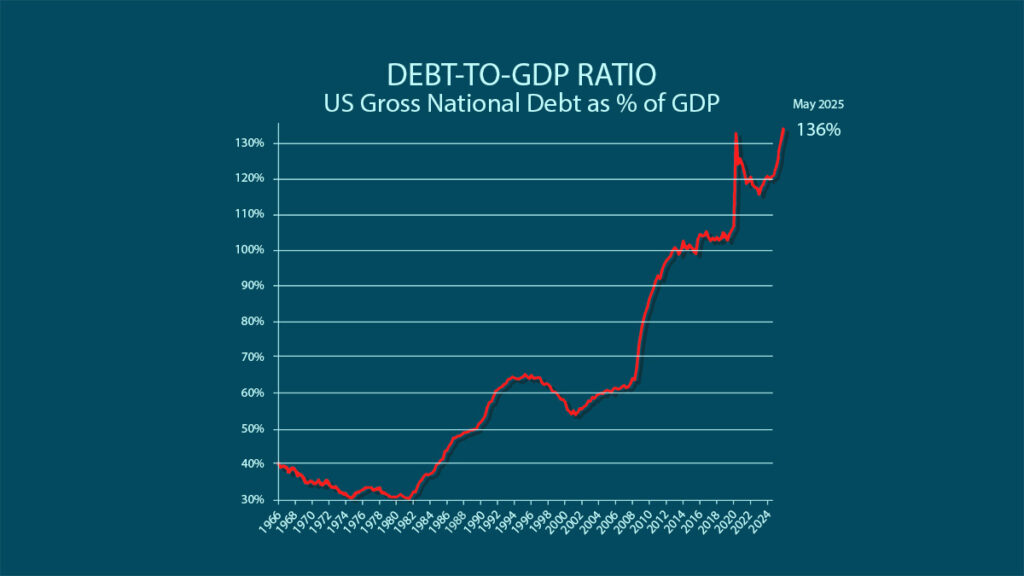

Economists often refer to a country’s debt-to-GDP ratio when assessing an economy’s overall health. Simply put, this metric compares how much a country owes (measured by its debts) to how much it earns (tracked by its gross domestic product).

According to the World Bank and the EU, public debt remains manageable and sustainable at around 60% of economic output, although a lower level is always preferable.

Currently, the US’s colossal $36.9 trillion national debt swallows its $27 trillion GDP, resulting in a towering 136% ratio. In other words, the country is spending 36% more than it makes–a recipe for economic disaster.

When Debt-to-GDP Cripples Economies

America’s unique position as the economic hegemon, with the dollar serving as the world’s reserve currency, has helped mitigate the consequences of an overextended debt-to-GDP ratio. However, this crucial metric has a long track record of forecasting the downfalls of even once-dominant economies, such as:

- Germany (Weimar Republic): 100-200%

- Zimbabwe: 120-150%

- Argentina: 50-60%

- Venezuela: 200-300%

- Hungary: 100%

- Yugoslavia: 80-100%

- Greece: 180%

Although the governments are responsible for managing a country’s expenses, it’s always the people suffering the consequences of fiscal malpractice. For example, only ten years ago, Greeks were limited to withdrawing €60 ($64) per day.

The debt-to-GDP ratio has crippled economies when left unchecked. The keywords are momentum and acceleration. That’s what we’re seeing now.–

The world is already taking action to shield against the blowback of a US debt crisis. An increasingly weak dollar and spiking bonds reflect an exodus of capital from USD-linked assets. Recently, Moody’s became the third major credit rating agency to downgrade the US, citing the country’s unsustainable debt levels.

Gold Cements Its Safe-Haven Role

After the abandonment of the gold standard, countries attempted to substitute fiat currencies for gold. Despite not being an official part of the monetary system, gold remained a core safe-haven asset.

That’s why central banks, the printers and managers of fiat currency globally, have always maintained significant physical reserves. As official demand for physical gold accelerates at an unprecedented pace, governments are revealing the fragility and weakness of paper money.

“When a currency is faltering, which we see all around the world, we come back to what we can rely on. It doesn't matter the decade, the century, the millennium, the country, the kingdom, the nation...when it comes down to it, gold is always going to hold its value.”

This tacit acknowledgement of gold’s central role has come to a head with the recognition of the metal as Tier 1 collateral in the banking sector. Now, financial institutions can use physical gold to meet their reserve requirements, cementing the metal’s role in the global financial system.

The Yellow Metal as Legal Tender

This week, Florida passed a law recognizing gold as legal tender, allowing investors to use physical gold for everyday transactions. The Sunshine State joins a growing list of legislators across the country, officializing the use of gold as currency, including:

- Utah – March 10, 2011

- Oklahoma – June 4, 2014

- Wyoming – March 8, 2018

- Arizona – May 10, 2017

- Arkansas – April 11, 2023

- Louisiana – May 31, 2024

- West Virginia – March 2024

- Missouri – May 6, 2025

Gold is the ultimate currency. There’s no other currency that could replace gold.–

US Debt-to-GDP Forecast Looks Grim

America’s national debt has taken center stage in public discourse, but talk has yet to lead to action. Despite mounting concern, each new party in power seems to simply keep the debt snowball rolling.

Currently, Senate Republicans are weighing the One Big, Beautiful Bill Act, which the Congressional Budget Office estimates would add $3.8 trillion to the federal deficit. According to the Tax Foundation, the bill could push the debt-to-GDP ratio to 172.3% by 2059, even when factoring in potential economic growth.

Even Elon Musk, former head of the government’s cost-cutting agency DOGE, revealed he was “disappointed” in Trump’s pursuit of the bill. The world’s richest man quipped that a bill could be either “big” or “beautiful,” but not both–highlighting the bill’s contradictory goals of cutting the deficit while permanently reducing government revenue through tax cuts.

NEW Report: Gold Rush 2.0

Want to understand why gold is making a comeback on the global stage? Our new report, Gold Rush 2.0: A New Era in the Global Monetary Order, breaks down how the yellow metal is reshaping the financial system. Don’t miss this deep dive into the forces driving a modern gold revival. CLICK HERE TO READ NOW!

Question or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Comment

Questions or Comments?

"*" indicates required fields