Fundamentals confirm that rising consumer prices will lead to rising interest rates. But the signals from central banks suggest that they will only raise them less than might be expected to compensate currency holders for loss of purchasing power. This is a repeat of the conditions that drove gold up from $35 to over $800 in the 1970s.-Alasdair Macleod / London banker

The upside potential for gold is multiples of the current price, especially since the currency debasement will accelerate as money printing accelerates.Gold is the king of wealth preservation and should be held in physical form outside the banking system.-Egon von Greyerz / Matterhorn Asset Management

Gold and silver have been trading sideways to lower for 16 months now and I’m noticing a greater number of investors (and potential investors) in gold and silver are discouraged. After all, it seems everyone is making big money in selected stocks, crypto’s and real estate, so why bother with precious metals when they can’t even go up with inflation ramping higher? Of course, I’m being facetious when posing this question and in reality, I’m extra bullish on the precious metals at the moment. Why? Well, partly because the public is not excited about gold and silver currently, and in fact I’ve noticed some clients selling their metal to put everything in other assets that are “high flying” and volatile. Historically speaking, this type of public attitude is often associated with markets (in this case gold and silver) about to rise significantly and in long duration.

And speaking of history, today is a great time to see what the markets did in the 1970’s, since today’s inflation and economy seem to be following a similar pattern. Rick Rule of Sprott USA pointed out recently there was a lag in the earlier 70’s between inflation rising and the gold market responding. It wasn’t until the pubic became truly fearful of inflation that gold made its move from $35oz to $875oz over a ten-year period.

Also, Bloomberg had the following to say this weekend, “For those who think gold missed the inflation train, there are several reasons to reconsider. There have only been two other inflationary periods in the last 50 years. The first was in the seventies, the second from 2003 to 2008. In each of these inflationary periods, gold underperformed commodities in the first half and outperformed in the second half. It seems that markets don’t take inflation (or gold) seriously until it proves to be intractable.”

Along this same line of thinking, seasoned veteran Adam Hamilton of Zeal Research, expressed the following views, “Gold is lagging the raging inflation unleashed by the Fed’s epic money printing. Despite leading inflation benchmarks skyrocketing to multi- decade highs, gold prices have barely budged. Serious inflation initially fuels record-high stock markets, which stunt gold investment demand. But festering inflation increasingly erodes corporate earnings, hitting stock prices. As stock markets roll over, gold will start reflecting this inflation.”

Hamilton was also quick to point out that, “Runaway inflation is increasingly plaguing the United States, as evident in this week’s major economic releases. The December Consumer Price Index headline number came in up 7.0% year-over-year, its hottest print since June 1982! That’s a 39.5-year high, despite the CPI being intentionally lowballed by the government to mask inflation. Fast-rising general prices slash standards of living, and this is just beginning to anger the American voters. The Fed has effectively more than doubled the US-dollar monetary base! Such extreme excess is wildly-unprecedented.”

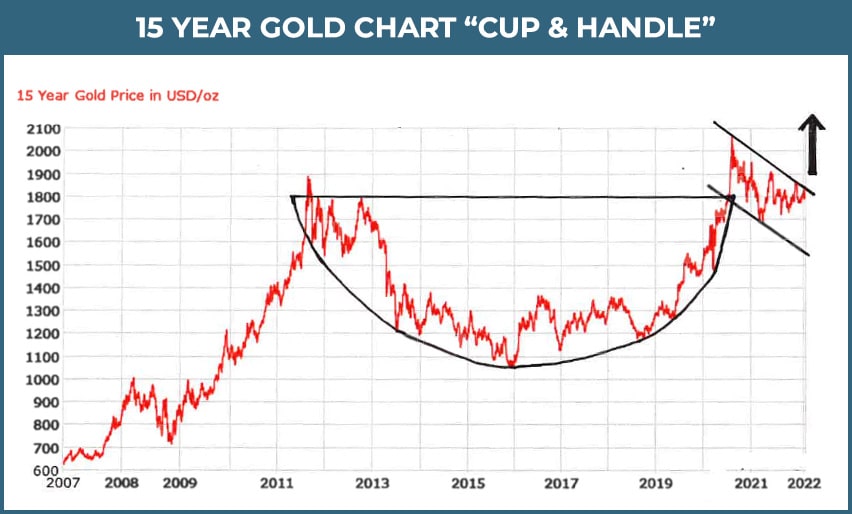

In conclusion, Hamilton says, “The bottom line is gold is only lagging inflation temporarily. Fed-levitated record-high stock markets have retarded gold investment demand, while the yellow metal consolidated high after massive mid-2020 gains. But this serious inflation will increasingly erode corporate earnings, forcing bubble-valued stock prices much lower. And gold is nearing a major forced breakout from a gigantic bullish technical chart formation. So gold prices should soon start reflecting this raging inflation unleashed by the Fed’s extreme monetary excesses. Gold soared by multiples during the last serious-inflation bouts in the 1970s as stock investors diversified into it. And since the Fed can’t hike rates high enough to fight today’s inflation without crashing these bubble-valued stock markets, high-and-rising prices are likely to continue festering for years to come.”

From a historical standpoint and fundamental supply/demand standpoint and technical standpoint, gold and silver have every reason to rise dramatically from current levels. And speaking of technical evaluation, below is the gold chart Hamilton described as “gigantic and bullish”, and a long-term silver chart as well. The gold chart shows a massive “cup and handle” formation, which gets more and more bullish each day it builds, and projects a price of $2,700oz.

The silver chart reveals its price at the bottom of a range. As you can see, each time silver breaks out of this consolidation pattern, the price advance higher is fast and furious. And finally, knowing that gold and silver prices have been artificially held down for many years, now is the time to own these precious metals, while the downside risk is limited and the upside is “off the charts.”