Gold and silver are breaking records, and veteran economist Peter Schiff says the rally’s just getting started. His latest warning paints a stormy picture for the dollar, debt, and the future of money itself.

In this week’s The Gold Spot, Scottsdale Bullion & Coin’s Precious Metals Advisors Brian Conneely and Tim Murphy discuss gold and silver’s unshakeable momentum, how a short squeeze could develop, and why US assets are losing their appeal.

A Big Week for Gold & Silver

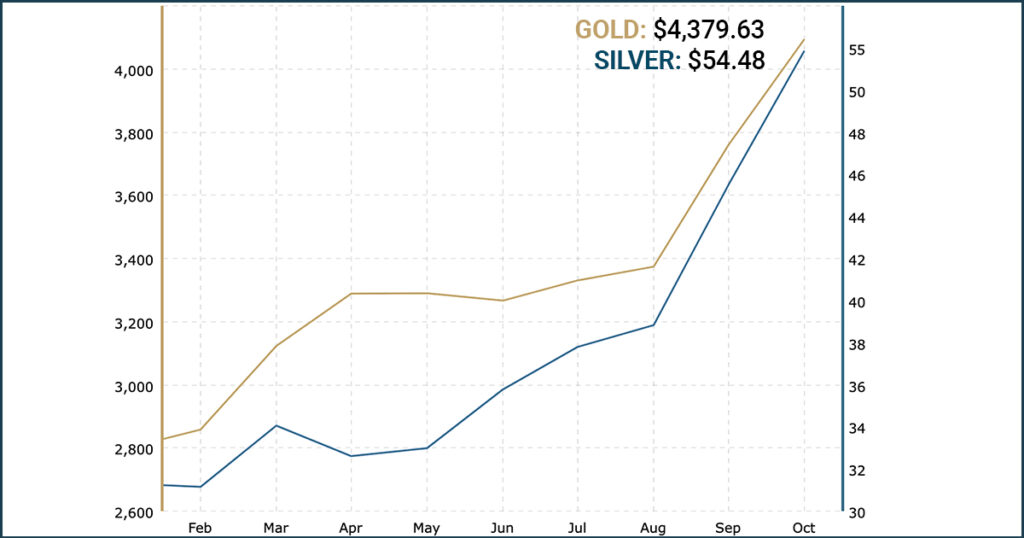

Both gold and silver have had tremendous movements over the past week, capitalizing on recent all-time highs.

After crossing the $4,000/oz mark, gold prices have soared to over $4,300/oz, marking more than a 5% increase in a matter of days. Not to be outshone, silver prices have climbed to over $54/oz after landing a fresh record of $50 last week. That’s nearly a 10% jump. Once again, silver is outperforming gold, a trend experts expect to continue throughout 2025.

Every time investors may think the rally is over, the precious metals market locks in further gains, strengthening the broad safe-haven demand. Recently, a growing number of experts have been calling for higher prices.

Peter Schiff Warns of “Category 5 Financial Hurricane”

Gold is about to break above $4,150 and silver is about to break above $53. Get ready for a silver short squeeze for the ages. But the main event will be the global rug pull on the U.S. dollar and Treasury market. This is a coming Cat-5 financial hurricane hiding in plain sight.

— Peter Schiff (@PeterSchiff) October 14, 2025

This week, Peter Schiff revealed his bullish forecast on X, describing how rising prices mixed with physical shortages could result in “a silver short squeeze for the ages.”

In the same message, the famed investor warned of an incoming “rug pull” from US assets as countries seek to diversify away from American influence, both financially and politically.

Together, Shiff described the developing situation as a “Cat-5 financial hurricane,” underscoring the severity of the economic and fiscal climate. This message’s brevity masks the depth of its warning. Let’s break it down.

The Mechanics Behind a Silver Short Squeeze

A short squeeze occurs when short sellers, investors who wager a commodity will decrease in value, are quickly forced to accumulate more of the asset when prices rise unexpectedly. Investors often short an asset to buy it back later at a cheaper price, but there’s always a risk that prices move in the opposite direction.

That’s precisely the kind of pressure Schiff anticipates in the silver market. However, the squeeze won’t only come from the paper market. Schiff warns of a deeper, systemic physical squeeze where years of institutional shorting, from major players like J. P. Morgan, run headlong into a real-world supply shortfall.

For years and for decades, we’ve had JP Morgan and other banks selling the silver and the gold on the paper exchanges and keeping the price down.–

With trust in the US’s financial stability at record lows, investors losing faith in paper silver may start taking physical delivery of the metal. Even the world’s largest bullion banks might not have the inventory to cover these losses, which could force short sellers to cover their positions and add fuel to the rally.

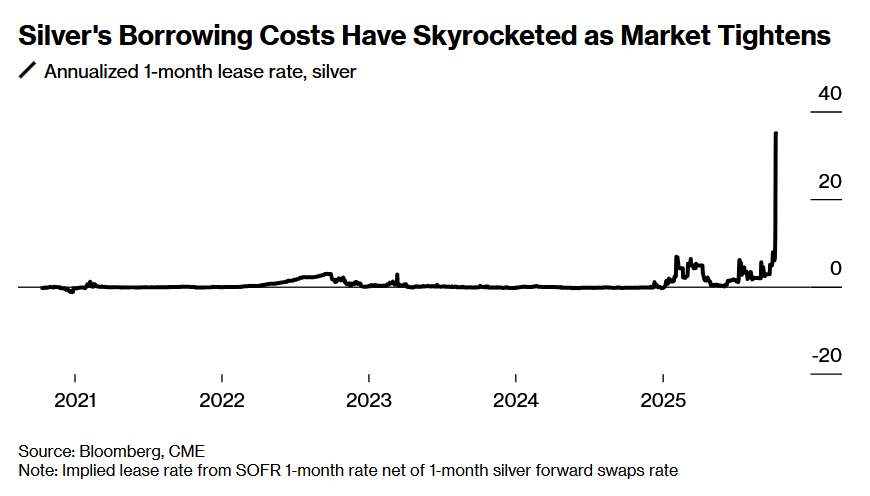

We’re already seeing a strain on the available silver on the London and New York exchanges as physical silver demand picks up. Borrowing costs have spiked from slightly above zero to near 40 within the year, signaling considerable pressure.

Source: The Bubble Bubble Report

“Everyone’s scrambling now to get the physical in their hands, and that’s driving the prices higher.”

A Global “Rug Pull” on the Dollar

In the latter half of his message, Schiff warns of a “global rug pull on the US dollar and Treasury market,” referring to the de-dollarization push as countries, especially among the BRICS cohort, seek to distance their economies from American influence. Shiff employs the term “rug pull” to suggest the US economy and average Americans aren’t in a sufficiently defensive position to protect against this global transition.

To service its mammoth $37 trillion national debt, the federal government issues debt securities in the form of Treasuries. Long-term bonds have been among the most in-demand Treasury assets for foreign governments seeking to align their economies with the stability of the US economy.

However, the sheer size of the debt and its soaring servicing costs have hampered the US bond market’s stability, leading to credit rating downgrades from all major credit agencies. Foreign countries are now buying more gold than US Treasuries for the first time in decades.

Source: Crescat Capital LLC via Investing.com

Schiff anticipates that the worsening US economy, plagued by a weakening US dollar and falling bond market, will light a fire underneath the furnace of de-dollarization. The result would be a swift devaluation of the dollar and a rapid fall in value for dollar-adjacent assets, such as those in the stock market. This zapping of demand for US bonds would make it impossible to pay for the towering debt bubble.

The Crisis Everyone Should See Coming

This “Cat-5 financial hurricane” is “hiding in plain sight,” according to Schiff, for two main reasons. First and foremost, the bearish economic indicators are apparent for anyone to see: national debt is rising, de-dollarization is spreading, central bank gold demand remains elevated, and the Treasury market is weak.

Despite these flashing warning signals, the average American is heavily invested in dollar-linked assets and remains on the sidelines of the precious metals market. Meanwhile, investors across the world, especially in Asia, are pouring into physical gold and silver to protect their wealth. Even major financial institutions are encouraging investors to abandon the traditional 60/40 rule in favor of a portfolio with fewer bonds and more gold. Bank of America goes as far as to urge investors to hold 40% gold.

The Fed’s Impossible Choice

If Schiff’s “financial hurricane” hits, the Federal Reserve could face a no-win scenario. Raising rates to defend the dollar would crush growth and markets, while printing money to buy Treasuries would flood the system with new dollars and fuel inflation.

Either path erodes confidence in paper assets, reinforcing Schiff’s point that investors may turn to hard assets like gold and silver coins as trust in US fiscal management fades. Many analysts are comparing the current economic climate to that of the 1970s before the economy entered nearly a decade of corrosive stagflation.

Right now, it seems the Fed is keen to stick with inflating the economy to avoid the worst of the economic fallout — a significant tailwind for precious metals prices moving forward.

Get in Position for the Silver Squeeze

Your opportunity to benefit from a potential silver short squeeze is wholly dependent upon your preparation today. Schiff and other analysts are pointing to the bullish writing on the wall, suggesting silver’s inertia will carry it much higher, fueled by systemic short sellers.

If you’re looking to optimize your portfolio for the potential silver short squeeze breakout, check out our FREE Silver Investor report.

Unlock Silver Investor Trade Secrets in our Investor Report.

Get Your Free Report

Question or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Comment

SUGGESTED READING

SUGGESTED READING

Questions or Comments?

"*" indicates required fields