Following a major breakout earlier in the year, silver has remained largely idle, struggling to break through the $40/oz barrier, until today! Is the shiny metal’s surge at a breaking point, or is another boost around the corner?

In this week’s The Gold Spot, Scottsdale Bullion & Coin’s Precious Metals Advisors Tim Murphy and Joe Elkjer discuss which major financial institution is encouraging investors to go long on silver, why the silver market is getting squeezed, and what’s driving demand to new highs in the future.

UBS Encourages Investors to Go Long on Silver

The world’s largest private bank is advising investors to load up on silver with expectations of a sustained rally. The Swiss investment firm pointed to recent price consolidation as a signal of further strength.

Recently, silver spot prices hovered around $38/oz after breaking a 14-year high by crossing the $35/oz and $39/oz ceilings within a few months of each other. Although UBS analysts project the shiny metal to hit $42/oz in Q1 2026 and $44/oz in Q2, current prices and any pullbacks present a buying opportunity to dollar-cost average for a lower cost basis.

UPDATE: The silver futures price reached a new 52-week high today after breaking through the $40 mark.

The US Strengthens Silver Importer Status

The United States is currently a net importer of silver, meaning Americans buy more physical silver products than they sell. In June 2025, domestic investors brought in $507 million worth of the shiny metal, with $384 million exiting. The resulting net import of $124 million is higher than in previous years, marking a rise in silver demand.

Exploding Silver Delivery Times

Physical silver consumption is also on the rise across the pond. In London, major bullion banks are struggling to keep pace with demand as more investors assume tangible ownership of silver by letting futures contracts expire.

Usually, these speculative traders seek to profit from the market’s volatility with no intention of allowing the contract to expire. This growing trend of holding the futures agreements until completion and taking ownership of the physical asset is straining banks. The time between trade finalization and delivery has surged from one day to eight weeks.

“Entities are taking physical delivery at an incredible rate. It’s breaking all records. Basically, they’re taking the physical silver off the market, and it’s not coming back.”

Saudi Arabia Jumps Into Silver

Saudi Arabia, one of the wealthiest countries on earth, has diversified into the silver market with a sizable $40 million investment. The nation’s central bank expanded into silver exchange-traded funds (ETFs) such as SLV.

Although the oil-rich country’s other investments dwarf this holding, it’s part of a foundational shift as central banks diversify their portfolios amid de-dollarization efforts and geopolitical instability.

Mexico and Russia have both been active silver investors, and financial leaders from the Czech Republic and Mongolia discussed the possibility at the 2024 LBMA Precious Metals Conference.

Silver’s Expanding Industrial Demand

Silver’s dual role as an industrial and investment metal provides the market with consistent demand, regardless of economic conditions.

Although silver investment purchases are on the rise, industrial uses — which already account for 55% of total demand — are set to surge in the coming years.

Silver demand is off the charts right now.–

The rapid advancement of technology and the country’s ever-expanding economy are opening up different avenues of industrial applications.

- Photovoltaics — The rapid growth of the solar panel industry is set to account for nearly 100% of the silver supply by 2050.

- Artificial Intelligence — AI server farms demand up to three times more silver than traditional ones due to higher processing output, more energy requirements, and greater interconnectivity.

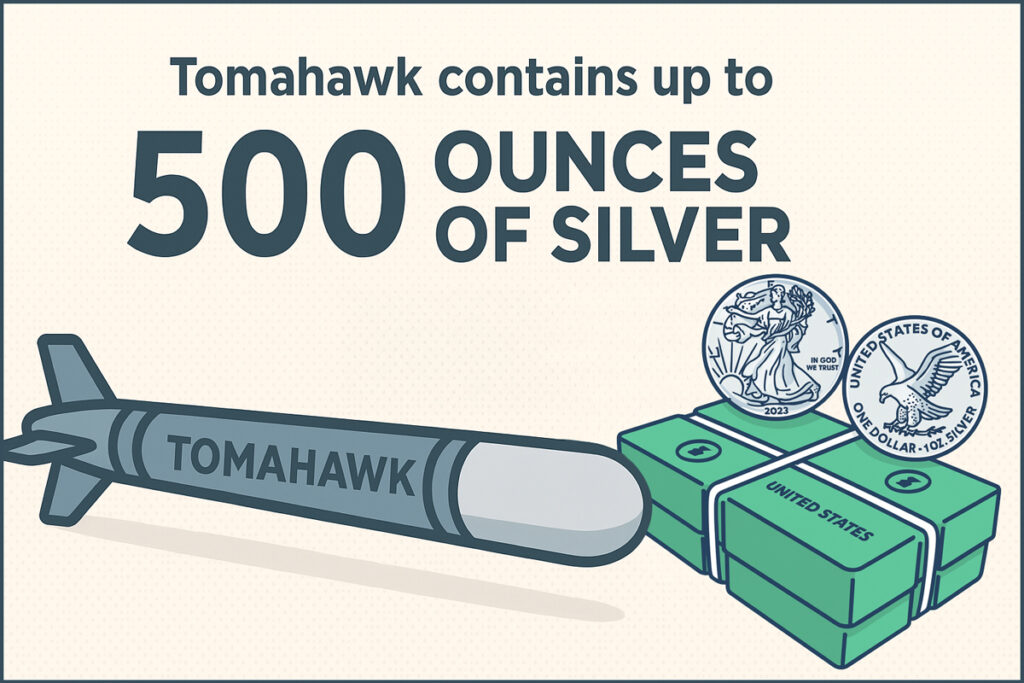

- Defense — It’s believed that a single Tomahawk missile uses 500 ounces of silver, the equivalent of a flying Silver Monster Box.

A 1970s-Style Economic Catalyst

Silver’s future is shining with an upbeat forecast, even assuming economic strength. Yet, the metal’s performance could be even more bullish if the markets sour. During the 1970s stagflation, silver soared by 900%, stretching from $5/oz to $50/oz.

Although the stock market sits near all-time highs, troubling economic data continues to emerge, prompting many investors to wonder about the true state of the economy. J.P. Morgan still places the chance of a recession at 40%.

Don’t Miss the Silver Wave

With silver demand surging from industrial and investment sources, and global supply remaining tight, silver is poised to rise further. The metal’s year-to-date gains already rival those of gold, and experts see more room to run.

“From a fundamental standpoint, it’s the best situation you could have for a major bull market.”

If you’d like to learn how silver can help protect your wealth, claim access to our free Silver Investor Report.

Unlock Silver Investor Trade Secrets in our Investor Report.

Get Your Free Report

Question or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Comment

Questions or Comments?

"*" indicates required fields