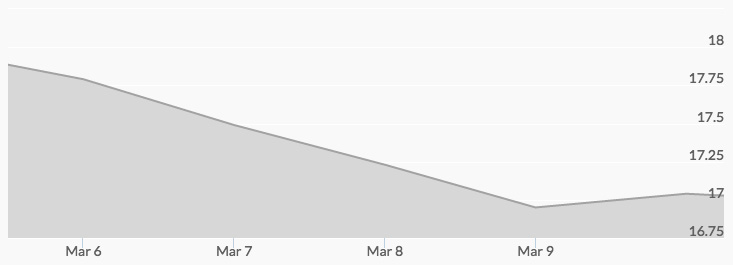

After opening Monday at the week’s high of $17.87, silver prices pulled back due to signals of a strengthening U.S. economy. By Wednesday’s close, the silver price chart reported that an ounce of silver was selling for $17.25, and it dropped another $.20 by Friday to close at $17.05.

News of rising U.S. interest rates and securities yields brought in more sellers. Traders who also watch fundamentals and technical data reported that sell signals had been generated, and that was thought to hold up some buying. Strong silver buying trends in January and February had many analysts predicting this correction.

The U.S. dollar also played a role in the week’s dip, showing increased strength against a basket of six major currencies. 1 Underlying much of the concern in the precious metals market’s bullpen was an indication of an additional rate increase by the FOMC after the scheduled March 14-15 meeting. 2 Increases in interest rates can affect short-term buying of silver and other precious metals since they do not earn current income.

However, many observers continue to raise concerns that the stock market is overvalued and that the optimism of current buying is still not supported by fundamentals. 3 If there is a major correction or a 2017 stock market crash, it will create more bullish trends for silver and gold.