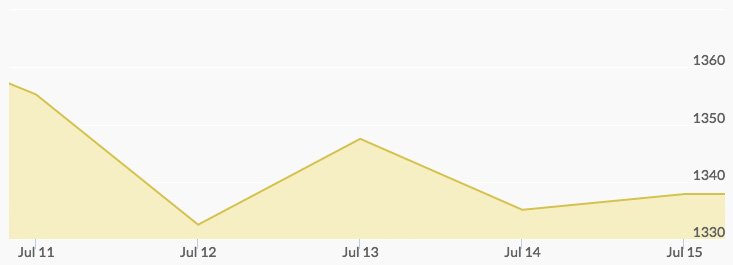

After last Friday’s unemployment report, gold opened this week down $11, around $1,355 per ounce. The report showed U.S. jobs growing by 287,000 in June, significantly higher than analysts expected, yet analysts don’t expect this news to spark a change in interest rates. Some global economic indicators strengthened, including the British pound and the S&P 500. Chinese and Japanese currencies, as well as the dollar, were weaker.

The IMF gave two warnings this week: one to China to tackle its over-lent situation, and one to the EU that a recession is on the way in the next year.

Safe haven demands for gold were abating by Tuesday, pushing the yellow metal to a two-week low at $1,330 per ounce. The Dow Jones was up to record highs. Wednesday’s gold prices were higher after the momentary dip, which allowed an opportunity for new investors to enter the market. World stock markets have rebounded since the Brexit vote mid-June.

Gold took another dip Thursday after the Bank of England surprised the world by not implementing monetary stimulus in the form of slashed interest rates. Markets overwhelmingly expected some form of action, but the BOE has taken no steps forward. Friday’s gold price closed around $1,328 per ounce.