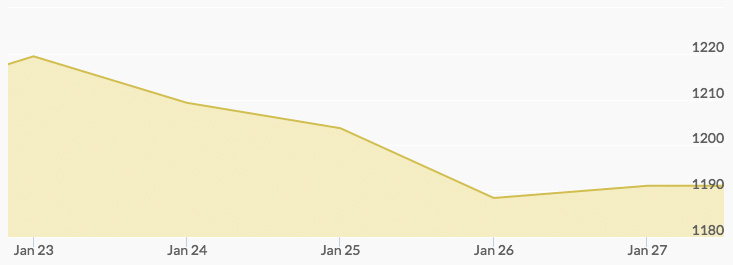

Fluctuations in gold spot prices last week reflected the political and economic climate at home and abroad as the new administration implements its policy changes. The price of gold started off Monday stronger in early trading in foreign markets at $1,218.32, opening at $1,113 in the U.S. The day closed at a healthy $1,219.55—the high for the week.

The yellow metal shined again on Tuesday, with gold prices reaching $1,216.78. The psychologically important $1,200 floor pulled back on Wednesday, generating an opening price of $1,189.81 on Thursday. The week ended with a slight cheer as the price of gold moved back to close at $1,191.22 on Friday.

A number of analysts dismissed the mid-week dip as an effort to price in what the Fed might do in its first 2017 meetings on Tuesday and Wednesday. The economic news for Q4 2016 did not end on a rousing note, and the dollar weakening hasn’t helped.

The unprecedented pace of the new administration played a major role in the week’s trading. The mixed signals for the market included the discussion of a 20 percent border tax with Mexico, newly reassuring talks with the UK prime minister, and withdrawal from the Trans-Pacific Partnership accord. 1 2

In the coming week, if no support is provided by the Fed announcements gold prices could face some pullback. However, such short-term challenges are balanced with growing expectations of a market adjustment, making this period an excellent time to average down gold holdings.

Additional Sources

2 – https://www.bloomberg.com/politics/articles/2017-01-23/trump-said-to-sign-executive-order-on-trans-pacific-pact-monday