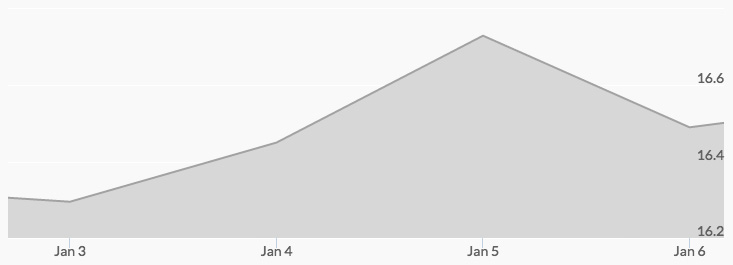

The new year opened with a strong start for silver trading: Tuesday’s silver prices jumped from $15.91 to a daily high of $16.42. 1 After a series of adjusting trades, the silver price chart showed an increase to $16.47 on Wednesday; this trend continued into Thursday, with the price of silver peaking at $16.69. The week ended at $16.49.

The dollar weakening was one explanation many analysts gave for the performance of precious metals, with the news sending speculators in and out of the market. 2

Many analysts point to the anticipated increase in safe haven buying as another underlying factor in the market’s recent strength. 3 Year-end assessments of the U.S. and global economies, especially the European economic crisis, have shifted market participants’ focus back to long-term financial realities.

Strong buying during dips in silver spot prices this week also seemed to be driven by shorts trying to cover positions. The year ended with some speculators betting on further pressure on precious metals due to the optimism of last year’s elections. However, the abovementioned issues of a weaker dollar and economic uncertainty caused many of the shorts to step back.

As market analysts attempt to evaluate the most recent U.S. economic news, including the jobs report, many buyers will be watching for silver prices to react to gold prices. While silver price changes often lag behind those of gold by 5-10 days, the week’s rise in prices for the yellow metal is expected to be bullish for silver prices soon.

Additional Sources

2 – http://www.reuters.com/article/global-precious-idUSL4N1EV18G

3 – https://www.bulliondesk.com/gold-news/metals-morning-view-rallies-metals-prices-pause-as-dollar-firms-126429/