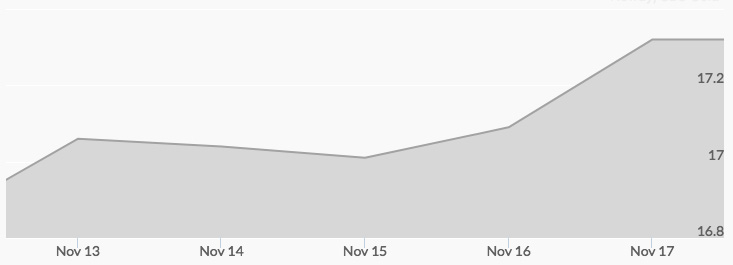

Silver started the week off exactly as it ended the previous week, at $16.88, but not long after the New York open, the market took off to close Monday up $0.17 at $17.05. Tuesday saw slippage to $16.94 at the open, but again, the bulls started running before long and the day closed at $17.02. Wednesday reversed the trend, opening at up $17.18 after being pushed up in afterhours trading, then saw a pullback to close the day at $16.99. Thursday opened up again at $17.05 and the day stayed in a narrow range, closing at $17.08. Friday opened level to Thursday’s close and then the bulls really started running, as gold led the entire precious complex in a massive buying spree. Friday’s close was at an astonishing $17.31, the highest close since October 16, indicates the silver spot price history chart.

The big news in the silver market last week was a report detailing that as many as two thirds of silver miners have seen a fall in production in 2017. 1 The report details production decreases in mines in Australia, Chile, Mexico, and Peru and makes the prediction that supply will be down by 40 to 50 million ounces, and this will soon lead to much higher prices for silver. Mine production also fell from 2015 to 2016, and industry insiders have been asking, “When will silver peak?”

Further bullish news for silver was market commentary in the wake of Bitcoin’s skyrocketing value that when the crypto-currency bubble bursts, expect the markets to come crashing back into the precious complex in a big way. 2

Finally, Friday’s rally was driven by general market skittishness about chaos in the US Congress, as widening scandals on both sides of the aisle threaten what seemed to be safe seats. When added to the squabbles over the GOP tax plan, economic uncertainty driven by incoherent governance seemed to have set off a strong flight to quality. 3