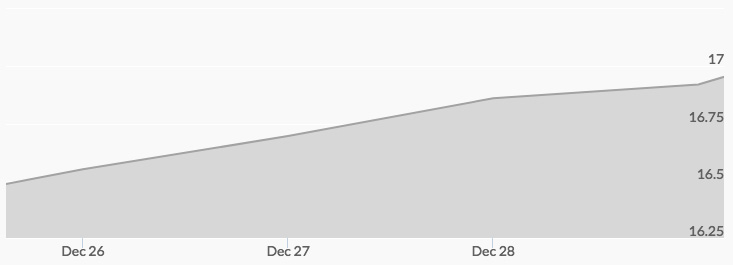

Silver kept the good times rolling last week, despite the short trading week, reported the silver spot price history chart. Markets were closed for the Christmas holiday on Monday but opened Tuesday up significantly at $16.51 and kept pushing to close the day at $16.54. Wednesday opened still higher at $16.67 and rose to $16.69 by the close. Thursday’s open spiked to $16.81, then traded modestly throughout the day to close up slightly at $16.84. Silver shot up again in afterhours trading to open Friday at $16.95, saw an intra-day high of $17.06—also a peak for December—then settled to close the week at $16.94, a rise of 3.74 percent from the previous week’s close.

The week opened to the news that less than a decade after the 2008 financial crisis investors are yet again piling into mortgage-backed structured credit products. This year saw a massive rise in the amount of money put into credit-risk transfer (CRT) bonds and predictions for the market in 2018 are staggering, as rate hikes will make the bonds even more attractive to investors. CRTs are effectively first-loss risk participations in pools of residential mortgages guaranteed by Fannie Mae and Freddie Mac. In other words, CRT bondholders are the first to lose if Americans don’t pay their mortgages. These bonds have exploded to a market value of more than $40 billion over the past four years, and if predictions for 2018 are correct, longtime market observers will recognize a pattern: overconfidence in Fannie and Freddie and a dumbing down of the market will mean that many investors won’t bother to conduct their own due diligence on the actual pools of mortgages. Sound familiar, anyone?

To make matters worse, the week concluded with a story that Florida real estate values are under worse threat from global warming than previously believed. A jointly prepared study by the University of Colorado at Boulder and Pennsylvania State University showed that sea-level properties in many areas of Florida are at significantly higher risk of flooding than previously believed and that this is having a major negative impact on real estate. To summarize: we’ve got a red-hot structured credit product to share risk in mortgages and the possibility of lots of real estate not being worth as much as believed. The time for a flight to quality is getting closer and closer!