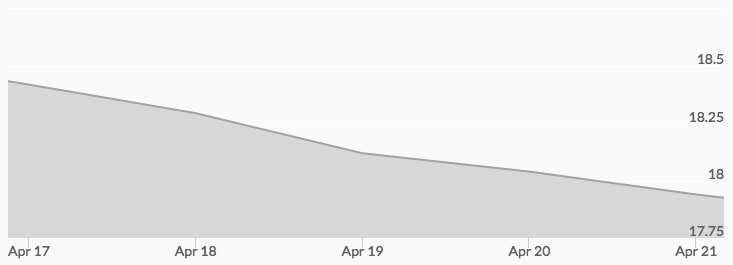

Silver prices opened on Monday at $18.53 an ounce and closed at $18.41. The spot silver price chart reported $18.17 on Tuesday morning, but the price of the white metal climbed to $18.36 by midday before closing at $18.30. This pullback in silver prices continued for the remainder of the week. Light trading kept silver prices within pennies of $18.20 on Wednesday. Thursday opened at $18.12 and closed at $18.02. After opening at $17.89 on Friday, silver tracked the trend of gold in afternoon trading to almost recover to the important $18 point, but closed just short at $17.94.

Investors who follow the gold silver ratio noted this week’s trading set up one of the larger ratios in recent weeks. In spite of a strong performance so far in 2017, there are indications that silver speculators are sitting on the sidelines until more clarity in the French election and U.S. economic indicators.

Industrial demand is a major factor in the price of silver, and some traders are concerned over global economic conditions and a potential slacking in industrial output. This is creating some bargain hunting from long-term investors. Overall, the silver supply and demand outlook for the year is expected to push silver prices up.

With the announcement that far-right populist Marine Le Pen moved into the second round of voting in France, some risk-aversion buying may affect silver prices this week. 1 On the economic news front, there are two potential market movers anticipated. On Wednesday, the Trump administration is expected to announce details about the proposed tax reform and on Friday U.S. GDP Q1 data will be read.