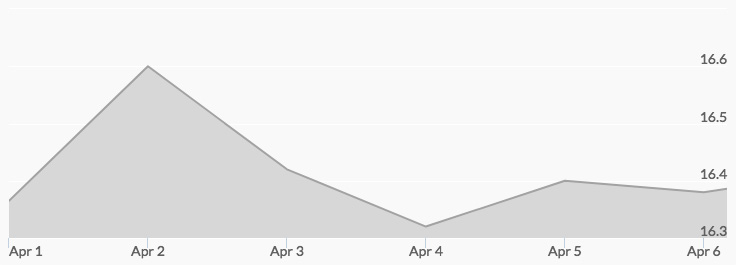

Last week’s silver prices ended just about where they began but gave quick investors opportunities to take advantage of small climbs and dips. On Monday, silver opened at $16.42 before climbing to the week’s high of $16.66 around midday. The white metal closed the day at a respectable $16.57, reported the silver price chart. Tuesday saw the price of silver open at $16.55 before pulling back to $16.41. Wednesday opened at $16.41 before rising briefly to $16.51 and closing the day at $16.27. On Thursday, prices opened at $16.26 before dipping further to the week’s low of $16.19. The price recovered throughout the day, however, closing at $16.40. Friday showed some volatility, opening at $16.38 before climbing to $16.42 and closing at $16.34.

A weak dollar in the face of tariffs from China could be responsible for silver’s rising price on Monday.[1] Tariffs from one of America’s largest trading partners could have effects on areas throughout the U.S. economy, which can make investors more likely to seek safe haven assets like precious metals.

However, many equities investors’ fears were tempered by Amazon’s rebound on Tuesday. The dollar also saw gains, which stoked investors’ appetite for risk. Oil prices experienced their largest single-day fall in a year. Lower fuel prices can mean lower expenses for a range of industries, which make precious metal investment seem less imperative. Given that oil prices hit highs not seen since 2014 just last January, the recent lows may be more of a sign of market volatility than of long-term economic strength—a buy signal for silver!

The dip in silver prices in the latter part of the week may be due to tentative rapprochement between the U.S. and China. China’s representatives say that they would rather resolve any dispute between the two countries through negotiation than hardball tactics.[2] Meanwhile, representatives from the White House say that they feel confident that China and the U.S. will come to an agreement on trade that both countries can live with.[3]

The one thing that can be depended on is that this era’s “business as usual” is not usual at all. Smart investors looking for both short-term profits and long-term protection are well served by silver’s affordable prices right now.