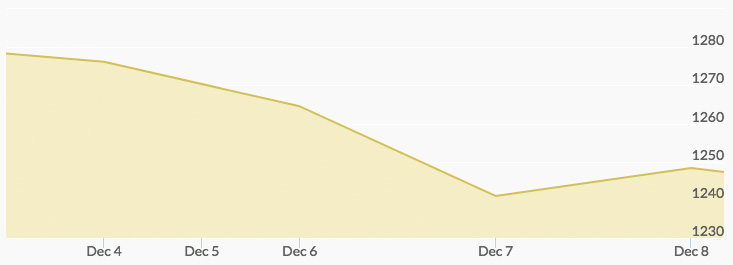

Gold prices slipped on the open Monday to start the week at $1,275.57, then traded up throughout the day to close at $1,276.29, reported the gold price history chart. Tuesday opened slightly off at $1,274.10 then pulled back to $1,267.22 by the close. Wednesday opened up at $1,267.62 then slipped to $1,264.76 to close the day. The price of gold pulled back on Thursday for an open of $1,255.15 and continued to close the day at $1,247.64. Friday opened a bit off at $1,246.88 but then rallied to a high of $1,249.86 in early trading, finally settling up on the day at $1,248.50.

The week started with news that House GOP leaders are moving to put down a rebellion from within their own party against a stopgap spending bill required to avert a shutdown of the federal government. The bill’s intent was required to prevent a shutdown by the end of the day on December 8th and would instead keep the lights on until December 22nd, during which time leaders hope to have agreement on the tax plan and a final budget. However, Freedom Caucus members have been threatening a shutdown unless they are granted certain concessions, in particular the end of support for Obamacare insurance markets, but senior House Republicans see the request as short sighted. Further disruptions such as these could ignite a crash in equities and a bull run in precious metals if the GOP and the Trump administration are viewed as having failed to get the tax bill and budget passed by year-end.

The prospects of an upcoming stock market crash were made ever more likely as a new report by Societe Generale, the French banking giant, predicted a credit crunch and accompanying economic slowdown, or even a possible recession, in 2018-2019. The bank warned that overleverage and low interest rates had extended the economic expansion beyond the end of its life and that markets should expect a retrenchment in the coming months. 1 Further compounding fears of a bubble, a number of banks predicted a dollar crash in 2018. 2 Bearish projections have the dollar on the verge of its worst year in a decade, which will directly affect precious metals prices.