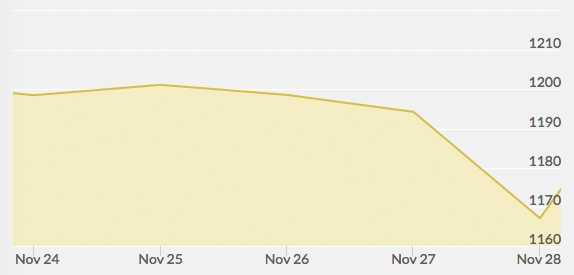

Open: $1,197.30 Close: $1,168.50 | High: $1,201.00 Low: $1,166.80

Gold prices opened the week on Monday down from a three-week high. The last week was bullish for gold as China surprised investors with an interest rate cut, but Monday saw Germany’s president state that monetary policy alone wouldn’t spur economic growth. This was after European Central Bank president Mario Draghi gave indication in the past couple of weeks that the ECB would be expanding its stimulus program.

Much of the week was quiet, due to the Thanksgiving holiday on Thursday, and anticipation of the Swiss vote on Sunday. Swiss voters would take to the polls on November 30th to vote whether the Swiss government should have to keep 20% of its monetary holdings in gold within five years. The dollar was strong and the U.S. economy has created a sense of optimism among investors, which is bearish for gold.

Gold prices slipped slightly on Wednesday. The entire marketplace held their breath the entire week on the Swiss vote. Forbes reported that polls show most people do not expect the referendum to pass. However, if it does pass, it could mean a huge spike for gold.

On Thursday, gold dropped on low crude oil prices. The New York Stock Exchange was closed for the holiday. Gold fell again on Friday, extending a three-week drop to a two-week low on a strong dollar and anticipation of the Swiss vote.

Thanks for the overview. I am interested to see what gold prices do through 2015 with increasing oil costs and emerging markets in Asia driving increased demand.