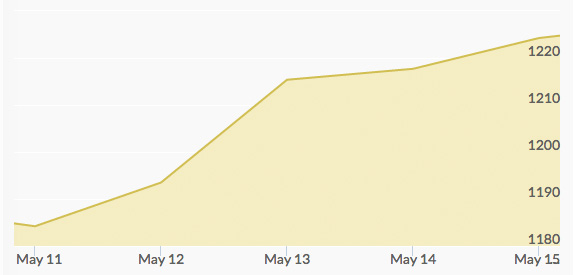

This week opened at $1,183 and closed at $1,225—resulting in more than $40 in gains for the yellow metal. The price of gold started out steady on Monday, nearly a flat line from last week’s closing point, but began gaining on Tuesday and went up all week.

Gold struggled to gain any momentum on Monday, even though conversations about the Fed raising interest rates have recently showed only a small likelihood of any major policy changes by summer, as some had previously been anticipating. JP Morgan predicts only a seven percent chance that the Fed will make any moves in July. China announced a boost in its stimulus program over the weekend, in that it will reduce lending rates, but this also did not immediately affect gold prices at the beginning of the week.

Tuesday was still relatively flat but noted some gains. International news focused on the fact that Greece nearly defaulted on its debt with the International Monetary Fund on Monday, and used emergency funds to repay the IMF. Yet, this did not send gold traders rushing back into safe haven gold.

Wednesday was the big day of gains for gold, as the U.S. dollar sank overnight in advance of a U.S. consumer report released on Thursday. The Fed has stated that its monetary policy will be primarily dependent on economic data, so poor economic growth statistics indicate that the economy is not strong enough for an interest rate hike.

As expected, economic data released on Thursday showed worse-than-expected numbers. The producer-price index, which measures the prices business receive for goods and services, fell 0.4% in April from the previous month. Economists expected this number to be a positive 0.1%. The price of gold hit a three-month high on this disappointing economic news.

Friday revealed some profit-taking after the gains incurred Wednesday and Thursday, but overall gold prices remained steady.