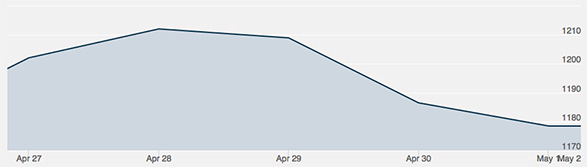

The past week of trading saw the price of gold shoot up and come back down again to finish off almost exactly where the precious metal started out. A big drop negated steady growth, indicating that the volatile market can fall just as soon as it climbs, whenever currency fluctuations cause investors to seek out more or less share in the metal.

Monday saw the metal climb a full two percent to close out just above $1,205, providing relief for investors who worried that the previous week of trading might signal new lows. It was the biggest single-day gain for gold since January and triggered a series of echo gains in other precious metals; silver gained no less than five percent due to the higher valuation of metal. Gold futures in June climbed higher, reaching 2.4 percent. Mark O’Byrne of GoldCorp noted that the metal was “undervalued,” with a “long period of consolation around the $1,200 mark” that influenced further buying.

Tuesday proved to be another strong gainer for gold, rising nearly ten dollars per ounce to close out trading at $1,212. While gold gained by a significant amount, silver only climbed by a paltry twenty cents. Volume on Tuesday was one of the highest in 2015, with no less than 185,000 contracts on the move, about twice the average for the month of April.

Wednesday would close out the peak value of gold on the week, ending at $1,214 and giving investors hope that the metal may be headed firmly for a bull market for the first time in months. Part of this hope came at the hands of an announcement about a Chinese stimulus that would necessitate a large quantity of gold changing hands to bolster currency. Surprisingly, total contracts dropped, with only 155,000 changing hands.

Thursday saw the climb fade out in dramatic fashion. Hopes of good times came crashing down, as gold dropped no less than $27 per ounce. The gold fall came at the hands of a strong jobs report suggesting a 15-year low in unemployment benefits, says Ross Norman of SharpsPixley.

Friday didn’t stop the bleeding as gold dropped by .7% to close out the week at $1,174. Hopes of a bull market may seem misplaced; if gold remains below $1,200 for longer than a week or two, it could be just the opposite as more and more investors unload the precious metal.