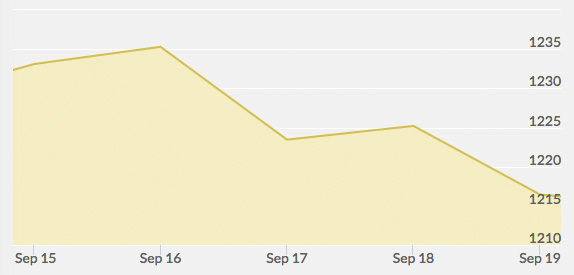

Open: $1,232.70 Close: $1,217.50 | High: $1,239.50 Low: $1,216.90

September usually marks the beginning of the gold-buying season in Asia as people prepare to wear and give gold at weddings and festivals. This week, gold rallied slightly on Monday in favor of physical gold buying in Asia. Traders also bought gold ahead of the U.S. Federal Open Market Committee meeting.

Tuesday continued to steady the price of gold, helping the yellow metal recover slightly from last week’s losses. Physical gold buying came largely from China, Malaysia, Thailand, and Singapore. In U.S. stock markets, traders started whetting a risk-off appetite, as the Federal Open Market Committee meeting loomed ahead; many expect the Federal Reserve to raise interest rates as the quantitative easing program tapers off.

On Wednesday the Federal Reserve announced they would be cutting back the bond-buying program by $10 billion per month, which was not unexpected. Gold dropped at first on this news, but then stabilized when the Federal Reserve continued to use the language that interest rates would remain low for “considerable time.”

Thursday’s gold prices continued to drop and then stabilize after the news of Wednesday’s Federal Reserve meeting. Even though interest rates were not raised, traders anticipate a less friendly atmosphere for gold in the coming months and years. The dollar also experienced significant strength, and gold plummeted to its lowest levels in eight months Thursday morning, but had stabilized on short covering by the close of the day.

Gold closed out the week moderately softer than when it began, mostly due to a rising dollar and anticipation of higher real interest rates on the horizon.