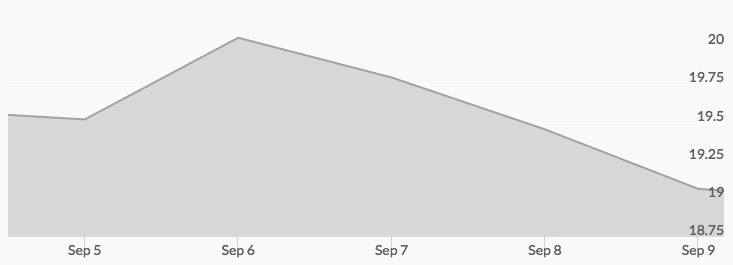

The silver price chart this week looks almost identical to the gold price chart. Both precious metals experienced stagnation during the Labor Day holiday as traders were away from their desks, then jumped up in a two-day rally as investors digested last week’s economic data.

A jobs report for August came in lower than expected, and the market responded with anticipation that the Federal Reserve might not end up raising interest rates soon. Silver reached above $20 on Tuesday, the peak of the week and a three-week high. Manufacturing data came in weaker than expected, and the dollar took a slip downward.

Then, by Wednesday the silver price had made a U-turn on profit taking. Meanwhile, in China the Yuan is gaining momentum as a currency of choice throughout the world, which can be expected to hurt the U.S. dollar.

The post-Labor Day rally reverted through the end of the week, and silver closed at $19.20 per ounce, comparatively lower than gold’s end-of-week price. Silver is generally more volatile than gold. The European Central Bank’s decision not to raise interest rates boosted the dollar and lowered gold and silver prices.