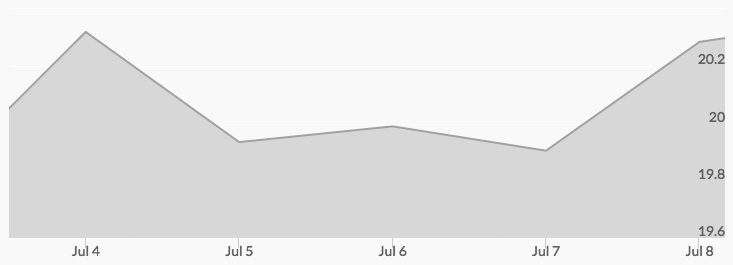

Silver surged this week, starting the week out at a two-year high on Monday at $20.40 per ounce. The jump was driven by continued uncertainty about the Brexit decision, and the anticipation that the Bank of England would loosen monetary policy at their meeting this week (which did occur).

Increased silver buying from China also boosted the silver price strongly—Asian speculative demand on commodities influenced silver higher.

Silver had moved 11.5% upwards in only the past three trading days. The gold silver ratio was reduced; meaning silver is raising its price per ounce relative to gold. Silver can be a volatile metal because it is a lower-quantity commodity, and prices can change rapidly, as we are seeing in this case after the Brexit vote.

Tuesday opened U.S. markets again after the Independence Day holiday, and silver was still soaring. Safe haven demand rocked the marketplace, as gold, silver, and the Japanese yen rose, while world stock markets and bond yields sank.

Wednesday morning brought a new set of economic woes, as the British pound and U.S. bond yields both dropped to 30-year lows. Thursday, silver paused and analysts expect the silver price to reach at least $25.

The momentum in silver continued through to the end of the week, after dipping down after a positive U.S. jobs report temporarily, and rising back up to close the week around $20.25 per ounce.