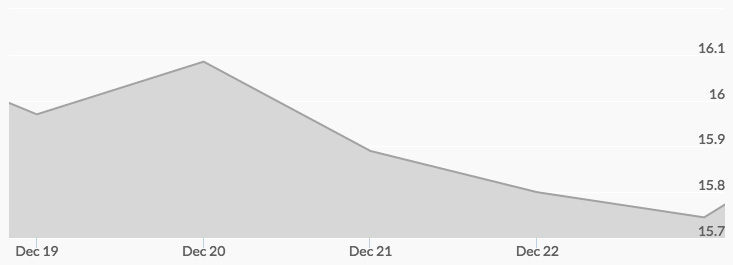

The week before Christmas in the United States brought no significant news to the silver markets. Starting with a downward bias after opening at $16.02 an ounce, silver spot prices dipped to $15.95 by the end of Monday.

Tuesday saw a bump in the U.S. dollar, with the DXY index hitting 103.65 intraday. This strength in the dollar drove the price of silver to $15.67 before noon. However, as the rally in currency cooled later in the day, the $16 level was reached again, closing at $16.07.

Opening at $16.02 on Wednesday, sellers dominated the silver trading activity and the metal again dropped to a closing mark of $15.89. There appeared to be a number of traders covering positions and adjusting trades for yearend accounts, as well as concerns over the continued surprising strength of equities and the dollar.

Part of the silver selling is coming from speculators who jumped in at the high earlier this year. Long-term silver investors are comfortable holding the metal to see what 2017 has in store for the markets.

The market continued to react to news of the strong dollar after a Thursday open of $15.80, with the price of silver Friday remaining below the $16 level again, closing at $15.78 following light afternoon trading. 1